Investing in the Unseen: The Gold Rush for Mobile Bandwidth Protocols

You know the feeling. You’re trying to stream a 4K video, join a high-stakes video call, or even just load a ridiculously media-heavy webpage on your phone. And then it happens. The spinning wheel of death. Buffering. Lag. In that moment, your cutting-edge, thousand-dollar smartphone feels like a brick. The culprit isn’t your device; it’s the invisible highway your data travels on—the network. It’s congested, inefficient, and creaking under the strain of our insatiable demand for data. This is precisely why savvy investors are looking past the flashy apps and metaverse hype, focusing instead on a foundational layer: the protocols built to optimize bandwidth for mobile users. It’s not sexy, but it’s where the next wave of digital fortunes could be made.

Key Takeaways

- The Problem: Mobile data demand is exploding due to 5G, AI, and Web3, but existing infrastructure can’t keep up, creating a significant bottleneck.

- The Solution: A new class of decentralized protocols is emerging to optimize data transmission, reduce latency, and lower costs for mobile users.

- The Investment Opportunity: These protocols, often part of the DePIN (Decentralized Physical Infrastructure Networks) sector, represent a foundational investment in the future of the mobile internet.

- Evaluation is Key: Not all protocols are created equal. Investors must analyze the technology, tokenomics, team, and real-world adoption potential before committing capital.

The Mobile Data Crunch: Why We’re Hitting a Wall

Think of the internet’s infrastructure as a global system of highways. For decades, we’ve been adding more lanes and increasing the speed limit. But we’re reaching a point where that’s not enough. The number of vehicles—data packets—is growing exponentially. It’s a traffic jam on a planetary scale, and our mobile devices are stuck right in the middle of it.

The 5G Promise vs. Reality

Wasn’t 5G supposed to fix all of this? Yes and no. 5G offers incredible peak speeds, but its coverage is spotty, and its high-frequency signals have trouble penetrating buildings. It’s like having a Formula 1 race car that can only drive on a few specific streets in your city. For the vast majority of users, most of the time, the experience isn’t a revolutionary leap. Furthermore, 5G increases the capacity for data consumption, which in turn encourages the development of even more data-intensive applications. It solves one problem while amplifying another. We can now download a full-length movie in seconds… but what happens when millions of people in the same city are trying to do that at once while also streaming games and running AI apps? The local backhaul and core network infrastructure still feel the strain.

The Data Tsunami from Web3, AI, and the Metaverse

The problem is about to get much, much worse. The next generation of the internet is incredibly data-hungry.

- Web3 & Crypto: Decentralized applications require constant communication with a distributed network of nodes. Every transaction, every state update, every NFT mint—it all adds up to a constant stream of data.

- AI on Mobile: On-device AI is becoming a reality. Think real-time language translation, advanced computational photography, and AI assistants that understand context. These applications need to pull massive datasets and models, often from the cloud, creating huge data spikes.

- The Metaverse & AR/VR: This is the big one. Creating persistent, shared, 3D virtual worlds requires a continuous, high-bandwidth, low-latency connection that our current infrastructure can only dream of supporting. A few minutes in a low-res metaverse environment today can consume more data than an hour of HD video streaming.

The centralized, hub-and-spoke model of companies like AT&T, Verizon, and T-Mobile was not designed for this future. It’s too expensive, too slow to upgrade, and too inefficient. We need a new approach.

