The Unbundling of the Blockchain: Why Your Next Big Bet is on the Pieces in Between

Remember the last crypto bull run? The excitement was electric, but so was the frustration. Networks clogged. Gas fees shot to the moon, making a simple transaction feel like buying a used car. It felt like we were all trying to squeeze through a single, tiny door at the same time. That’s the monolithic blockchain problem in a nutshell. For years, we’ve relied on chains like Ethereum to do everything: process transactions, secure the network, and store all the data. It’s an incredible feat of engineering, but it’s also a massive bottleneck. The future, however, isn’t about building a bigger door. It’s about building a whole new kind of building with countless specialized entrances. We’re talking about the rise of modular blockchain layers, and the real investment goldmine isn’t just in the new layers themselves, but in the critical infrastructure that connects them all.

Key Takeaways

- The Monolithic Problem: Traditional blockchains like Ethereum try to handle everything (execution, settlement, data availability), leading to bottlenecks and high fees.

- The Modular Solution: Modular blockchains specialize, breaking up these core functions into separate, optimized layers. This unbundling allows for massive scalability and customization.

- The Investment Thesis: The most significant opportunities may not be in a single new blockchain, but in the “in-between” infrastructure—the bridges, sequencers, and data layers—that connect this new modular ecosystem.

- Key Areas to Watch: Focus on interoperability protocols (bridges), shared sequencers, ZK-proving infrastructure, and dedicated data availability solutions as prime investment targets.

- Risks are Real: This is cutting-edge tech. Be aware of technological risks, intense competition, and complex tokenomics before investing.

So, What’s the Big Deal with Modularity Anyway?

To truly grasp this shift, you need to think about specialization. Imagine a single, heroic craftsman trying to build an entire car by himself. He has to forge the steel, stamp the body panels, build the engine, stitch the upholstery, and assemble everything. He might build a beautiful car, but it would take forever and cost a fortune. That’s a monolithic blockchain.

The Monolithic Logjam

In a monolithic chain, every node in the network is responsible for everything. They execute transactions (the engine), ensure finality (the assembly), and store the history of every transaction (the blueprint library). This creates a tight coupling between these functions. If one part gets congested—like transaction execution during an NFT mint—the whole system slows down. Scaling becomes a nightmare because you have to scale every single component together, even the parts that aren’t the bottleneck. It’s inefficient and expensive. It’s why your transaction fees can vary so wildly. The network is constantly trying to balance these competing demands within a single, constrained environment.

