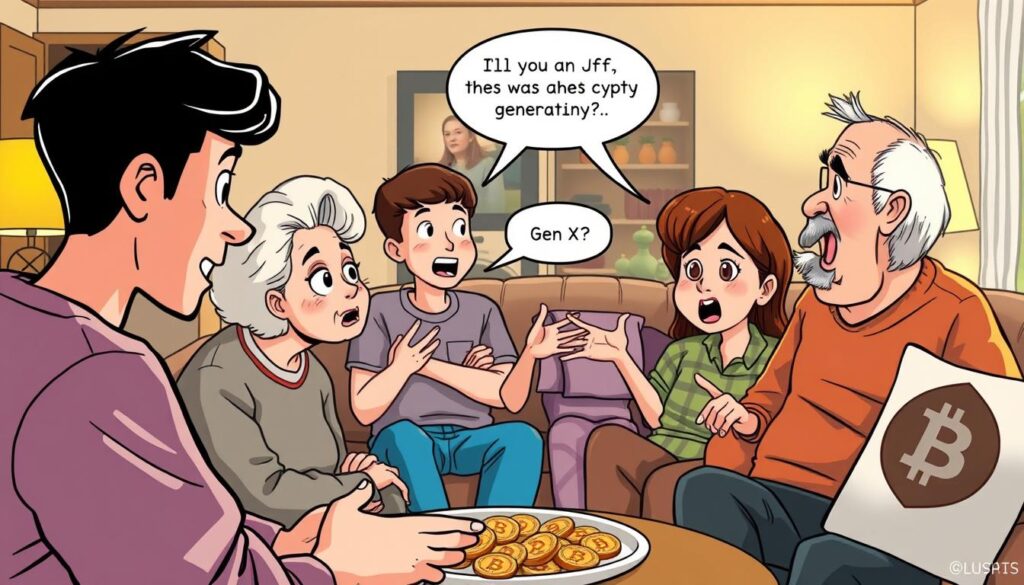

Money talks with relatives can feel like walking through a minefield – especially when digital currencies enter the conversation. Toronto blogger Martin Dasko learned this firsthand in 2021 when his tech-savvy father questioned the wisdom of blockchain-based ventures. Despite shared interest in modern finance, their discussion revealed deep divides in risk tolerance and market understanding.

These exchanges are becoming common as digital assets reshape financial planning. Younger generations often lead these dialogues, armed with YouTube tutorials and Reddit threads. Certified financial expert Robin Taub calls this “reverse mentoring” – a role reversal where adult children explain decentralized systems to skeptical parents.

Successful discussions require more than technical knowledge. Emotional intelligence proves crucial when addressing concerns about volatility or security. Preparation transforms heated debates into productive exchanges, helping relatives grasp concepts like wallets and tokenization without feeling overwhelmed.

This guide offers practical strategies for bridging generational gaps. You’ll learn to present market data effectively while respecting different comfort levels with technology. We’ll explore how clear communication can turn financial disagreements into opportunities for collective learning.

Key Takeaways

- Generational differences shape perspectives on digital asset adoption

- Effective dialogue combines technical knowledge with emotional awareness

- Real-world examples demonstrate common family concerns

- Reverse mentoring creates mutual learning opportunities

- Structured preparation improves discussion outcomes

- Shared financial literacy strengthens family decision-making

Grasping the Fundamentals of Cryptocurrency and Blockchain

Navigating the world of digital assets starts with understanding two interconnected concepts: decentralized money systems and their underlying frameworks. These innovations challenge traditional financial models while creating new opportunities for users worldwide.

What Is Cryptocurrency?

Digital currencies operate without central oversight, using encryption to secure transactions. Unlike physical money, they exist as code entries on shared networks. Over 20,000 such currencies now trade globally, with Bitcoin processing 400,000 daily payments despite its volatility.

