The Role of Bug Bounties in Securing DeFi Protocols for Investors

It seems like every other week, there’s a new headline about a nine-figure DeFi hack. A flash loan attack here, a reentrancy exploit there. Billions of dollars have vanished from protocols that were once considered safe bets. As an investor in this space, you’ve probably felt that stomach-dropping lurch, wondering if your capital is truly safe. You do your due diligence, you check for audits, but is that enough? The hard truth is, often it isn’t. This is where the conversation needs to shift towards a more dynamic and continuous form of defense. We’re talking about the critical, often-underappreciated role of bug bounties in securing DeFi protocols and, by extension, protecting your hard-earned assets.

Key Takeaways

- Continuous Defense: Unlike one-time audits, bug bounties provide ongoing, real-world security testing by a global pool of ethical hackers.

- Economic Sense: Paying a large bounty for a critical bug is infinitely cheaper than losing hundreds of millions of dollars in a hack. It’s a powerful form of insurance.

- Investor Trust Signal: A well-funded, active bug bounty program shows that a DeFi project is mature and serious about protecting user funds, which is a major green flag for investors.

- Finding What Audits Miss: Bug bounties incentivize diverse, creative minds to find novel attack vectors and complex bugs that traditional, time-boxed audits might overlook.

What Exactly Is a Bug Bounty Program, Anyway?

Let’s clear something up. A bug bounty isn’t just a protocol throwing some cash at a random person who finds a typo in their code. It’s a structured, formalized program that invites ethical hackers—often called “white hat” hackers—to find and responsibly disclose vulnerabilities in their systems in exchange for a monetary reward. Think of it as crowdsourcing your security team.

More Than Just a Reward

A proper bug bounty program, often managed through platforms like Immunefi or HackerOne, has clear rules of engagement. It defines what systems are “in scope” for testing, outlines the types of vulnerabilities they’re looking for, and establishes a severity scale that determines the size of the payout. A minor bug that could cause a UI glitch might earn a few hundred dollars. A critical vulnerability that could lead to the draining of the entire treasury? That could net the researcher a bounty of millions. This structure ensures the process is organized and that hackers focus their efforts where it matters most.

The Key Players: White Hat Hackers

Forget the stereotype of a hooded figure in a dark basement. White hat hackers are some of the most skilled security researchers, developers, and cybersecurity professionals on the planet. They thrive on the intellectual challenge of breaking complex systems. For them, it’s a puzzle. The bounty is the prize for solving it, but the motivation is often the thrill of the hunt and the satisfaction of helping to secure the digital world. They are the polar opposite of “black hat” hackers, who find the same vulnerabilities but exploit them for personal gain, leaving devastation in their wake.

Why Traditional Audits Just Aren’t Enough

“But the protocol was audited!” It’s a common cry heard after a major exploit. And it’s true, a smart contract audit from a reputable firm is an absolutely essential first step. It’s non-negotiable. But relying on an audit alone in the fast-moving world of DeFi is like building a fortress and then firing all the guards.

The ‘Snapshot in Time’ Problem

An audit is a snapshot. It’s a deep-dive analysis of a specific version of the code at a particular moment. The auditors do their work, identify potential issues, and the dev team fixes them. The protocol launches. Everyone breathes a sigh of relief. But what happens next week when the protocol integrates a new oracle? Or next month when they upgrade a key smart contract to add new functionality? The original audit is now partially obsolete. The code has changed. New attack surfaces have been created. DeFi doesn’t stand still, so a static security check can’t be the only line of defense.

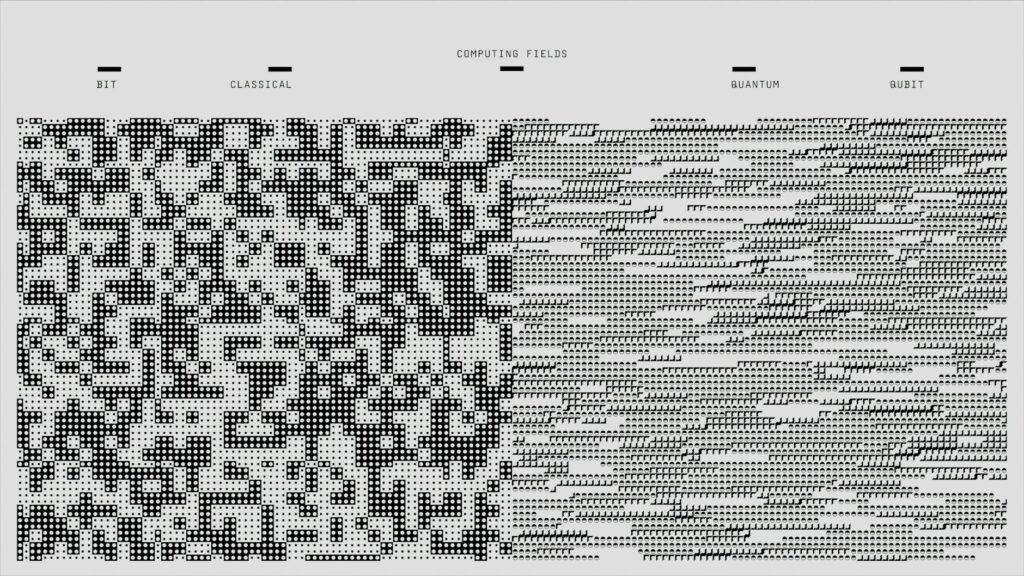

The Limits of a Few Pairs of Eyes

Auditing firms employ brilliant people, but they are still just a handful of individuals working against a deadline. A bug bounty program, on the other hand, unleashes a global army. Hundreds, even thousands, of security researchers with different backgrounds, different skill sets, and different ways of thinking are all poking and prodding the code from every conceivable angle. It’s the ultimate stress test. Someone in Brazil might spot a flaw that a team in Germany missed. It’s the power of the crowd, applied to security, 24/7/365.