The Modular Breakup: A Specialization Story

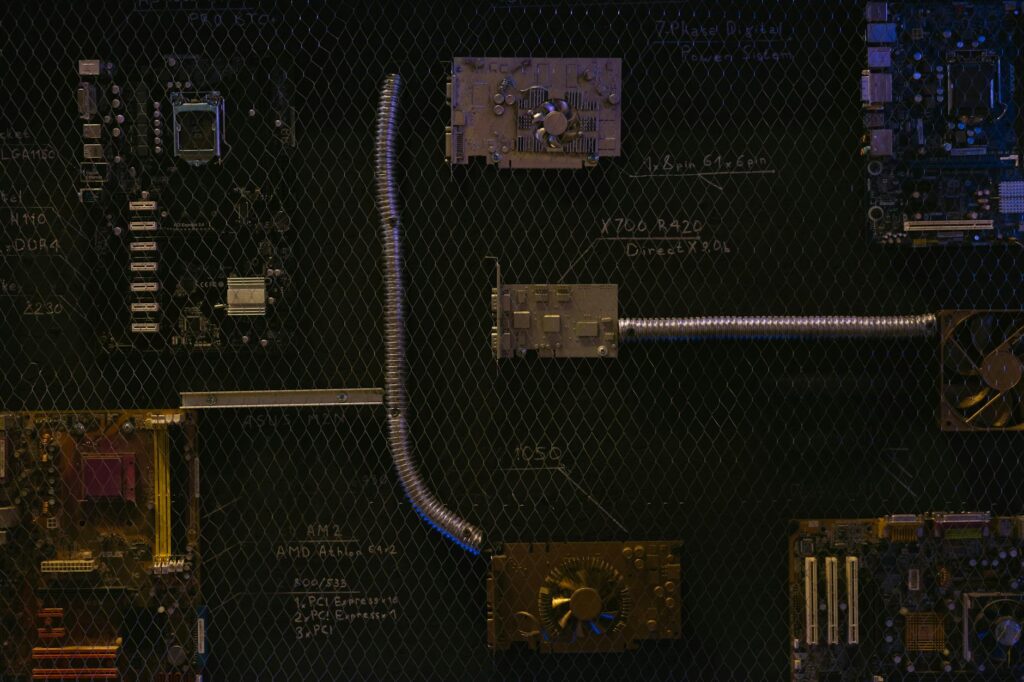

Now, imagine a modern car factory. You have a specialized line for engine assembly, another for the chassis, another for painting, and a final assembly line. Each part is optimized for its specific task. That’s the modular approach. A modular blockchain architecture unbundles the core functions of a blockchain into separate, interoperable layers. This means you can have one chain that’s hyper-optimized for executing transactions, another that’s a fortress for settlement, and a third that’s a vast, cheap library for data storage. They all work together, but they aren’t tripping over each other. This specialization allows for incredible gains in performance, scalability, and cost-effectiveness. A developer can pick and choose the best-in-class components to build their application without compromise.

The Anatomy of Modular Blockchain Layers

To understand where to invest, you need to know the map of this new world. The modular stack is generally broken down into three or four key layers. Think of them as the specialized departments in our car factory.

The Execution Layer: Where the Magic Happens

This is where the work gets done. The execution layer is where smart contracts are run, and the state of the blockchain changes. Think of all the rollups you hear about—Arbitrum, Optimism, zkSync. These are primarily execution layers. They batch up thousands of transactions off-chain, process them in a super-fast environment, and then just post a small summary back to a more secure chain. They are the high-performance engine assembly lines, churning out processed transactions at a blistering pace. Their main job is speed and low cost for the end-user.

The Settlement Layer: The Court of Finality

If the execution layer is where transactions happen, the settlement layer is where they become *official*. It’s the ultimate source of truth and security. This layer arbitrates disputes, verifies proofs from the execution layers, and provides the final, irreversible stamp of approval on the state of the system. Ethereum is increasingly positioning itself as the premier settlement layer for the entire crypto ecosystem. It’s not trying to be the fastest anymore; it’s trying to be the most secure and decentralized court in the world. Other projects like Celestia are also building settlement functionalities. Security and trust are the products here.

The Data Availability (DA) Layer: The Public Record

This is perhaps the most revolutionary and least understood piece of the puzzle. The DA layer has one simple, crucial job: to store transaction data and guarantee that it’s available for anyone to check. It doesn’t process or validate the transactions; it just makes sure the raw data is there. Why is this so important? Because it allows anyone to verify the state of a rollup or execution layer. Without guaranteed data availability, a malicious rollup operator could hide data and potentially steal funds. Projects like Celestia, EigenDA, and Avail are pioneers here, offering a massive, cheap, and secure hard drive for the modular world. This dramatically lowers the cost for rollups, as they no longer have to pay expensive fees to post their data on a chain like Ethereum.

Investing in the Infrastructure Connecting Modular Blockchain Layers

Okay, so we have all these specialized layers. Great. But how do they talk to each other? How does value move from an execution layer on Arbitrum to another on Starknet? How do they all agree on the order of transactions? This is the crux of the investment thesis. The most durable value in this new paradigm might not accrue to any single layer, but to the “golden glue” that holds the entire modular stack together. This is the infrastructure layer, the pipes and wiring of the modular city.

Interoperability and Bridging Protocols

If modular chains are like different countries specializing in different goods, interoperability protocols are the global shipping and communication networks. They are essential for a functioning ecosystem.

- Asset Bridges: These are the most common type, allowing users to move tokens like ETH or USDC from one chain to another. Think of projects like Wormhole or Stargate. They are the container ships of the modular world.

- General Message Passing (GMP) Protocols: This is the next evolution. Instead of just moving assets, these protocols (like LayerZero or Axelar) allow smart contracts on different chains to communicate with each other. This enables complex cross-chain applications, like borrowing on one chain using collateral from another. It’s the difference between shipping a box and having a live video call.

Investing here means betting on the protocols that become the TCP/IP or SWIFT of the blockchain world—the trusted standards for communication. The key is to look for robust security, wide adoption, and a clear value accrual mechanism for their native token.

Shared Sequencers: The Traffic Cops

As we get hundreds or thousands of rollups (execution layers), a new problem emerges: coordination. Sequencers are responsible for ordering transactions within a single rollup. But what if you want to perform an action that spans two different rollups? This is where shared sequencers come in. A shared sequencer network can order transactions across multiple rollups simultaneously, enabling what’s known as atomic cross-chain composability. This means you can execute a complex trade across two different DeFi protocols on two different rollups as a single, indivisible transaction. It either all succeeds or all fails. This is a massive unlock for user experience and liquidity. Projects in this space, like Espresso Systems and Radius, are building the fundamental coordination layer for the rollup-centric future. Investing here is a bet on the need for a neutral, decentralized traffic cop for the entire modular ecosystem.

