How to Use On-Chain Tools to Anticipate Market-Moving Events

Remember that time Bitcoin suddenly dipped 10%? I do. My palms were sweaty, my heart was racing. I felt…blindsided. That’s when I realized relying solely on price charts was like navigating a ship in a dense fog. I needed something more. I needed to understand the underlying currents, the whispers of the market. I needed to learn how to use on-chain tools market insights. And trust me, it’s been a game-changer.

Why On-Chain Data is Your Secret Weapon

Traditional market analysis often focuses on price action and trading volume. But that’s only part of the story. On-chain analysis digs deeper, providing a granular view of what’s really happening on the blockchain. Think of it as peering behind the curtain. You see the puppeteers, the strings, the entire mechanism driving the market.

Decoding the Data: Key On-Chain Metrics

There’s a wealth of information available, but knowing which metrics to focus on is key. Here are a few of the most impactful:

- Exchange Flows: Track large deposits and withdrawals to gauge potential buying or selling pressure. A sudden influx of Bitcoin to exchanges? Might signal a sell-off.

- Whale Alerts: Follow the movements of large holders (whales). Their actions can significantly impact market prices.

- Transaction Volume: A spike in transaction volume can indicate increased network activity and potential price volatility.

Using On-Chain Tools: A Practical Example

Let’s say you’re analyzing Ethereum. You notice a significant increase in the number of active addresses and a surge in transaction volume on a decentralized exchange (DEX). This could indicate growing interest in a particular DeFi project. Combining this on-chain data with other market indicators could give you an edge in anticipating a potential price increase. It’s like having a crystal ball, albeit a data-driven one.

Mastering On-Chain Analysis: Top Tools and Resources

The beauty of on-chain analysis is the availability of powerful tools. Here are a few favorites:

- Glassnode: In-depth metrics and visualizations.

- CryptoQuant: Real-time on-chain data and market insights.

- Nansen: Advanced analytics for DeFi and NFTs.

How to Use On-Chain Tools Market Insights for Smarter Trading

Don’t just passively consume the data. Actively interpret it. Look for patterns, correlations, and anomalies. Combine on-chain analysis with other forms of market research for a more comprehensive view.

“Forewarned is forearmed.” On-chain analysis gives you that crucial foresight in the often volatile crypto market.

Understanding on-chain data isn’t just about anticipating market movements. It’s about gaining a deeper understanding of the underlying forces shaping the crypto landscape. It’s about empowering yourself to make informed decisions. It’s about navigating the crypto seas with confidence, even in the thickest fog. And that’s the kind of confidence I wish I had back when I first started. Live and learn, right? So, dive in, explore these tools, and start unraveling the mysteries of the blockchain. You won’t regret it.

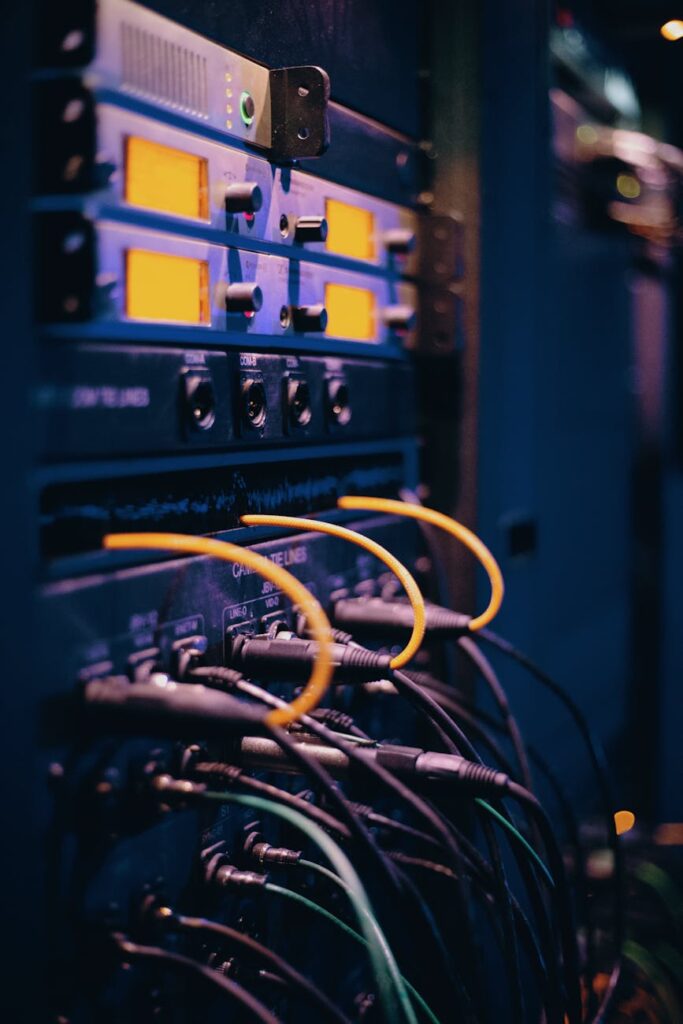

The image above represents the complex network of on-chain transactions, illustrating the intricate data landscape that can be analyzed for market insights.

This video further explores practical applications of on-chain analysis.

On-Chain Data: The Future of Crypto Analysis

As the crypto market matures, on-chain analysis will become even more crucial. It’s no longer a niche skill, but a fundamental requirement for anyone serious about navigating this exciting and often unpredictable space. So, start exploring. Start learning. And start anticipating.