The digital asset landscape has undergone a seismic shift. Once dominated by basic transactions, crypto derivatives now represent over 75% of all trading activity in this space. Quarterly volumes regularly exceed $1 trillion, reflecting a transformational leap in how investors engage with modern financial tools.

Blockchain technology fuels this evolution by enabling faster settlements and transparent record-keeping. Traditional systems often struggle with inefficiencies, but on-chain solutions streamline processes while reducing operational costs. This shift isn’t just about speed—it’s reshaping risk management and strategic flexibility for traders.

Sophisticated investors increasingly favor derivatives over spot trading due to enhanced capital efficiency. Complex strategies like hedging and leveraged positions are now accessible through innovative platforms. What began as simple asset exchanges has matured into a multi-layered ecosystem of financial instruments tailored for precision.

Institutional participation further validates the market’s growth, with quarterly activity often outpacing spot trades by fivefold. This trend underscores a broader acceptance of crypto assets as legitimate components of diversified portfolios. The blend of blockchain’s transparency and institutional-grade tools creates unprecedented opportunities.

Key Takeaways

- Crypto derivatives dominate digital asset trading, capturing 75% of total activity.

- Blockchain technology reduces costs and improves efficiency for complex trades.

- Institutional investors drive market maturity through advanced strategies.

- Modern platforms offer greater flexibility compared to traditional spot trading.

- On-chain systems democratize access to sophisticated risk management tools.

Introduction to the On-Chain Derivatives Market

Blockchain technology has introduced new ways to manage financial risk through innovative agreements like crypto derivatives. These tools allow traders to speculate on or hedge against market movements without direct asset ownership. Their value stems from underlying digital assets, creating opportunities beyond traditional spot trading.

What Are Crypto Derivatives?

Crypto derivatives are binding agreements tied to cryptocurrency assets like Bitcoin. Two parties might agree to exchange BTC at $50,000 next month, regardless of market fluctuations. This setup eliminates the need to hold the actual currency while enabling price speculation.

Each contract specifies critical details like the underlying asset quantity and expiration timeline. Modern agreements often use cash settlements instead of physical transfers. This method streamlines transactions while maintaining market exposure.

Key Concepts and Terminology for Beginners

Understanding basic terms helps navigate derivatives trading:

- Long/short positions: Betting on price increases or decreases

- Strike price: Predetermined execution value

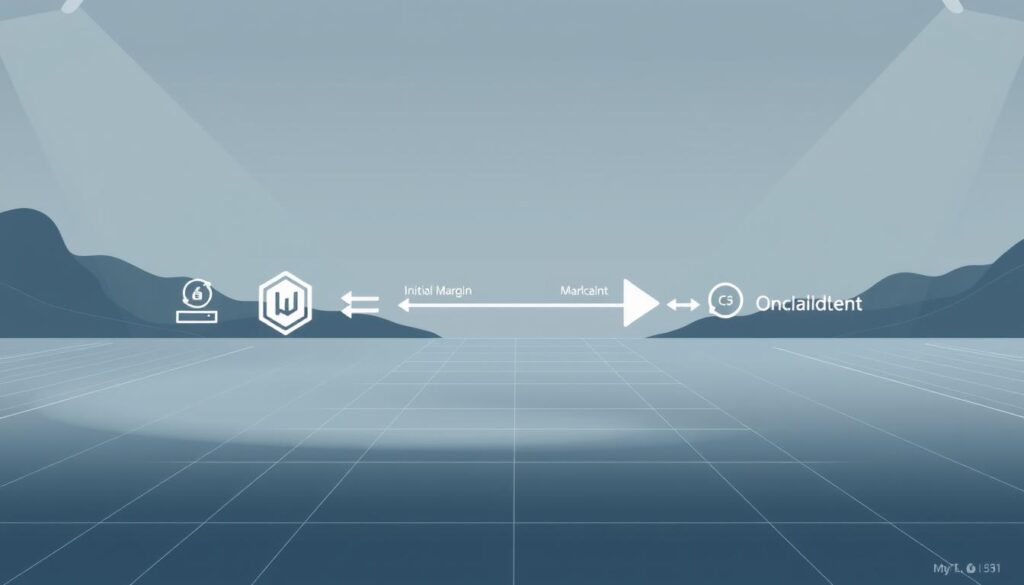

- Margin requirements: Collateral needed for leveraged trades

Since their 2012 debut, these instruments have evolved significantly. BitMEX’s 2014 perpetual swap innovation revolutionized accessibility for retail traders. Today, platforms combine blockchain efficiency with institutional-grade strategies, serving diverse investor needs.