Provers and ZK-Infrastructure

Zero-Knowledge (ZK) rollups are a key piece of the modular future, offering incredible scalability and privacy. But they have a dirty secret: generating the cryptographic “proofs” that guarantee their validity is computationally intense and expensive. This has created a new market for ZK-proving infrastructure. Think of it as a specialized hardware market, like NVIDIA building GPUs for AI. Companies are building decentralized prover networks and even custom hardware (ASICs) to generate ZK proofs faster and cheaper. Investing in the protocols and companies that dominate this space is a picks-and-shovels play on the entire ZK-rollup ecosystem. You’re not betting on one ZK-rollup to win; you’re betting that ZK-rollups as a category will be massive, and they’ll all need to buy their shovels from someone.

“The long-term value in a modular world won’t be about picking the ‘best’ Layer 2. It will be about owning the decentralized, credibly neutral services that all layers come to depend on for security and connectivity.”

Risks and Due Diligence: Don’t Get Rekt

This all sounds amazing, but let’s pump the brakes. We are at the absolute bleeding edge of technology here. The potential for reward is matched only by the potential for risk. Blindly aping into the latest infrastructure play is a recipe for disaster.

Technology Risk: Is it Battle-Tested?

Much of this technology is brand new, complex, and has not been tested through the crucible of a bear market or a sophisticated hack. Bridges are notoriously vulnerable and have been the site of the industry’s largest exploits. New cryptographic models and consensus mechanisms could have unforeseen bugs. You must assess the maturity of the technology and the quality of the engineering team behind it.

Competition and Moats

The modular infrastructure space is already becoming incredibly crowded. There are dozens of bridging solutions, multiple teams working on shared sequencing, and a fierce race in the DA layer space. What is a project’s defensible moat? Is it network effects (everyone uses it), superior technology, or deep liquidity? Many projects may not survive the initial Cambrian explosion. Your job as an investor is to figure out which ones have a sustainable competitive advantage.

Tokenomics and Value Accrual

Finally, and perhaps most importantly, how does the investment make you money? You need to deeply understand the project’s tokenomics. Does the native token have a clear role in the protocol? Does value from the protocol’s activity (e.g., fees) flow back to the token holders through staking, burning, or revenue sharing? A project can be technologically brilliant and widely used, but if its token is purely for governance with no value accrual, it can be a terrible investment. Read the whitepaper. Understand the flow of money. Don’t skip the hard part.

Conclusion: Assembling the Future

The shift from monolithic to modular blockchains isn’t just an incremental upgrade; it’s a fundamental paradigm shift in how we build and scale decentralized networks. It’s the transition from a single craftsman to a global, specialized assembly line. While a great deal of attention is focused on the shiny new execution layers, the enduring investment opportunities may lie in the less glamorous, but utterly essential, infrastructure that connects them.

The bridges that move value, the sequencers that create order, the provers that guarantee truth, and the data layers that provide memory—this is the connective tissue of the modular future. By focusing your research and capital on these critical components, you’re not just betting on a single application or chain. You’re investing in the foundational pillars that will support the entire next generation of crypto. It’s a complex, risky, and incredibly exciting frontier, but for the diligent investor, it may just be the most compelling thesis of the next decade.

FAQ

What’s the main difference between a rollup and a modular blockchain?

It’s a matter of scope. A rollup (like Arbitrum) is primarily an execution layer. It outsources its security and data availability to another chain, typically Ethereum. A true modular blockchain architecture involves multiple, separate, specialized chains for different functions. So, a rollup is a *component* within a potentially larger modular ecosystem. For example, a rollup could use Celestia for data availability and Ethereum for settlement, creating a fully modular stack.

Is it too early to invest in this infrastructure?

It depends on your risk tolerance. We are in the very early innings. The technology is new, and many clear winners have not yet emerged. This means there is higher risk, but also potentially higher reward. A prudent approach could be to make smaller, diversified bets across different categories of infrastructure (e.g., one interoperability play, one DA play) rather than going all-in on a single project. The thesis is strong, but the specific winners are still being determined.

What are some example projects in each infrastructure category?

This is not financial advice, but for educational purposes, some well-known projects in these categories include: Interoperability: LayerZero, Wormhole, Axelar. Shared Sequencing: Espresso Systems, Radius. Data Availability: Celestia, EigenDA, Avail. ZK-Proving Infrastructure: Risc Zero, Succinct. Always do your own thorough research before considering any investment.