The Hunt for ‘Free Money’: Unpacking Cryptocurrency Arbitrage

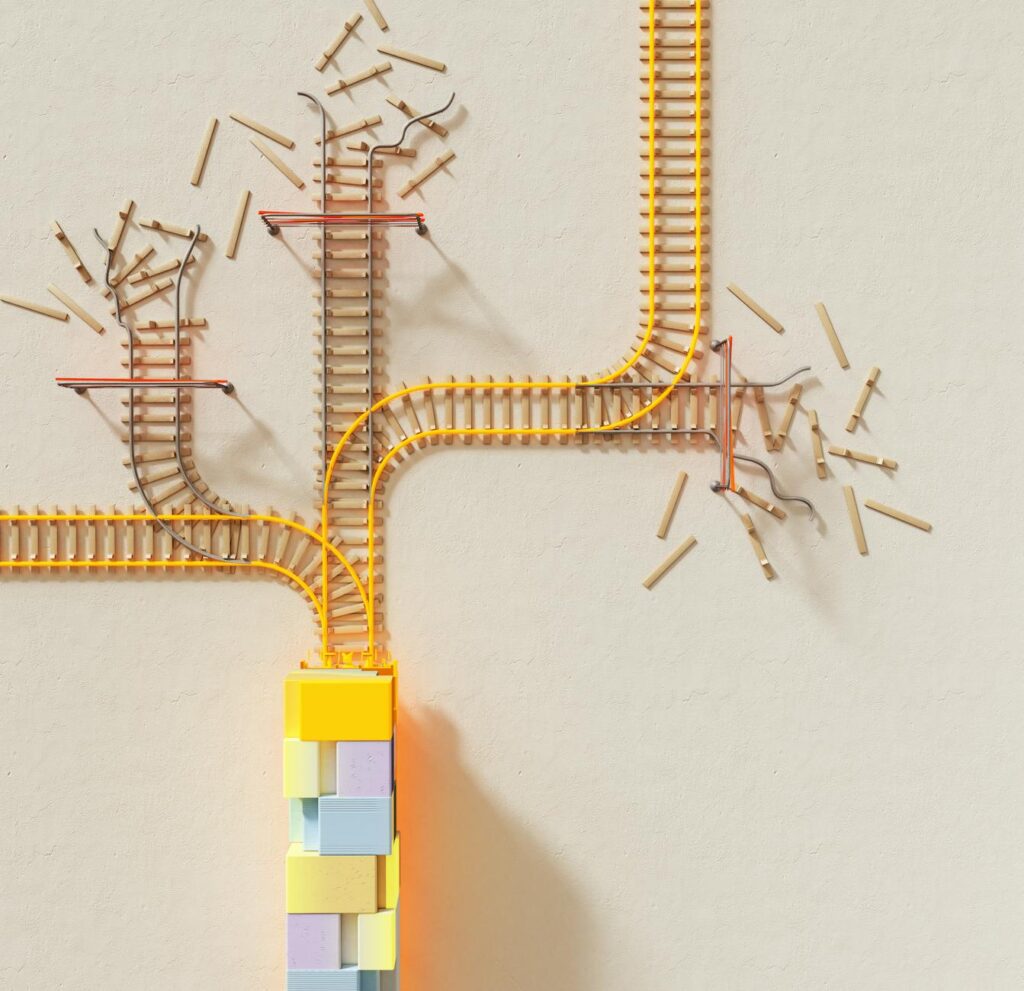

Ever see Bitcoin priced at $65,100 on one exchange and $65,350 on another and think, “Wait a minute… can I just buy it cheap and sell it high instantly?” That, my friend, is the siren song of cryptocurrency arbitrage. It’s a concept that sounds almost too good to be true, like finding a magical money machine. The idea of risk-free profit is tantalizing. But like most things in the crypto space, what seems simple on the surface is often a complex beast lurking just beneath the waves. It’s not a secret glitch in the matrix; it’s a legitimate trading strategy. But it’s also a high-stakes game of speed, fees, and meticulous planning. Let’s break down what it really is, how it works, and whether you can actually make it work for you.

Key Takeaways

- What it is: Cryptocurrency arbitrage is the practice of buying a digital asset on one exchange where the price is lower and simultaneously selling it on another where the price is higher to pocket the difference.