Understanding Blockchain Technology

Every digital currency transaction relies on blockchain – a tamper-proof ledger duplicated across thousands of computers. This system prevents fraud by making historical records unchangeable. Financial strategist Robin Taub notes:

“Blockchain’s transparency forces accountability while maintaining user privacy through pseudonyms.”

| Feature | Traditional Banking | Blockchain Networks |

|---|---|---|

| Transaction Speed | 1-3 business days | 10 minutes – 1 hour |

| Fee Structure | Fixed percentages | Dynamic based on network demand |

| Record Alteration | Possible with approvals | Impossible after confirmation |

The $2.5 trillion market value of digital assets reflects growing institutional adoption. Major retailers and payment processors now accept select currencies, blending speculative trading with practical utility.

Understanding Family Dynamics Around Money and Investments

Many households treat financial matters like guarded secrets, creating invisible barriers to meaningful dialogue. Financial expert Robin Taub observes:

“Silence around money often stems from generational patterns, not personal choice.”

Exploring Money as a Taboo Topic

Three generations of Americans have inherited money habits shaped by economic crises and cultural norms. Nearly 45% of parents avoid financial talks due to:

- Unresolved debt or spending guilt

- Limited understanding of modern tools

- Concerns about judgment from relatives

These patterns directly affect how households approach emerging opportunities. Families avoiding basic budgeting talks rarely engage productively about digital assets. Start by observing reactions to routine topics like retirement plans or college funds.

Emotional barriers often surface as dismissive phrases: “We never discuss such things” or “That’s not your concern.” Address these gently by sharing neutral examples – like how grocery prices now include QR codes – to demonstrate technological shifts.

Creating safe spaces for money dialogue requires patience. Begin with low-stakes topics before introducing specialized terms. This builds confidence for future discussions about market trends or portfolio diversification.

Addressing Crypto Myths, Risks, and Scams

Digital finance innovations often face skepticism rooted in outdated information. Over $309 million vanished through fraudulent schemes in Canada during 2023 alone, according to national reports. Clearing up confusion requires separating technical realities from persistent myths.

Debunking Common Misconceptions

Three major myths distort public understanding of digital assets. First, the idea that these systems lack tangible value ignores 400,000 daily Bitcoin transactions powering real-world purchases. Second, environmental concerns fade when comparing energy use – Bitcoin mining uses 59% renewable power versus gold extraction’s 20%.

| Comparison Metric | Traditional Systems | Digital Networks |

|---|---|---|

| Transaction Tracking | Partial visibility | Full blockchain history |

| Energy Sources | Mixed grid reliance | Renewable prioritization |

| Government Adoption | Central bank control | 8% Bitcoin held nationally |

Spotting and Avoiding Crypto Scams

Fraudulent schemes often mimic legitimate platforms. Watch for these red flags:

- Guaranteed high returns with zero risk

- Unsolicited wallet address requests

- Celebrity-endorsed giveaway demands

The FTX collapse taught crucial lessons – users holding their own assets retained control despite exchange failures. Self-custody wallets prevent third-party vulnerabilities, while blockchain explorers let anyone verify transactions publicly.

Mastering explaining crypto, family communication, investment conversation

Navigating discussions about modern financial tools demands strategy. Start by acknowledging varying comfort levels with emerging trends. Certified planner Shannon Lee Simmons advises:

“Explicitly label the discussion’s purpose. A simple ‘Can we set aside time to explore digital assets?’ creates mental preparation.”

Initiating Open and Honest Discussions

Tailor your approach based on existing financial openness. For reserved households:

- Frame topics around learning: “I’m researching new financial tools – could we discuss them?”

- Use relatable comparisons: “Remember how online banking seemed risky at first?”

Financially transparent groups benefit from directness: “I want to share my portfolio experiments – when works for you?” Schedule sessions when participants feel alert, avoiding holiday stress or rushed mornings.

Setting Clear Expectations for Investment Conversations

Establish ground rules upfront. State objectives like: “This talk aims to share information, not pressure decisions.” Encourage questions with: “What aspects feel confusing or concerning?”

