Let’s be honest. When most people hear ‘crypto,’ their minds jump straight to skyrocketing prices, dizzying drops, and stories of overnight millionaires. It’s all about the numbers, the charts, the Lambos. But what if I told you that focusing on the price is like admiring the paint job on a rocket ship while completely ignoring the fact that it can take you to the moon? The real, game-changing power of this technology isn’t its potential for speculative gain. It’s something far more fundamental, something baked into its very code: censorship resistance. In fact, the most important feature of censorship resistance crypto provides is the guarantee that no single person, corporation, or government can block you from using it. It’s a radical idea, and frankly, it’s the one thing that truly sets it apart from every financial system we’ve ever known.

Key Takeaways

- Censorship Resistance is the Core Value: More than price speculation, crypto’s ability to operate without a central authority that can block or freeze transactions is its most defining and impactful feature.

- It’s a Technical Achievement: This property isn’t just a promise; it’s the result of decentralization, cryptographic security, and public consensus mechanisms like Proof-of-Work or Proof-of-Stake.

- Real-World Impact is Profound: From activists in authoritarian regimes to citizens in countries with hyperinflation, censorship-resistant money provides a lifeline when traditional systems fail or become tools of control.

- Goes Beyond Simple Payments: The principle extends to decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs), creating entire ecosystems free from central control points.

- It’s Not Without Challenges: The very nature of this technology raises valid concerns about illicit use, scalability, and usability, which are important trade-offs to consider.

First, What Exactly Do We Mean by ‘Censorship Resistance’?

It sounds a bit abstract, doesn’t it? Let’s break it down with a simple comparison. Think about your bank account. It’s your money, right? Well, sort of. You have a claim to it, but you don’t truly control it. A bank, a payment processor like PayPal, or a government can, for a variety of reasons, decide to freeze your account, block a transaction, or even seize your funds. They are central gatekeepers.

Maybe you’re trying to send money to a family member in a sanctioned country. Blocked. Maybe you run a business that a payment processor deems ‘high-risk.’ Deplatformed. Maybe you participated in a political protest that the government didn’t like, and suddenly, your accounts are frozen. This isn’t theoretical; it happens all the time. Just look at the Canadian trucker protests, where bank accounts of supporters were frozen by government order. That’s financial censorship in action.

Censorship resistance is the polar opposite. It means that as long as you control your private keys (the cryptographic password to your funds), you and you alone decide what happens to your assets. There is no CEO to call, no government department to petition, no compliance officer to appease. The network is the final arbiter, and it’s designed to be neutral. It doesn’t know who you are, what you’re doing, or why. It only knows one thing: does this transaction have a valid digital signature? If yes, it gets processed. Period.

The Technical Pillars: How is This Even Possible?

This property isn’t magic; it’s a carefully engineered outcome of several interlocking technologies. It’s a system built on trust in mathematics and code, not in institutions.

1. Radical Decentralization

Instead of a single server or database (like at a bank), a cryptocurrency’s ledger is distributed across thousands of independent computers, or ‘nodes,’ all over the world. Anyone can run a node. This means there is no central point of failure or control. To censor a transaction, you wouldn’t just need to shut down one server in a data center. You’d have to find and shut down thousands of nodes, operated by anonymous individuals, scattered across every continent. It’s an impossibly hard game of whack-a-mole. This global distribution is the first and most critical line of defense.

2. Cryptographic Security (The ‘Crypto’ Part)

Your access to your funds is secured by a pair of cryptographic keys: a public key (like your bank account number, which you can share) and a private key (like your password, which you must keep secret). Only your private key can create a valid ‘signature’ to authorize a transaction from your account. This signature is mathematical proof that you, the owner of the private key, approve the transaction. Without it, the funds cannot move. This puts control squarely and solely in your hands. No one can forge this signature, and as long as you protect your key, no one can take your money.

3. Consensus Mechanisms

How do all these thousands of nodes agree on which transactions are valid? They use a consensus mechanism. The two most famous are:

- Proof-of-Work (PoW): Used by Bitcoin, this requires nodes (called ‘miners’) to solve a complex mathematical puzzle. It costs a lot of real-world energy and computing power to participate. This economic cost makes it prohibitively expensive for any single entity to gain enough control to rewrite the transaction history or censor others. To do so, they’d need to overpower the combined computational might of the entire rest of the network, a feat that is economically irrational.

- Proof-of-Stake (PoS): Used by Ethereum and others, this requires nodes (called ‘validators’) to ‘stake’ or lock up a significant amount of the network’s native currency as collateral. If they act dishonestly (e.g., try to approve a fraudulent transaction), their staked collateral is destroyed (‘slashed’). This creates a direct financial incentive to play by the rules and honestly validate transactions.