The Solution: Protocols That Optimize Bandwidth for Mobile Users

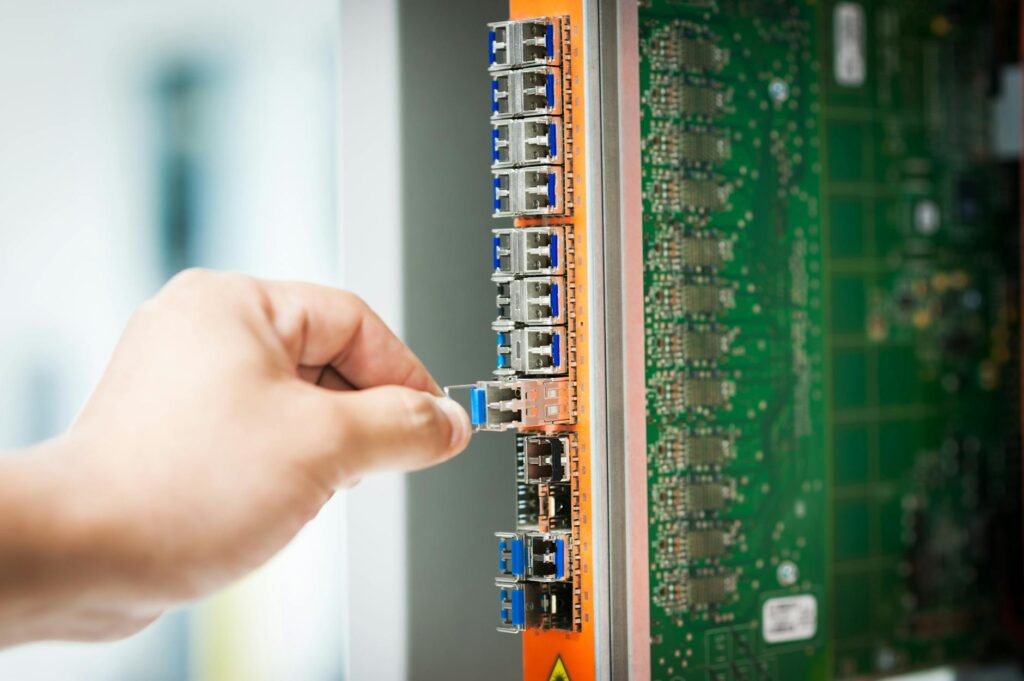

Enter a new breed of protocols. These aren’t user-facing applications. They are the plumbing, the wiring, and the fundamental physics of the new mobile internet. They are decentralized projects that use crypto-economic incentives to build a more efficient, resilient, and cost-effective way to move data from point A to point B. Instead of relying on a few massive data centers, they create a distributed network of thousands, or even millions, of small-scale nodes—sometimes even our own smartphones—to share the load.

How Do They Work? A Look Under the Hood

These protocols aren’t using magic. They’re employing a combination of clever computer science and economic incentives to squeeze every last drop of performance out of our networks. Key techniques include:

- Intelligent Data Compression: We’re not talking about simple .zip files. These are advanced, context-aware algorithms that can reduce the size of data streams in real-time without a noticeable loss in quality. Think of a video stream where the protocol only sends the pixels that change from one frame to the next, dramatically reducing the total data sent.

- Decentralized Content Delivery Networks (dCDNs): Instead of pulling a video from a server a thousand miles away, a dCDN protocol finds a copy of that video on a node just a few miles from you—maybe even in your neighbor’s house. By sourcing content from the ‘edge’ of the network, it dramatically reduces latency and eases congestion on the core internet backbone.

- Edge Computing: Rather than sending raw data to a central cloud for processing, these protocols allow for computation to happen on nodes closer to the user. An AR application, for example, could offload its heavy graphical rendering to a powerful local node instead of a distant server, resulting in a much smoother experience.

- Mesh Networking: Some protocols enable devices to connect directly to each other, forming a resilient mesh. If a local cell tower goes down, devices in the mesh can still relay data for each other, creating a self-healing network that is far more robust than our current centralized model.

- Token-Based Incentives: This is the secret sauce. How do you get thousands of people to run nodes for your network? You pay them. These protocols have their own native cryptocurrencies (tokens) that are used to reward participants for contributing resources like storage, compute power, or bandwidth. This creates a powerful flywheel effect: more users lead to more demand, which increases the value of the token, which incentivizes more people to become providers, strengthening the network.

Spotlight on Promising Protocols: Where to Look

While the space is still nascent, a few projects are paving the way and serve as great examples of the different approaches being taken. (Note: These are illustrative examples of project types and not financial advice.)

Project Aethera: The Bandwidth Marketplace

Aethera is building a decentralized marketplace where users can buy and sell unused mobile data and home internet bandwidth. Think of it as Airbnb for your Wi-Fi. Using their mobile app, users can contribute their spare bandwidth to a global pool. Other users, particularly those in areas with poor or expensive connectivity, can then purchase access to this pool at a fraction of the cost of traditional carriers. The entire system is powered by the AET token. Providers earn AET for the bandwidth they share, and consumers use AET to pay for access. It’s a beautifully simple model that directly tackles the issue of last-mile connectivity and data pricing.

Helios Mesh: The Resilient Network

Helios Mesh takes a different approach, focusing on infrastructure resiliency. They are not trying to replace ISPs, but to augment them. Helios encourages users to set up small, low-power radio nodes that create a secondary, independent communication network. If the primary cell network in a city is congested or fails during an emergency, devices can automatically switch to the Helios Mesh to send and receive critical data packets. Node operators are rewarded with SOLAR tokens based on their uptime and the amount of data they successfully route. This is a classic DePIN play, building a physical infrastructure network from the ground up, funded and operated by its community.

Substratum CDN: The Decentralized Content Engine

Substratum is a direct competitor to centralized CDNs like Cloudflare and Akamai. Their goal is to make content delivery faster and cheaper by decentralizing it. Website owners and application developers can pay in SUB tokens to have their content hosted on thousands of nodes around the world. When a user in, say, Tokyo, requests that content, Substratum’s protocol automatically serves it from the nearest node in Japan, rather than from a server in Virginia. This results in lightning-fast load times and a more censorship-resistant internet. Node runners earn SUB tokens for providing storage and bandwidth, creating a marketplace for content delivery.