Consider these parameters:

- Time limits prevent fatigue (30-45 minutes ideal)

- Neutral locations reduce power dynamics

- Shared note-taking maintains focus

Financial therapist Amanda Clayman notes: “Clarity about boundaries transforms anxiety into curiosity.” Regular check-ins help address evolving concerns without overwhelming participants.

Tailoring the Conversation for Different Generations

Generational tech adoption gaps create unique challenges in financial discussions. Over 60% of US investors under 35 view digital assets as viable options, compared to 23% over 55. This divide demands customized approaches for productive dialogue.

Engaging Younger Relatives with Digital Fluency

Children raised in app-based environments grasp virtual value systems intuitively. Start with Minecraft coin comparisons: “Remember how emeralds buy tools? Digital tokens work similarly.” Teenagers familiar with CashApp need clear explanations about market swings – compare crypto volatility to concert ticket resale prices.

| Age Group | Communication Approach | Key Topics |

|---|---|---|

| 8-12 | Gaming currency analogies | Digital ownership basics |

| 13-17 | Fintech app comparisons | Privacy protections |

| 18-34 | Market trend analysis | Regulatory changes |

Bridging Perspectives with Older Adults

Parents often prioritize stability over innovation. Frame digital assets through traditional lenses: “This functions like stocks but trades 24/7.” Highlight how 401(k) plans now include blockchain ETFs. Address security concerns by demonstrating hardware wallet setups alongside bank safety deposit boxes.

Successful intergenerational talks blend respect for experience with enthusiasm for innovation. Grandparents teaching savings habits while learning wallet security creates mutual growth. Regular check-ins help balance emerging opportunities with proven strategies.

Utilizing Trusted Resources and Tools for Crypto Education

Building financial literacy in emerging technologies starts with accessible learning tools. Certified planner Shannon Simmons emphasizes:

“Interactive resources turn abstract concepts into tangible skills – they’re bridges between curiosity and confidence.”

Over 70% of first-time users report reduced anxiety after exploring simulation platforms.

Educational Platforms That Simplify Learning

Trusted guides break down complex topics through visual storytelling. Animated explainers outperform text-heavy manuals by 40% in retention rates, according to MIT studies. Focus on platforms offering:

- Step-by-step wallet setup tutorials

- Interactive blockchain diagrams

- Real-world scam prevention scenarios

| Resource Type | Best For | Verification Check |

|---|---|---|

| Regulated Trading Platforms | Secure transactions | OSC/CSA registration |

| Demo Wallets | Risk-free practice | Open-source code audits |

| Blockchain Explorers | Transaction tracking | Public ledger confirmation |

Hands-On Exploration Without Risk

Simulation tools let families experiment safely. Set up demo accounts on platforms like Coinbase Learn or Binance Academy to:

- Practice buying/selling with virtual funds

- Analyze historical market patterns

- Test security features like 2FA

Public blockchain explorers serve as digital microscopes. Viewing live transactions builds understanding of network transparency. Pair these tools with regulator-approved guides from the CSA website to reinforce trust.

Merging Crypto with Traditional Investment Strategies

Integrating emerging technologies into financial plans requires careful calibration between innovation and stability. Certified expert Robin Taub stresses:

“Digital currencies should enhance existing strategies, not overshadow proven methods.”

Balancing Risk, Reward, and Long-Term Goals

Financial planners often treat digital currencies as satellite holdings rather than core assets. Most experts suggest limiting exposure to 1-5% of total portfolio value. This approach maintains diversification while accounting for market swings.

Consider these allocation guidelines:

| Investor Profile | Crypto Allocation | Traditional Assets |

|---|---|---|

| Conservative | 0-1% | Bonds, Index Funds |

| Moderate | 2-3% | Stocks, Real Estate |

| Aggressive | 4-5% | Startups, Commodities |

Retirement-focused individuals face unique challenges. Those within 10 years of leaving work often reduce volatile holdings. Digital assets demand frequent reassessment – quarterly reviews help align positions with changing goals.

