Navigating the Crypto Roller Coaster Without Losing Your Lunch

Let’s be honest. The cryptocurrency market feels like the Wild West on a triple-shot of espresso. One minute, a meme coin with a dog on it is skyrocketing to the moon, and the next, a seemingly solid project is plummeting back to Earth. It’s exhilarating, confusing, and incredibly loud. In the middle of all this noise, it’s dangerously easy to get swept up in the emotion of it all. This is the seductive, and often destructive, world of hype cycles in cryptocurrency. We’ve all felt that pull—the fear of missing out (FOMO) as prices climb, the urge to jump on the bandwagon before it leaves without us. But blindly following the crowd is one of the fastest ways to turn a promising investment into a painful lesson.

Key Takeaways:

- Hype cycles are a predictable pattern of public enthusiasm, from initial excitement to a peak of inflated expectations, followed by a crash and a slow recovery.

- Psychological traps like FOMO, herd mentality, and social media echo chambers are the primary fuel for these cycles.

- Chasing hype often leads to buying at the peak and selling at the bottom, resulting in significant financial losses and emotional distress.

- Developing a strategy based on fundamental analysis, due diligence (DYOR), and long-term thinking is the best defense against getting caught in a hype trap.

So, What Exactly Is a Crypto Hype Cycle?

You’ve seen it happen. A new token is announced. A few tech bloggers mention it. Then, it starts popping up on Reddit. Suddenly, it’s all over Crypto Twitter, with influencers posting rocket emojis and wild price predictions. The price starts to tick up. Then it jumps. Then it goes parabolic. Everyone is a genius. This is the hype cycle in action.

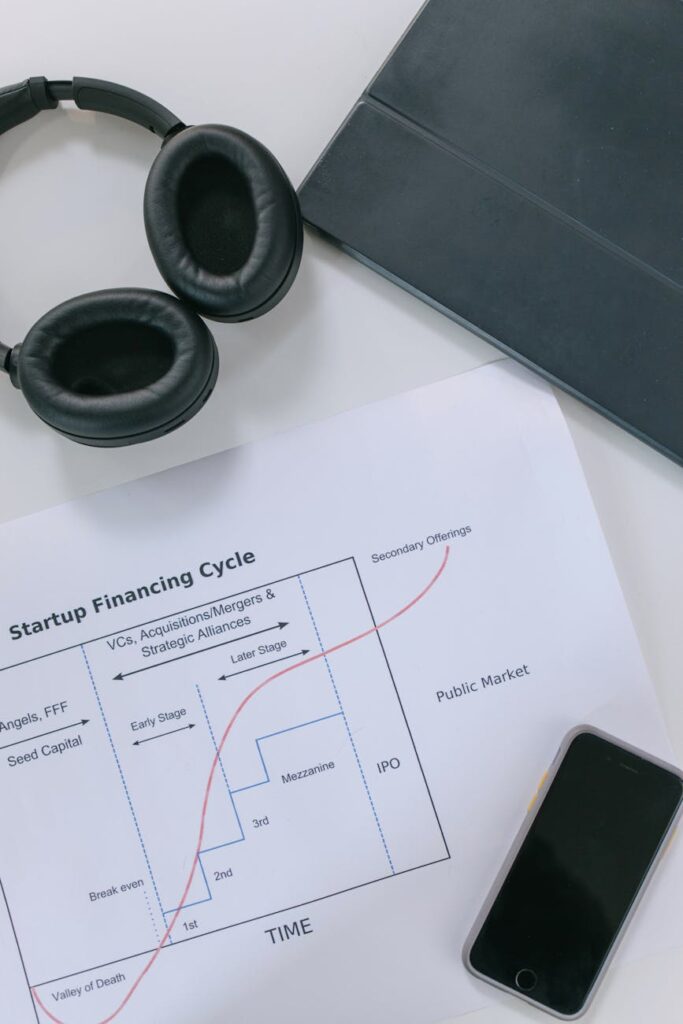

It’s not just a random phenomenon; it follows a surprisingly predictable pattern, often modeled after the Gartner Hype Cycle, which was originally designed for tracking technology adoption. It breaks down like this:

- Innovation Trigger: A new project, technology, or concept emerges. It’s niche, interesting, and full of potential, but mostly known only to insiders and enthusiasts. Think of Bitcoin in its earliest days.

