The Future of Cross-Domain MEV in a Modular Blockchain World

For years, Maximal Extractable Value (MEV) has been the boogeyman lurking in the dark forest of monolithic blockchains like Ethereum. It’s the invisible tax, the shadowy super-coder game of front-running, back-running, and sandwiching transactions for profit. We’ve built sophisticated systems like Flashbots to tame it, to democratize it, and to bring it out of the shadows. But just as we started to get a handle on it, the entire landscape shifted from under our feet. The future isn’t monolithic; it’s modular. And with this new, fragmented world of countless rollups and appchains comes a new, far more complex beast: cross-domain MEV. This isn’t just MEV on a new map; it’s MEV in a whole new dimension.

Key Takeaways:

- The Modular Shift: Blockchains are unbundling into specialized layers (execution, data availability, consensus). This creates a fragmented ecosystem of many ‘domains’ like L2 rollups.

- What is Cross-Domain MEV?: It’s the value that can be extracted by ordering transactions across multiple, independent blockchain domains (e.g., between two different rollups) in a specific way.

- The Central Challenge: Without a shared sense of ‘time’ or transaction order, capturing this value is nearly impossible, leading to market inefficiencies.

- Key Solutions Emerge: Technologies like shared sequencers, based sequencing, and intent-based systems are racing to solve this coordination problem, each with its own trade-offs.

- High Stakes: The way we solve for cross-domain MEV will fundamentally shape the future of blockchain user experience, decentralization, and the very structure of the crypto economy.

First, A Quick Refresher: The MEV We Know

Before we jump into the multi-dimensional future, let’s ground ourselves in the present. Traditional, or ‘single-domain,’ MEV exists because block producers (miners or validators) have the power to decide the order of transactions within a single block. They can, and do, sell this prime real estate to ‘searchers’ who spot profitable opportunities.

Think about it. You see a huge buy order for ETH on Uniswap and you know it will pump the price. What do you do?

- You place your own buy order just before it (front-running).

- The big order executes, pushing the price up.

- You immediately sell your ETH for a tidy, near-risk-free profit.

This is the classic ‘sandwich attack.’ It’s just one flavor of MEV. Others include DEX arbitrage (exploiting price differences between two pools on the same chain) and liquidations in lending protocols. It’s a game of speed, information, and ordering power, all confined within the walls of a single blockchain like Ethereum mainnet. Systems like Proposer-Builder Separation (PBS) and MEV-Boost have helped create a more orderly market for this value, but the core game remains the same: control the ordering, control the value.

The Great Unbundling: Why the Modular World Changes Everything

The monolithic era is fading. Why? Because trying to do everything on one chain—execution, security, and data availability—is like trying to run a global shipping company, a high-frequency trading firm, and a public library out of the same small office. It just doesn’t scale.

The modular thesis proposes a better way: specialization. We’re now seeing the blockchain stack get unbundled into distinct layers:

- Execution Layer: This is where the action happens. Transactions are executed, and smart contracts run. Think of rollups like Arbitrum, Optimism, or ZKsync.

- Settlement Layer: The court of law. It’s where disputes are resolved and the final state of execution layers is verified. Often, but not always, the L1.

- Consensus Layer: Provides ordering and finality for the settlement layer. The heart of the L1’s security.

- Data Availability (DA) Layer: The public library. It simply guarantees that all the transaction data from the rollups is available for anyone to check. Projects like Celestia are pioneers here.