The Direct Impact of Bug Bounties on Securing DeFi Protocols

So, how does this all translate into better protection for you, the investor? It’s about shifting from a reactive posture to a proactive one.

Proactive vs. Reactive Security

An audit is proactive before launch. A bug bounty is proactive *after* launch. It’s a continuous hunt for vulnerabilities. Instead of waiting for a black hat to find an exploit and drain the liquidity pools, the protocol incentivizes a white hat to find it first. Let’s use an analogy. An audit is like the city inspector approving the blueprints for a new bank vault. It’s crucial. But a bug bounty is like hiring the world’s best safecrackers to try and break into that vault every single day, and paying them handsomely if they find a way in. Which bank would you feel safer putting your money in?

Fostering a Culture of Security

When a DeFi protocol launches a significant bug bounty program, it sends a powerful message. It tells the world, and especially its investors, “We are humble enough to know we’re not perfect, and we are serious enough to invest heavily in protecting your funds.” It builds immense trust and credibility. Conversely, a project with no bounty program, or a laughably small one, might be signaling either arrogance (they think their code is flawless) or a lack of concern for user security. Both are massive red flags.

The Simple Economic Equation

Consider this: in 2022, the Nomad bridge was hacked for $190 million. The Euler Finance hack in 2023 was nearly $200 million. Now, imagine if those protocols had offered a $10 million bounty for the critical vulnerability that led to those disasters. The white hat who found it would have been set for life, the protocol would have saved itself from an existential catastrophe, and investors would have slept soundly. Paying a multi-million dollar bounty is a bargain compared to a nine-figure exploit. It’s one of the best investments a protocol can make.

“A DeFi protocol without a bug bounty is like a bank that’s left its vault door wide open, simply hoping that no one with bad intentions happens to walk by.”

What Investors Should Look For in a Protocol’s Security Stack

As an investor, you need to become a savvy assessor of a project’s security posture. It’s no longer enough to just check if they have an audit. You need to look deeper. Here’s a simple checklist:

- Is there an active bug bounty program? First and foremost, check their website or security documentation. If there isn’t one, ask why.

- Is it well-funded? A bounty of $50,000 for a critical bug that could lose $500 million is not a serious deterrent. The potential reward for reporting must be competitive with the potential reward for exploiting. Look for bounties in the hundreds of thousands or millions for the most severe findings.

- Is it hosted on a reputable platform? Using a third-party platform like Immunefi adds a layer of legitimacy and management that shows the team is serious about the process.

- Do they have a history of payouts? A program that exists on paper but has never paid out a bounty is a red flag. Check platforms for their track record of rewarding researchers.

- Do they have multiple audits from different firms? Remember, bounties *complement* audits, they don’t replace them. The gold standard is multiple audits *and* a strong bug bounty program.

- How transparent are they? Look at how they have communicated about security in the past. Do they openly publish post-mortems after an incident, or do they try to sweep things under the rug?

The Risks and Realities: It’s Not a Silver Bullet

While incredibly powerful, bug bounty programs aren’t a perfect, magical solution. It’s important to understand their limitations.

The Threat of Unreported Bugs

There’s always the risk that a hacker finds a critical vulnerability and decides the potential reward from exploiting it is greater than the bounty. This is precisely why the size of the bounty is so important. By making the legitimate path overwhelmingly profitable, protocols can tip the economic scales in favor of responsible disclosure.

Scope and Limitations

Bounty programs have a defined scope. A hacker might find a vulnerability in a third-party application that a protocol integrates with, which might not be covered by the bounty. This is why a holistic approach to security, looking at every piece of the puzzle, is so vital.

Conclusion

In the high-stakes, adversarial environment of decentralized finance, security can’t be an afterthought or a one-time checklist item. It must be a continuous, living process. Bug bounties are the beating heart of that process. They represent a fundamental shift from a static defense to a dynamic, ever-evolving one powered by collective intelligence. For investors, they are more than just a technical detail; they are one of the strongest indicators of a project’s commitment to protecting capital, its operational maturity, and its potential for long-term survival. The next time you evaluate a DeFi project, don’t just ask, “Are you audited?” Ask, “How big is your bug bounty?” The answer might tell you everything you need to know.

FAQ

Are bug bounties better than smart contract audits?

They aren’t better or worse; they are different tools for different jobs that are most effective when used together. An audit is a deep, formal analysis before launch, essential for catching initial flaws. A bug bounty is a continuous, real-world stress test after launch, crucial for finding new vulnerabilities as the protocol evolves. The best security combines multiple audits with a robust, ongoing bug bounty program.

How can I check if a DeFi protocol has a bug bounty program?

The easiest way is to check the protocol’s official website, often in the footer under a “Security” or “Developers” link. Many projects also announce their programs on their blog or social media. You can also go directly to major bug bounty platforms like Immunefi and search for the protocol by name to see if they have an active program listed.

Does a large bug bounty guarantee a protocol is 100% safe?

No. Nothing can guarantee 100% safety in DeFi. Security is a process of risk mitigation, not risk elimination. A large bug bounty is a very strong sign that a project takes security extremely seriously and is investing heavily in it. It significantly reduces the risk of an exploit but doesn’t completely remove it. It should be seen as one crucial component of your overall due diligence.