- Peak of Inflated Expectations: This is where the hype machine goes into overdrive. The mainstream media picks up the story. Success stories (some real, many exaggerated) go viral. Everyone and their grandmother is talking about it. The price decouples from its actual utility and value, driven purely by speculation and FOMO. This is the point of maximum financial risk.

- Trough of Disillusionment: Reality sets in. The technology fails to live up to the impossible expectations. Early adopters start taking profits. A negative news story might act as a catalyst, causing a panic. The price crashes, often wiping out 80-90% or more of its value. The project is declared ‘dead’ by the media.

- Slope of Enlightenment: The dust settles. The tourists have left. The developers who stuck around keep building. The community that remains understands the technology’s real-world applications and limitations. The project starts to find its footing and deliver on its initial promise, albeit in a more measured way.

- Plateau of Productivity: The technology finds its place in the market. Mainstream adoption begins, but it’s based on tangible value and utility, not wild speculation. The growth is slower, more stable, and sustainable.

Recognize that pattern? It’s played out with countless altcoins, with NFTs in 2021, and even with broader market cycles. Understanding these stages is like having a map of the emotional battlefield you’re about to enter.

The Psychology Behind the Hype: Why We’re All Suckers for a Good Story

It’s easy to look at a chart after a crash and say, “Who would be foolish enough to buy at the top?” The answer is: most people. Our brains are simply not wired for rational decision-making in high-stress, high-reward environments. We’re fighting against millennia of evolutionary psychology.

The Unbeatable Power of FOMO

Fear of Missing Out is perhaps the single most powerful emotion in investing. Watching a green candle shoot up on a chart triggers a primal part of our brain that screams, “Everyone else is getting rich and you’re being left behind!” This feeling can override logic, due diligence, and any semblance of a plan. It turns cautious investors into gamblers, chasing a price that is already astronomically high with the hope that it will go just a little bit higher.

Social Media: The Ultimate Hype Amplifier

If FOMO is the fuel, social media is the engine. Platforms like Twitter, Reddit, and TikTok are echo chambers designed to amplify excitement. Algorithms feed you more of what you’re engaging with, so if you’re looking at a hyped coin, you’ll be inundated with posts confirming your bias. You’ll see screenshots of massive gains (but never the losses), celebrity endorsements, and a manufactured sense of urgency. This is called social proof—the tendency to assume the actions of others reflect the correct behavior. When it seems like everyone is buying, it feels safer to join in, even if it’s objectively a terrible idea.

“In the crypto world, a ‘community’ can sometimes just be a large group of people who all bought the same thing at the same time, desperately trying to convince others to buy it so the price goes up.”

The Real-World Dangers of Following Hype Cycles in Cryptocurrency

Giving in to the hype isn’t just a minor misstep; it can be absolutely devastating to your portfolio and your mental health. It’s more than just a bad trade. It’s a systemic problem that preys on inexperienced investors.

- Buying High, Selling Low: This is the classic, tragic outcome. Hype-driven investors almost always arrive late to the party. They buy near the Peak of Inflated Expectations, providing the liquidity for early investors and insiders to cash out. When the inevitable crash happens, panic sets in, and they sell at a massive loss in the Trough of Disillusionment.

- Investing in ‘Vaporware’: Many projects that generate incredible hype have little to no substance. They might have a flashy website and a vague whitepaper full of buzzwords, but no working product, no clear use case, and no experienced team. You’re not investing in a technology; you’re buying a marketing campaign.

- Emotional Burnout and Decision Fatigue: Constantly riding the emotional roller coaster of a hype cycle is exhausting. The stress of watching your portfolio value swing wildly, the anxiety of trying to time the top, and the despair of a crash can lead to total burnout. This makes you more likely to make poor, emotionally-driven decisions with your other investments.