Both systems, while different, are designed to make coordinated cheating or censorship incredibly difficult and expensive. They create a trustless environment where participants are economically incentivized to maintain the integrity of the network.

The Real-World Power of Censorship Resistance Crypto

This is where the rubber meets the road. This technology isn’t just a cool computer science experiment; it’s a vital tool for human freedom and empowerment in a world where traditional systems are increasingly used as instruments of control.

“When a government can freeze your bank account because they don’t like your political views, money is no longer a tool for freedom. It becomes a leash. Permissionless money cuts that leash.”

A Lifeline for Political Dissent

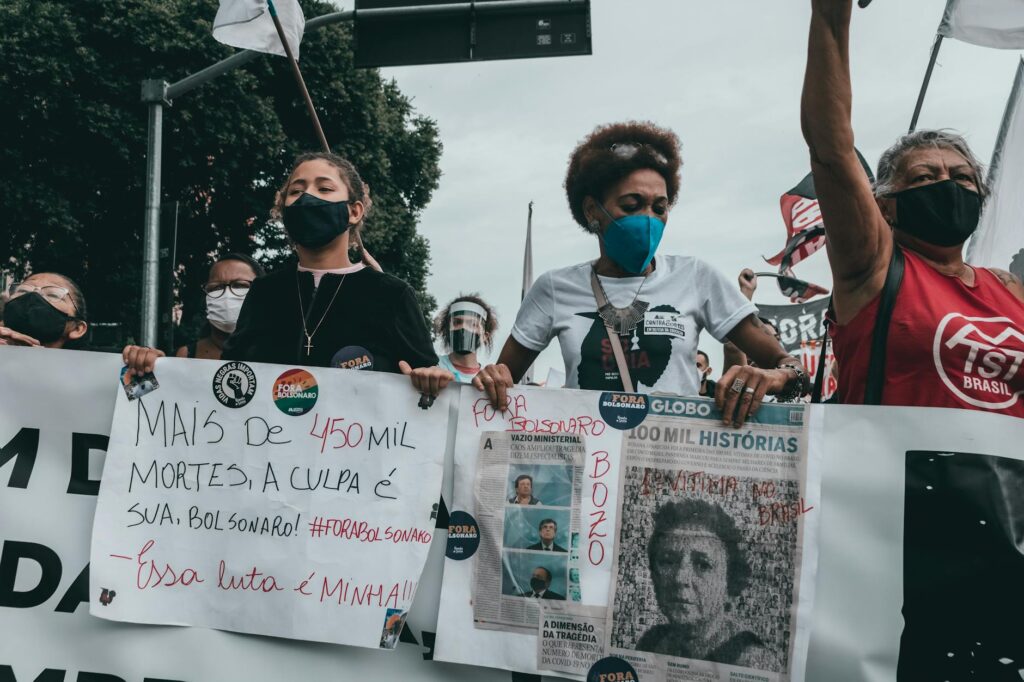

Think about activists and journalists living under authoritarian regimes. When governments want to silence dissent, one of their first moves is to cut off the flow of money. They shut down bank accounts of opposition leaders, block donations to NGOs, and weaponize the financial system. We saw this during the #EndSARS protests in Nigeria against police brutality, where the government ordered banks to freeze accounts linked to the movement. Activists swiftly pivoted to accepting Bitcoin donations, allowing them to continue funding legal aid, medical supplies, and support for protesters. The Nigerian government could pressure the banks, but it couldn’t pressure the Bitcoin network. Similarly, crypto has been used to fundraise for the opposition in Belarus and to get aid directly into Ukraine, bypassing traditional systems that might be slow, corrupt, or blocked entirely.

An Escape from Economic Mismanagement

Censorship isn’t always political. Sometimes it’s economic. In countries like Argentina, Venezuela, or Lebanon, citizens have watched their life savings evaporate due to hyperinflation and disastrous government policies. Capital controls are often imposed, preventing people from converting their rapidly devaluing local currency into more stable assets like the U.S. dollar or from moving their money out of the country. For them, cryptocurrencies like Bitcoin or stablecoins pegged to the dollar aren’t a speculation; they are a life raft. It’s a way to opt-out of a failing system, to preserve wealth, and to transact freely without needing permission from the very institutions that created the crisis.

Fighting ‘Deplatforming’ Culture

In the digital age, censorship also comes from large corporations. Payment processors have been known to cut off services to entire industries or individuals they deem controversial, from adult content creators to political commentators. A freelancer platform can decide to withhold your earnings. A crowdfunding site can shut down your campaign. Relying on these centralized platforms means you are always subject to their changing terms of service and subjective enforcement. Crypto payments offer an alternative. A transaction is just a transaction; the network doesn’t have a ‘terms of service’ clause and cannot be pressured to deplatform someone.