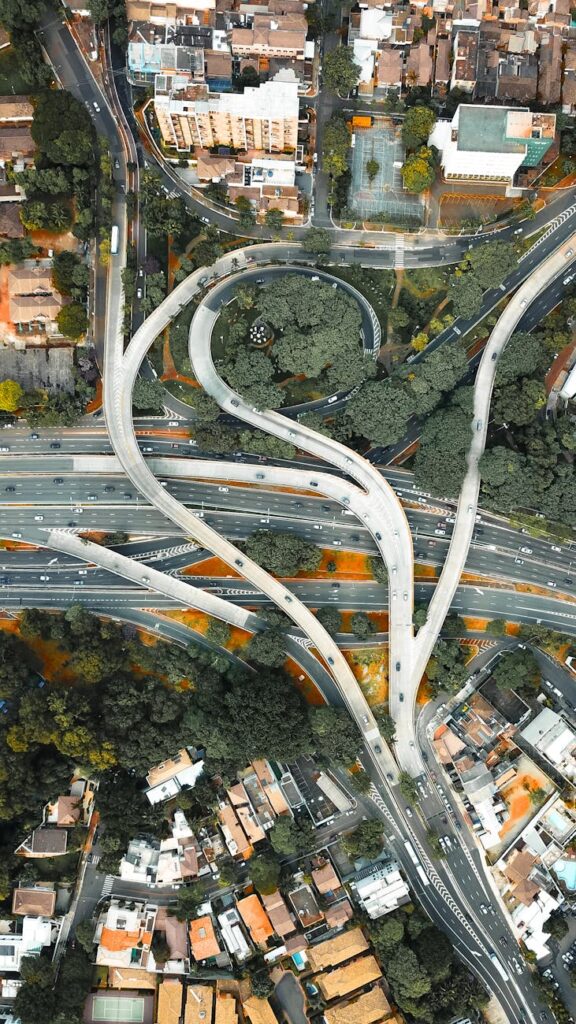

This is fantastic for scalability. We can now have thousands of rollups, each optimized for a specific purpose—one for DeFi, one for gaming, one for social media. But this explosion of execution environments creates a massive new problem: fragmentation. Liquidity is fragmented. State is fragmented. And most importantly for MEV, transaction ordering is fragmented. Each rollup has its own sequencer, its own little fiefdom of transaction ordering. An Arbitrum sequencer has no idea what a ZKsync sequencer is doing in the next block, or even in the same millisecond. This makes a cross-chain sandwich attack impossible… or does it?

A New Frontier: Defining Cross-Domain MEV

This fragmentation is precisely what gives rise to cross-domain MEV. It is the value that exists *between* these isolated domains, value that can only be captured if you can coordinate transaction ordering across them. It’s a much bigger, more complex, and potentially far more lucrative game.

Let’s make this real. Imagine the price of ETH on a Uniswap pool on Arbitrum is $3000, but on a different DEX on Starknet, it’s $3005. That’s a clear arbitrage opportunity. In a single-domain world, you’d just execute a multi-step transaction in one block. Easy. But here, you need to:

- Buy ETH on Arbitrum.

- Bridge or somehow move that value.

- Sell ETH on Starknet.

The problem? By the time your Arbitrum transaction confirms and you get to Starknet, the price difference is gone. Someone else beat you to it. You can’t guarantee that your ‘buy’ and ‘sell’ transactions will be executed together atomically. You can’t lock in the profit. This is the core challenge of cross-domain MEV: a lack of atomic composability. The ability to have a transaction succeed across multiple domains, or fail completely, with no in-between state.

The Billion-Dollar Opportunities

The opportunities aren’t just limited to simple arbitrage. Think about:

- Cross-Rollup Liquidations: A user has collateral on Optimism but their debt position on Polygon is about to be liquidated. A searcher could atomically repay the debt on Polygon and seize the collateral on Optimism, if they could guarantee both transactions executed in the right order.

- Multi-Domain NFT Minting: An NFT collection mints on one rollup, but the whitelist is managed on another. A searcher could atomically verify whitelist status and execute the mint.

- Complex DeFi Hedging: A sophisticated strategy might involve balancing a perpetual futures position on a specialized derivatives rollup while simultaneously providing liquidity on a general-purpose rollup.

All of these scenarios are currently incredibly difficult, if not impossible, to execute without taking on massive risk. The value is there, locked behind a wall of fragmentation.

The Contenders: Technologies Racing to Unify the Domains

Nature abhors a vacuum, and so do markets. A whole new class of infrastructure is being built to bridge this gap and unlock cross-domain MEV. This is where the real innovation is happening.

Shared Sequencers: The Great Unifiers?

The most direct solution is a shared sequencer. Instead of each rollup running its own private sequencer, a network of rollups can agree to use a single, decentralized sequencing layer. Think of it as a universal transaction ordering service for the modular world.

Projects like Espresso and Astria are leading the charge here. A shared sequencer creates a single, combined ‘block’ of transactions from multiple rollups (say, Arbitrum, Optimism, and a new gaming chain). A searcher can now submit a bundle of transactions—one for each rollup—to this shared sequencer and know that they will either all be included together in the correct order, or none of them will. Suddenly, that cross-rollup arbitrage we talked about becomes not only possible, but reliable.

This approach gives us back the atomic composability we lost. It creates a single, unified mempool for all participating domains, making it a fertile hunting ground for cross-domain MEV searchers.

Based Sequencing and the L1 Auction

An alternative is ‘based sequencing,’ a clever term playing on the rollup being ‘based’ on the L1. Here, the rollup outsources its sequencing rights directly to the L1 validators. The rollup’s users submit their transactions to a mempool, and L1 builders can then bid for the right to build the next rollup block, often combining it with L1 MEV opportunities.