Understanding crypto derivatives, perpetual swaps, options, decentralized finance

Modern trading instruments rely on four core components to create binding agreements. These elements work together to establish clear terms while enabling advanced strategies. Let’s break down how these pieces form the backbone of digital asset agreements.

Derivative Contract Basics and Components

Every agreement begins with an underlying asset, like Bitcoin or Ethereum. This determines the contract’s value and market behavior. Traders analyze volatility and liquidity patterns specific to each asset before committing.

Quantity specifications standardize positions across platforms. One contract might equal 1 BTC, allowing easy scaling through multiples. Emerging platforms now offer fractional contracts, lowering entry barriers for smaller traders.

Settlement dates define when obligations conclude. Most agreements use cash settlements instead of physical transfers. This approach simplifies processes since traders never handle actual coins—profits reflect price differences at expiration.

Decentralized systems automate execution through smart contracts. These self-enforcing tools eliminate intermediaries while ensuring transparency. Blockchain’s immutable records provide audit trails, reducing disputes and enhancing trust in complex trades.

How Crypto Futures, Options, and Perpetual Contracts Work

Advanced trading tools enable precise market strategies through distinct structural frameworks. These agreements differ in obligations, timelines, and profit mechanisms.

Exploring Futures and Their Mechanics

Futures contracts lock prices for set dates. Both parties must execute trades regardless of market conditions. For example, buying Bitcoin futures at $60,000 requires purchasing at that price on the expiry date.

Markets use these agreements to hedge against volatility. Settlement occurs through cash transfers or asset delivery. Quarterly contracts dominate activity, though weekly versions suit short-term traders.

Understanding Options and Swaps

Options grant rights without obligations. Call agreements let buyers purchase assets at strike prices before termination dates. Put options work inversely, offering sale rights during specified periods.

Perpetual swaps mimic futures but lack fixed timelines. Automated funding payments balance contract values with spot prices hourly. This mechanism prevents prolonged price gaps while enabling indefinite positions.

Benefits and Risks of Trading Crypto Derivatives

Modern trading tools offer powerful advantages but demand careful navigation. While 43% of active traders use leveraged positions, only 12% consistently profit—highlighting the importance of understanding both opportunities and pitfalls.

Advantages: Amplified Opportunities

Leverage lets traders control $100,000 positions with $1,000 capital. This magnification works both ways—gains multiply, but so do potential losses. Platforms offer up to 100x leverage, though most experts recommend under 10x for sustainable trading.

Hedging strategies protect portfolios during downturns. For example, short positions in futures contracts can offset spot market losses. Speculators profit from both rising and falling markets without owning underlying assets.

| Benefits | Risks |

|---|---|

| 1:100 capital efficiency | Liquidation triggers at 5% price swings |

| 0.01% fee structures | Platform insolvency risks |

| 24/7 market access | Funding rate fluctuations |

Navigating Potential Pitfalls

Volatility becomes dangerous with high leverage. A 10% market swing can erase 100x positions entirely. Counterparty risks persist—four major platforms collapsed between 2020-2023, locking user funds.

“Treat leverage like fire—useful when controlled, catastrophic if mishandled.”

Smart Defense Strategies

- Limit positions to 2-5% of total capital

- Set stop-loss orders at 3% below entry

- Diversify across three uncorrelated assets

New traders should paper-trade for six weeks before risking real funds. Emotional discipline proves crucial—72% of liquidations occur during panic-selling events.

