The Future of Sustainable and Green Energy Crypto Mining Solutions.

Let’s be honest. When you hear “crypto mining,” your mind probably jumps to a few places. Maybe it’s a vision of instant digital wealth. Or maybe, more likely, it’s the headlines screaming about planet-sized carbon footprints and energy consumption that rivals entire countries. For a long time, the narrative has been that cryptocurrency, particularly Bitcoin, is an environmental disaster. And that narrative wasn’t exactly wrong. But it’s an incomplete picture. The industry is at a crossroads, and the path forward is looking remarkably green. We’re on the cusp of a revolution in green energy crypto mining, one that could not only clean up blockchain’s reputation but also accelerate the global transition to renewables. It’s a complex, fascinating, and incredibly important shift.

Key Takeaways:

- Crypto mining’s energy problem is primarily tied to Proof-of-Work (PoW) consensus mechanisms, used by Bitcoin.

- Miners are increasingly moving to renewable energy sources like solar, hydro, and geothermal to power their operations.

- Innovative solutions include using stranded energy, capturing flared methane gas, and recapturing heat from mining rigs for other uses.

- The shift to less energy-intensive models like Proof-of-Stake (PoS) represents a fundamental change in the industry’s energy profile.

- While challenges remain, the trend towards sustainable mining is reshaping the future of blockchain technology.

The Elephant in the Room: Crypto’s Massive Energy Appetite

You can’t talk about the solution without first staring the problem straight in the face. The energy consumption of some cryptocurrencies is staggering. The Cambridge Bitcoin Electricity Consumption Index is a real eye-opener, often placing Bitcoin’s annual energy draw in the same league as countries like Sweden or Malaysia. It’s a lot. But why?

Proof-of-Work: The Power-Hungry Engine

The culprit is an ingenious but ravenous system called Proof-of-Work (PoW). It’s the consensus mechanism that secures the Bitcoin network and many other early cryptocurrencies. In a nutshell, PoW requires a global network of specialized computers (miners) to compete against each other to solve incredibly complex mathematical puzzles. The first one to solve the puzzle gets to add the next “block” of transactions to the blockchain and is rewarded with new coins. This computational race is what keeps the network secure and decentralized. It’s brilliant. But it’s also a brute-force approach. The more computing power (or “hash rate”) a miner throws at the problem, the higher their chance of winning the reward. And all that computing power requires a colossal amount of electricity.

Think of it like a global lottery where your tickets are purchased with electricity. The more you spend, the better your odds. This has led to an arms race, with miners building massive data centers filled with thousands of specialized machines running 24/7. That’s where the energy bill comes from.

The Environmental Fallout

Initially, miners set up shop wherever electricity was cheapest. Unfortunately, for a long time, that meant regions heavily reliant on fossil fuels, particularly coal. The result was a significant carbon footprint that rightly drew the ire of environmentalists, regulators, and the public. The image of a revolutionary digital technology being powered by 19th-century energy sources was a tough pill to swallow. It created a PR nightmare for the entire industry and raised legitimate questions about its long-term viability in a world increasingly focused on sustainability. Something had to change. And it is.

The Green Revolution: Pioneering Sustainable Crypto Mining

The narrative is shifting, driven by a combination of economic sense, public pressure, and genuine innovation. Crypto miners are, at their core, energy arbitrageurs. They seek the cheapest, most reliable power on the planet. And guess what’s becoming the cheapest power on the planet? Renewables.

Solar-Powered Mining: Tapping into the Sun

Solar is a perfect example. The cost of solar photovoltaic (PV) panels has plummeted over the last decade. In sunny regions, solar energy is now cheaper than fossil fuels. Crypto miners are taking advantage of this by co-locating their operations with large-scale solar farms. This is a win-win. The solar farm gets a consistent, built-in buyer for its power, making new projects more financially viable. The miner gets access to incredibly cheap, clean energy, at least during the day. It’s a symbiotic relationship that can help stabilize energy grids and fund the expansion of solar infrastructure.