- Missing Genuine Opportunities: While everyone is distracted by the latest shiny object, truly innovative projects with long-term potential are quietly being built. By chasing hype, you’re not just risking your capital on a bad bet; you’re also missing the chance to invest in the next Amazon or Google of the crypto world during its early, undervalued stages.

How to Spot a Hype Cycle Before You’re a Victim

You can’t time the market perfectly, but you can learn to recognize the red flags of a project that’s running on fumes instead of fundamentals. It’s about becoming a skeptic in a world full of cheerleaders.

Red Flags to Watch For

Think of this as your hype-detection checklist. The more boxes a project ticks, the more cautious you should be.

- Promises of Guaranteed or Insane Returns: Legitimate investments don’t offer guaranteed returns. If you see phrases like “100x potential is inevitable” or “can’t-miss gains,” run the other way.

- Emphasis on Price, Not Product: Is all the discussion about the token’s price? Are people just speculating on when it will “moon”? If nobody is talking about the technology, the problem it solves, or its adoption, it’s a huge red flag.

- Anonymous or Inexperienced Team: Who is behind the project? Do they have a proven track record in software development, cryptography, or business? If the team is anonymous or their LinkedIn profiles look flimsy, you have to ask why.

- No Clear Use Case or Whitepaper: What does this token actually do? If you can’t explain its purpose in a simple sentence, it probably doesn’t have one. A weak or plagiarized whitepaper is an even bigger warning sign.

- Aggressive, Celebrity-Driven Marketing: Is the project paying C-list celebrities or huge influencers to shill their token? This is a tactic to manufacture hype and dump tokens on their followers. It’s not a sign of a quality project.

DYOR: Your Ultimate Defense

“Do Your Own Research” is a cliché for a reason. It’s the only thing that separates investing from gambling. But DYOR means more than watching a few YouTube videos. It means digging deep: reading the entire whitepaper, investigating the development team, understanding the tokenomics (how the tokens are distributed), and assessing the competition. It’s work. It’s not as fun as watching charts go up. But it’s what will keep you safe.

Building a Hype-Resistant Crypto Strategy

So how do you participate in this exciting market without getting burned? You need a plan. A boring, patient, and unemotional plan. That’s what works.

Focus on Fundamentals, Not Feelings

Instead of chasing hype, look for value. Analyze a project based on its core components:

- Technology: Is the blockchain secure, scalable, and genuinely innovative?

- Use Case: Does it solve a real-world problem that people will pay to fix?

- Team: Is the team public, experienced, and committed to their vision?

- Tokenomics: Is the token supply reasonable? Is it fairly distributed or heavily concentrated in the hands of a few insiders?

- Community: Is the community made up of developers and users, or just price speculators?

Diversification and Dollar-Cost Averaging (DCA)

Don’t go all-in on one project, no matter how much you believe in it. Diversification spreads your risk across different types of assets. If one fails, your entire portfolio isn’t wiped out.

Dollar-Cost Averaging is your secret weapon against volatility and FOMO. It’s the simple practice of investing a fixed amount of money at regular intervals (e.g., $100 every week), regardless of the price. When the price is high, you buy fewer tokens. When the price is low, your fixed amount buys more. This approach removes the impossible task of timing the market and ensures you’re buying during the downturns, not just at the euphoric peaks.

Patience is the most underrated skill in cryptocurrency investing. The market has a way of transferring wealth from the impatient to the patient. Don’t be the one giving your money away.

Conclusion

The cryptocurrency market is a powerful wealth-creation engine, but it’s also a minefield of psychological traps. Hype cycles are a natural part of this emerging landscape, fueled by human emotion and amplified by modern technology. They are exciting, alluring, and incredibly dangerous for the unprepared.

By understanding the stages of a hype cycle, recognizing the psychological triggers that make you vulnerable, and committing to a disciplined strategy based on fundamentals, you can navigate this market with confidence. Stop chasing rockets. Instead, focus on building a solid foundation, one well-researched, patient investment at a time. The real gains aren’t made in the frantic days of a bull run, but in the quiet months of research and steady accumulation that precede it.