It’s Not Just Money: The Uncensorable Stack

The principle of censorship resistance extends far beyond just sending and receiving money. It’s the foundation for a whole new parallel financial and digital ecosystem being built, often called Web3.

- Decentralized Finance (DeFi): Imagine a world where you can borrow, lend, or earn interest on your assets without a bank. DeFi protocols built on blockchains like Ethereum allow just that. These are open financial applications where the rules are written in code. No one can deny you access to a loan based on your credit score, nationality, or beliefs. If you can provide the required collateral, the smart contract will execute. It’s permissionless finance.

- Non-Fungible Tokens (NFTs): Beyond the hype of digital art, NFTs represent a form of uncensorable property rights. When you own an NFT, your ownership is recorded on a global, immutable blockchain. No company can take it away from you, and no government can easily seize it. It allows for true digital ownership of assets, from art and collectibles to event tickets and in-game items.

- Decentralized Autonomous Organizations (DAOs): These are like internet-native organizations where the rules and governance are encoded on the blockchain. Decisions are made by members voting with governance tokens. A DAO’s treasury is controlled by its members, not a CEO or board of directors, making it resistant to co-option or censorship from a single point of authority.

The Other Side of the Coin: Legitimate Concerns

It would be naive to pretend this technology is a perfect utopia. Its greatest strength is also the source of its most significant challenges. The neutrality that protects a political dissident also protects a criminal. This is a tension we have to acknowledge.

- Illicit Finance: Because of its permissionless nature, cryptocurrencies can be used by bad actors for money laundering, terrorist financing, and ransomware payments. While blockchain analysis tools are making it increasingly difficult to transact anonymously, this remains a primary concern for regulators and law enforcement worldwide.

- Complexity and User Experience: Being your own bank is a powerful concept, but it comes with immense responsibility. ‘Not your keys, not your coins’ is a common mantra. If you lose your private keys, your funds are gone forever. There is no customer support to call. This steep learning curve and the unforgiving nature of self-custody are major barriers to mainstream adoption.

- Scalability and Costs: Truly decentralized networks are often slower and more expensive to use than their centralized counterparts. Processing transactions on a global, trustless network requires significant computational effort. While solutions are being developed (like Layer 2 networks), this trade-off between decentralization, security, and scalability is a constant engineering challenge.

These are not small problems. They are serious issues that the industry is actively working to solve. But they don’t invalidate the core principle. The existence of free speech means some people will say terrible things. The existence of a free press means some will publish lies. And the existence of permissionless money means some will use it for illicit ends. The question for society is whether the immense value of the core principle outweighs the risks of its misuse.

Conclusion: The Feature, Not a Bug

The price of Bitcoin could go to a million dollars or it could go to ten thousand. In the grand scheme of things, it doesn’t matter as much as we think. The daily volatility is noise; the underlying signal is the quiet, relentless processing of blocks of transactions, open to anyone, controlled by no one. That is the revolution.

Censorship resistance is not just another item on a feature list. It is the entire point. It’s a powerful check on the overreach of both corporate and state power. It provides a parallel path, an opt-out, for anyone who finds themselves excluded, marginalized, or targeted by the traditional systems. In an increasingly digital and centralized world, the ability to own, control, and transfer value without asking for permission is not a niche feature for tech enthusiasts. It’s a fundamental necessity for a free and open society. And that’s why, long after the speculative frenzy has died down, this one feature will be crypto’s most enduring legacy.

FAQ

Doesn’t censorship resistance in crypto just help criminals?

While it’s true that some criminals use cryptocurrency, they also use the US dollar, the internet, and cars. The vast majority of transactions are for legitimate purposes. Furthermore, public blockchains like Bitcoin create a permanent, public ledger of all transactions. This is a powerful tool for law enforcement, and many major criminal cases have been cracked by following the money on the blockchain. The goal is to build systems that maximize freedom while developing tools to mitigate the inevitable misuse, rather than abandoning the principle of freedom itself.

Can’t governments just shut down the internet to stop crypto?

This is an extreme measure that would have catastrophic economic and social consequences far beyond cryptocurrency. Even in such a scenario, it’s not a surefire way to stop a decentralized network. Transactions can be broadcast via mesh networks, radio waves, and even satellite. As long as some nodes, somewhere in the world, are connected, the network can continue to function. The global and distributed nature of networks like Bitcoin and Ethereum makes them exceptionally resilient to localized shutdowns.

Is my crypto 100% uncensorable and safe?

The core protocol of a major decentralized network like Bitcoin is highly censorship-resistant. However, your personal vulnerability to censorship depends on how you interact with it. If you keep your crypto on a centralized exchange, you are trusting that exchange. They operate like a bank and can freeze your account. To achieve true censorship resistance, you must practice self-custody by holding your assets in a non-custodial wallet where you, and only you, control the private keys. This gives you maximum freedom but also maximum responsibility for your own security.