Harnessing Hydropower: Mining by the River

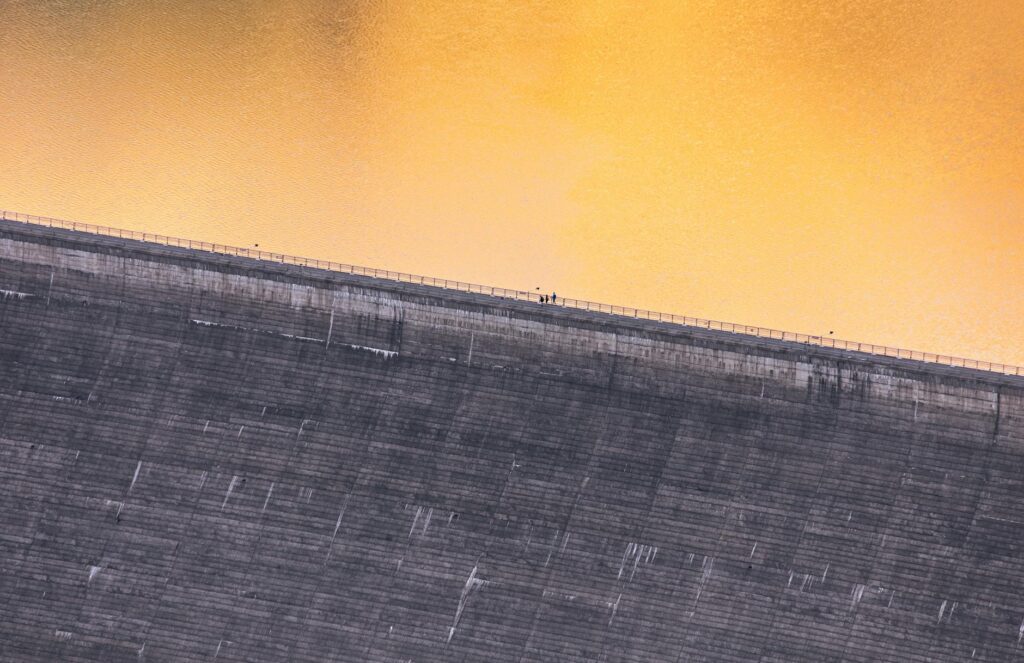

Hydropower is another major player in the green mining space. Regions with abundant hydroelectric resources, like parts of Canada, the Pacific Northwest, and Scandinavia, have become hotspots for sustainable mining. Hydropower provides a consistent, 24/7 baseload of clean energy, which is ideal for mining operations that never sleep. These miners aren’t just plugging into the existing grid; they are often the primary customers that make new hydro projects feasible or revitalize old ones.

Geothermal Energy: Earth’s Natural Heat

This is where it gets really interesting. Geothermal energy, which taps into the heat from the Earth’s core, is one of the most reliable and clean energy sources available. Countries like Iceland and El Salvador have become pioneers in this space. El Salvador, famously, is even using energy from its volcanoes to mine Bitcoin. Geothermal provides a constant power source, unaffected by weather or time of day, making it a holy grail for miners seeking stability and sustainability.

“What was previously a liability—stranded, intermittent, or excess energy—is now being turned into a digital asset. This is a profound shift in how we think about energy markets.”

The Wind Catcher: Wind Turbine Solutions

Much like solar, wind power is an intermittent source, but when it’s blowing, it’s incredibly cheap. Miners can set up operations near wind farms to absorb excess energy that the grid might not be able to handle during periods of high production. This helps prevent energy curtailment (where a grid operator has to tell a wind farm to stop producing) and provides an extra revenue stream for the wind farm operator. It makes the economics of wind power even more attractive.

Beyond Renewables: Innovative Green Energy Crypto Mining Solutions

The future of green energy crypto mining isn’t just about plugging into a solar panel. It’s about a whole ecosystem of innovative solutions that tackle energy problems from different angles. This is where the story gets truly exciting and reveals the potential for crypto to be a net positive for the environment.

Methane Gas Capture: Turning Waste into Watts

This is a game-changer. Across the world, oil and gas operations flare (burn off) excess natural gas (methane). This is done because it’s often not economical to build a pipeline to transport it. Methane is a potent greenhouse gas, far more damaging in the short term than CO2. Enter crypto mining. Companies are now deploying mobile mining data centers directly to these oil fields. They capture the methane that would have been flared, use it to generate electricity on-site, and power their mining rigs. It’s an almost perfect solution:

- It dramatically reduces methane emissions.