Emerging Trends and Blockchain Innovations in Derivative Trading

The trading landscape is evolving rapidly, driven by blockchain’s ability to create transparent and accessible financial tools. Over $500 billion flows through these markets daily, signaling a shift toward more inclusive and efficient systems.

The Rise of Synthetic Assets and Decentralized Platforms

Synthetic assets mirror traditional stocks or commodities through blockchain-based agreements. Projects like Synthetix enable traders to access global markets without intermediaries, using cryptocurrency as collateral. These instruments unlock 24/7 trading while maintaining price accuracy via real-time data feeds.

| Traditional Systems | Blockchain Solutions |

|---|---|

| Limited to institutions | Open to all participants |

| Manual settlements | Instant on-chain execution |

| High fee structures | 0.1% average transaction costs |

Decentralized exchanges like dYdX automate complex processes through smart contracts. This eliminates reliance on centralized entities while ensuring transparent record-keeping. Users retain full custody of funds—a critical security advantage.

Future Outlook and Market Developments

Three innovations will shape tomorrow’s markets:

- Cross-chain compatibility: Trade assets across Ethereum, Solana, and other networks

- Real-world integration: Oracle systems linking commodities and equities to blockchain

- Liquidity engines: AI-driven market makers balancing supply dynamically

These advancements reduce entry barriers for retail traders while meeting institutional demands for speed. As platforms evolve, expect tighter spreads and broader asset coverage across global exchanges.

Conclusion

The financial landscape has been reshaped by innovative trading mechanisms that redefine asset management. Crypto derivatives now drive over 75% of digital asset activity, with quarterly volumes surpassing $3 trillion. This growth reflects institutional confidence and retail adoption of advanced strategies once exclusive to traditional markets.

Three core instruments dominate this space: futures for price locking, options for flexible rights, and perpetual agreements for indefinite positions. Each serves distinct goals, from hedging against volatility to amplifying gains through leverage. However, the same tools that boost returns can trigger rapid losses without disciplined risk protocols.

New participants should prioritize education before deploying capital. Start with small positions in spot markets to grasp price movements, then gradually explore derivatives. Platforms offering synthetic assets and cross-chain compatibility will further democratize access to global markets.

As blockchain technology matures, these financial instruments will bridge digital and traditional economies. Success demands understanding both opportunities and obligations—master the terms, respect the risks, and let strategy guide every trade.

FAQ

What are the primary types of financial instruments in decentralized markets?

The most common instruments include futures, options, and perpetual swaps. These allow traders to speculate on price movements, hedge positions, or access leverage without owning the underlying asset directly.

How do perpetual contracts differ from traditional futures?

Unlike futures with set expiry dates, perpetual contracts use funding rates to maintain alignment with spot prices. Platforms like dYdX and Deribit popularized these products, enabling continuous trading without settlement deadlines.

What risks should traders consider when using leverage?

Leverage amplifies both gains and losses. A 10x position, for example, can liquidate accounts if prices move 10% against the trader. Risk tools like stop-loss orders and portfolio diversification are critical to managing exposure.

Can decentralized platforms match the liquidity of centralized exchanges?

While platforms like Synthetix and GMX have grown, liquidity varies. Centralized venues like Binance still dominate volume, but decentralized alternatives offer non-custodial trading, reducing counterparty risks.

How do options provide strategic advantages in volatile markets?

Options let traders buy or sell assets at predetermined prices, offering downside protection or profit potential. For instance, purchasing a put option can hedge against sudden price drops in assets like Bitcoin or Ethereum.

What role do synthetic assets play in derivative markets?

Synthetics replicate real-world assets (e.g., stocks, commodities) on blockchain networks. Protocols like Mirror Protocol enable exposure to Tesla or gold without direct ownership, expanding market access.

Are there regulatory concerns with on-chain derivative trading?

Yes. Regulatory bodies like the SEC and CFDC scrutinize these markets for compliance. Traders should verify platform licensing and jurisdiction-specific rules to avoid legal pitfalls.

How do funding rates impact perpetual swap positions?

Funding rates, paid between long and short traders every 8 hours, ensure perpetual contracts track spot prices. High rates may signal overcrowded positions, prompting traders to adjust strategies.