Younger investors might allocate more, leveraging time to recover from downturns. Always match decisions to personal risk thresholds. As financial advisor Simmons notes:

“A 3% loss feels different than a 30% plunge – size positions accordingly.”

Practical Tips for a Successful Family Crypto Conversation

Creating meaningful dialogue about modern finance starts with intentional planning. Toronto blogger Martin Dasko discovered this when his tech-savvy father asked pointed questions about market risks – despite both understanding blockchain basics. Their experience highlights three critical strategies for productive exchanges.

Setting a Dedicated Time to Talk

Schedule discussions when all parties feel relaxed and focused. Avoid meal times or busy weekends. Choose neutral settings like Sunday afternoon coffee hours to minimize distractions. Dasko found 45-minute sessions ideal for covering essentials without fatigue.

Encouraging Questions and Sharing Personal Experiences

Begin by inviting concerns: “What aspects make you hesitant?” Share your journey transparently – including setbacks. One parent reduced anxiety by explaining how a $50 test investment helped them learn market patterns. These stories build trust better than technical lectures.

Demonstrating How to Use Crypto Trading Platforms

Walk through secure platforms using screen-sharing tools. Highlight safety features like two-factor authentication. Many families benefit from joint demo accounts to practice risk-free. Consult a financial advisor to explain tax implications alongside trading mechanics.

Regular check-ins maintain momentum. Update relatives on market changes using simple examples, and acknowledge when answers remain uncertain. This balanced approach fosters ongoing learning while respecting boundaries.

FAQ

How do I start discussing digital assets with relatives who are skeptical?

Begin by acknowledging their concerns and sharing real-world examples, like Bitcoin’s role in decentralized finance. Use analogies, such as comparing blockchain to a secure digital ledger, to simplify complex ideas. Highlight platforms like Coinbase or Binance to demonstrate accessibility.

What are effective ways to address security concerns about decentralized finance?

Emphasize tools like hardware wallets (e.g., Ledger) and two-factor authentication. Discuss how platforms like Etherscan allow transparent tracking of transactions. Share stories of institutional adoption, such as PayPal’s integration of stablecoins, to build credibility.

How can I help older adults understand the volatility of tokens like Ethereum?

Compare market fluctuations to traditional assets, like stocks, while stressing diversification. Use visuals, such as price charts from TradingView, to show historical trends. Reinforce long-term strategies over short-term speculation to align with their risk tolerance.

What resources are trusted for learning about decentralized technologies?

Recommend beginner-friendly guides from CoinDesk or Khan Academy. Suggest experimenting with demo wallets, like MetaMask’s test networks, to practice without financial risk. Encourage attending webinars hosted by platforms like Kraken for deeper insights.

How do I explain the environmental impact of proof-of-work networks?

Acknowledge energy concerns but highlight shifts toward sustainable alternatives, such as Ethereum’s transition to proof-of-stake. Compare energy usage to industries like banking, and discuss eco-friendly projects like Solana or Algorand as alternatives.

What strategies balance digital assets with traditional portfolios?

Advocate for a “core and satellite” approach, where stable investments form the base, and tokens like Bitcoin act as growth supplements. Reference studies by Fidelity or Grayscale that analyze optimal allocation percentages based on risk profiles.

How can I protect loved ones from fraudulent schemes in decentralized markets?

Teach them to verify projects through CoinMarketCap or CoinGecko listings. Warn against “too good to be true” returns and emphasize due diligence. Share examples of regulatory actions, like the SEC’s crackdown on unregistered offerings, to underscore caution.

Why is transparency important when sharing portfolio decisions with households?

Open dialogue builds trust and aligns expectations. Use tools like Blockfolio or Delta to visually track holdings together. Stress that even experts like Cathie Wood advocate for gradual exposure to minimize emotional reactions during market swings.