This model, championed by proponents like the EigenLayer ecosystem, effectively uses the L1’s existing security and builder market to provide ordering. It’s a powerful way to decentralize the sequencing role and tie the rollup’s fate more closely to the L1. For cross-domain MEV, it means a single L1 builder could potentially construct blocks for multiple ‘based’ rollups simultaneously, achieving a similar effect to a shared sequencer.

Intent-Based Systems: The Paradigm Shift

This is where things get really futuristic. Shared and based sequencing are about ordering *transactions*. Intent-based systems are about fulfilling *outcomes*.

Instead of crafting a complex transaction (e.g., ‘swap 1 ETH for USDC on Arbitrum, bridge to Optimism, swap for VELO’), a user simply signs a message stating their intent: ‘I have 1 ETH on Arbitrum and I want the maximum amount of VELO on Optimism within the next 2 minutes.’ They don’t specify the ‘how.’ That’s the magic.

This intent is broadcast to a competitive network of ‘solvers’ (highly sophisticated searchers). These solvers compete to find the absolute best way to execute that intent. They might use private liquidity, route through multiple DEXs across several domains, and use their own inventory to make it happen. The user gets the best outcome, and the winning solver gets a fee or captures the surplus MEV.

Intents abstract away all the cross-domain complexity from the user. For MEV, it creates a whole new layer. The game is no longer just about ordering transactions, but about optimally pricing and executing complex, multi-domain paths. It’s a much richer and more expressive design space.

The Double-Edged Sword: Opportunities vs. Centralization

Unlocking cross-domain MEV isn’t a simple case of ‘problem solved.’ The solutions we’re building have profound implications for the entire crypto ecosystem, both good and bad.

The Good: A More Efficient, User-Friendly Future

On the bright side, solving this problem leads to a radically better user experience. Imagine swapping any token on any chain for any other token, in a single click, knowing you’re getting the best possible price across the entire ecosystem. That’s the promise. Liquidity is no longer fragmented, leading to better price discovery and less slippage for everyone. It creates a truly interconnected ‘internet of blockchains’ rather than a collection of siloed economies.

The Bad and The Ugly: Centralization Risks

Here’s the catch. The systems that coordinate cross-domain value have an immense gravitational pull. A successful shared sequencer could become a central point of failure and control for a huge portion of the modular ecosystem. If one entity sequences for dozens of major rollups, they wield enormous power. This could lead to:

- Economic Centralization: A small number of sophisticated builders or solvers could dominate the market, squeezing out smaller players.

- Governance Choke Points: A single sequencing layer could become a target for censorship or regulatory pressure, affecting all the rollups that rely on it.

- Increased Complexity: The strategies to extract cross-domain MEV will be exponentially more complex, potentially introducing new, unforeseen bugs and attack vectors.

The race is on to build these systems in a way that is credibly neutral, decentralized, and censorship-resistant. It’s one of the most critical open challenges in blockchain infrastructure today.

Conclusion: The Dawn of a New Era

We are at the very beginning of the cross-domain MEV story. The transition from a monolithic to a modular world has fundamentally rewritten the rules of value extraction. The wild, chaotic, and often-predatory ‘dark forest’ of single-chain MEV is being replaced by an entire universe of interconnected ecosystems, each with its own planets, trade routes, and hidden treasures.

The technologies being built today—shared sequencers, based rollups, intent systems—are not just technical upgrades. They are foundational pieces of economic infrastructure that will determine how value flows in the modular future. Navigating this new frontier requires us to be vigilant, to prioritize decentralization, and to build systems that empower users, not just extractors. The game has changed, and the stakes have never been higher.

FAQ

What is the difference between cross-chain MEV and cross-domain MEV?

While often used interchangeably, there’s a subtle distinction. ‘Cross-chain’ typically refers to MEV between two entirely separate L1 blockchains, like Ethereum and Solana. ‘Cross-domain’ is a broader term that is more fitting for the modular world, as it includes MEV between two rollups that might share the same L1 for security and settlement (e.g., Arbitrum and Optimism). The core challenge of transaction ordering is similar, but the underlying security models can be very different.

Are shared sequencers the only solution for cross-domain MEV?

No, they are just one of the leading proposals. Other powerful models include based sequencing (where rollups delegate sequencing to the L1’s block producers) and intent-based systems (which focus on user outcomes rather than transaction paths). Each approach has different implications for decentralization, efficiency, and user experience. The future is likely to be a mix of all these models, with different rollups choosing the solution that best fits their needs.