- It turns a waste product into a valuable resource (Bitcoin).

- It provides a new revenue stream for the energy producer.

This is arguably one of the most powerful environmental arguments in favor of Bitcoin mining today.

Heat Recapture: A Circular Economy for Mining

Mining rigs are basically very powerful, very specialized heaters. They generate a tremendous amount of heat. For years, this was just a waste product that had to be vented away. Not anymore. Creative miners are now recapturing this heat and putting it to good use. We’re seeing mining operations used to:

- Heat commercial greenhouses for year-round farming.

- Provide heat for district heating systems in cold climates.

- Warm swimming pools and industrial facilities.

- Power small-scale desalination plants.

This concept, known as a circular economy, turns a single-use energy process into a dual-purpose one, dramatically improving overall efficiency.

The Rise of Proof-of-Stake (PoS)

Perhaps the biggest change of all is moving away from Proof-of-Work entirely. The main alternative is Proof-of-Stake (PoS). Instead of requiring computational power to secure the network, PoS requires participants (called validators) to lock up, or “stake,” a certain amount of the network’s cryptocurrency. Validators are then chosen to create new blocks based on the size of their stake. The energy requirement is minuscule in comparison. Ethereum, the world’s second-largest cryptocurrency, famously transitioned from PoW to PoS in an event called “The Merge.” The switch cut its energy consumption by an estimated 99.95%. It was like the entire country of Finland just unplugged from the grid overnight. Many new blockchain projects are now launching directly on PoS, making the energy debate a non-issue from the start.

Challenges and the Road Ahead

Of course, the transition isn’t without its hurdles. The green future of crypto isn’t a foregone conclusion, and there’s work to be done.

Intermittency and Grid Stability

The primary challenge with renewables like solar and wind is their intermittency. The sun doesn’t always shine, and the wind doesn’t always blow. While miners can help absorb excess power, they still need a plan for when production dips. Battery storage solutions are becoming more common but add significant cost and complexity to an operation.

The Cost Factor

While the operational cost of renewables is low, the initial capital expenditure to build a solar farm or a geothermal plant is high. Connecting a mining facility to these sources, especially in remote locations, also requires significant investment in infrastructure. This can be a barrier for smaller mining operations, though the long-term economic benefits are often compelling.

Conclusion

The story of crypto and energy is evolving at a breakneck pace. The outdated image of dirty, coal-powered mining is being replaced by a much more nuanced and hopeful reality. From harnessing volcanic power to cleaning up methane emissions, the crypto mining industry is proving to be a powerful engine of innovation in the energy sector. It’s acting as a global buyer of last resort for clean energy, incentivizing the build-out of renewable infrastructure in ways no other industry can. The road ahead will have its bumps, but the trajectory is clear. The future of crypto isn’t just digital; it’s sustainable. The synergy between blockchain technology and renewable energy isn’t just a possibility—it’s fast becoming the new standard.

FAQ

Is all crypto mining bad for the environment?

No, this is a common misconception. The environmental impact is tied to the energy source used and the consensus mechanism. Mining powered by renewable energy like solar, hydro, or geothermal has a minimal carbon footprint. Furthermore, cryptocurrencies that use Proof-of-Stake (PoS) instead of Proof-of-Work (PoW) consume negligible amounts of energy, making them inherently eco-friendly.

Can crypto mining actually help the energy grid?

Yes, in several ways. Miners can provide a service called “demand response,” powering down during peak grid usage to free up electricity for homes and businesses. They can also co-locate with renewable energy sources, buying up excess power that would otherwise be wasted (curtailed). This makes renewable projects more profitable and encourages the development of more clean energy infrastructure.

Which is better for the environment, Proof-of-Work or Proof-of-Stake?

From a purely energy consumption standpoint, Proof-of-Stake (PoS) is vastly better for the environment. Its energy usage is over 99% lower than Proof-of-Work (PoW). However, proponents of PoW argue that its high energy cost is a feature, not a bug, as it provides a higher level of raw, physical security for the network. The debate involves trade-offs between security models and energy efficiency.