The Investment Thesis: Why This is a Multi-Billion Dollar Opportunity

Investing in these protocols is a bet on the continued growth of the mobile internet. It’s a bet that the future will be more decentralized, not less. And it’s a bet that the current oligopoly of telecom giants is ripe for disruption.

The global telecommunications market is valued in the trillions of dollars. Even capturing a tiny fraction of that market by providing a more efficient data transmission layer represents a monumental opportunity for these decentralized protocols and their investors.

Sizing the Market: A Trillion-Dollar Pie

We’re not talking about a niche market. We’re talking about the foundational infrastructure that will power everything from finance and gaming to communication and AI. The combined market caps of the top telecom and content delivery network companies are staggering. Decentralized protocols can compete on both cost and performance, enabling them to peel away market share piece by piece. They can serve underserved markets that legacy providers deem unprofitable and enable new applications that are simply not possible on the current internet.

The DePIN Revolution

This entire sector is a part of a larger narrative known as DePIN (Decentralized Physical Infrastructure Networks). DePIN projects use token incentives to bootstrap and operate real-world infrastructure, from wireless networks and GPU farms to server racks and energy grids. It’s one of the most compelling and tangible use cases for cryptocurrency, and bandwidth optimization protocols are at the very heart of this movement.

Risks and Considerations

Of course, it’s not without risk. This is the bleeding edge. Many of these projects will fail. Regulatory uncertainty is a major hurdle; telecom is a heavily regulated industry. Technological challenges remain, especially in ensuring security and scalability. And then there’s the challenge of mass adoption—convincing millions of users and developers to switch from the systems they know. An investment in this space requires a high-risk tolerance and a long-term perspective.

How to Evaluate These Protocols

So, how do you separate the wheat from the chaff? It requires deep, fundamental analysis. Here’s a framework to get you started:

- Analyze the Technology: Is it novel and defensible? Is the approach they are taking fundamentally better than the existing centralized solution? Read their whitepaper. Understand the core mechanics. Is it just a theory, or do they have a working product or testnet?

- Scrutinize the Tokenomics: The token is the economic engine of the protocol. How is it used? How is it distributed? Is there a fixed supply? What are the incentives for providers and consumers? Poor tokenomics can kill even the best technology. Look for models that create a sustainable, long-term feedback loop.

- Investigate the Team and Community: Who is building this? Do they have experience in networking, cryptography, and economics? Is the team transparent and communicative? A strong, engaged community is often a leading indicator of a project’s potential for success.

- Assess the Go-to-Market Strategy: How does the project plan to acquire its first million users or nodes? Are they targeting developers, enterprises, or individual consumers? A brilliant protocol with no adoption plan is just a science project.

- Look for Early Traction: Are there any real-world pilots or partnerships? Is the network usage growing? Data is your best friend. Look for on-chain metrics that show the protocol is gaining traction and being used as intended.

Conclusion

The race to build the next generation of the internet is on. While most of the attention is focused on the surface-level applications, the real war is being fought in the trenches—at the protocol level. The projects dedicated to solving the fundamental problem of mobile bandwidth aren’t just creating a niche product; they are laying the foundation for everything that will be built on top of it. The journey will be volatile, and many will fail. But the protocols that succeed in creating a truly decentralized, efficient, and scalable infrastructure to optimize bandwidth for mobile users won’t just deliver immense value to their users; they will also create immense wealth for their early investors. The spinning wheel of death on your phone isn’t just an annoyance; it’s a multi-trillion dollar market failure, and that’s an opportunity.

FAQ

Is this the same as Web3?

It’s a foundational component of Web3. For Web3 applications (like dApps, crypto gaming, and the metaverse) to work smoothly on mobile devices, they need a highly efficient and decentralized network layer. These bandwidth protocols provide that essential infrastructure, making the broader Web3 vision possible.

Don’t we need new hardware for this to work?

Not always. Many of these protocols are software-based and are designed to run on existing hardware like smartphones, laptops, and home Wi-Fi routers. Some, like Helios Mesh in our example, may encourage users to purchase small, low-cost hardware nodes to strengthen the network, but the barrier to entry is typically much lower than building a traditional cell tower.

How do these protocol tokens get their value?

Their value is derived directly from the utility they provide within their network. Think of them as a commodity needed to access a service. If a dCDN protocol becomes popular, developers will need to buy its token to pay for content delivery. If a bandwidth marketplace takes off, users will need to buy its token to purchase data. This demand, often against a fixed or predictably inflationary supply, is what drives the token’s value. It’s a direct reflection of the network’s adoption and economic activity.