- Why it exists: Price discrepancies happen due to varying levels of liquidity, trading volume, geographical regulations, and even listing times across hundreds of different exchanges worldwide.

- The Big Catch: It’s a race against time and bots. Transaction fees, network congestion, and price slippage can eat your potential profits in a heartbeat.

- Tools are Key: Manual arbitrage is nearly impossible. Most successful arbitrage traders rely on sophisticated bots and scanning software to spot and execute trades instantly.

So, What Exactly is Cryptocurrency Arbitrage?

Let’s forget the jargon for a second. Imagine you run a fruit stand. You notice that the farmer’s market on the north side of town sells apples for $1 each. But on the south side of town, where the market is smaller, apples are selling for $1.25. What do you do? You buy a truckload of apples in the north, drive them to the south, and sell them for a 25-cent profit on each apple. Simple. That’s arbitrage.

Cryptocurrency arbitrage is the exact same principle, just with digital assets and exchanges instead of apples and markets. Instead of driving a truck across town, you’re sending digital assets across the internet. The goal is to exploit temporary price inefficiencies between different trading platforms. If you can buy 1 ETH for $3,500 on Kraken and sell it for $3,525 on Binance at the same moment, you’ve just made a $25 profit, minus fees. The beauty is that you’re not speculating on whether the price of ETH will go up or down in the future. You’re capitalizing on a price difference that exists right now.

Why Do These Price Gaps Even Exist?

You might wonder, in our hyper-connected world, how can prices for the same digital asset be different? Shouldn’t the market correct itself instantly? Well, yes and no. The crypto market isn’t one single, unified entity like the New York Stock Exchange. It’s a fragmented collection of hundreds of independent exchanges, each with its own ecosystem. This fragmentation is the primary reason arbitrage opportunities pop up.

Liquidity and Volume Differences

Big exchanges like Binance or Coinbase have massive trading volumes. Billions of dollars change hands every day. This high liquidity means prices are generally stable and reflect the broader market consensus. A smaller, regional exchange might have much lower liquidity. A single large buy or sell order on that smaller exchange can dramatically move the price, creating a temporary gap compared to the larger platforms. Arbitrage traders are the sharks that quickly close these gaps, which in turn helps make the market more efficient.

Geographical Factors & Regulations

Crypto regulations vary wildly from country to country. In some regions, there might be a premium on certain assets like Bitcoin due to high demand and limited on-ramps. For example, the “Kimchi Premium” in South Korea historically saw Bitcoin trading at a significantly higher price on South Korean exchanges compared to the global average. Capital controls and strict regulations made it difficult for traders to exploit this, but the opportunity was there.

Exchange Listing Delays

When a hot new token gets listed on a major exchange like Coinbase, its price often pumps. But it might have been trading on smaller decentralized exchanges (DEXs) like Uniswap for weeks or months already. For a brief period after the big exchange listing, there can be a significant price difference between the new platform and the older ones, creating a ripe arbitrage opportunity for those who are prepared.

The Different Flavors of Crypto Arbitrage

Not all arbitrage is a simple A-to-B transaction. The strategies can get pretty complex, but most fall into a few main categories.

Simple (Cross-Exchange) Arbitrage

This is the classic fruit stand example we talked about. It’s the most straightforward form: buy low on Exchange A, transfer the crypto to Exchange B, sell high on Exchange B. While simple in theory, the transfer time between exchanges is its biggest weakness. The price gap could disappear by the time your coins arrive.

Triangular Arbitrage

This one is a bit more mind-bending and happens all on a single exchange. It involves exploiting price discrepancies between three different cryptocurrencies. For example, you might see an opportunity to trade your USD for BTC, then trade that BTC for ETH, and finally trade that ETH back to USD for more than you started with. It looks like this: USD -> BTC -> ETH -> USD’. Because these trades happen on one platform, you avoid withdrawal fees and slow transfer times, but the profit margins are usually razor-thin and require bots to execute.

Statistical Arbitrage

This is the big leagues. It involves using complex econometric models, algorithms, and high-speed bots to find and exploit a wide range of pricing anomalies. It’s not something you can do with a spreadsheet. This is the domain of quantitative trading firms and is well beyond the scope of most individual traders.

A Practical Guide: How to Actually Do It (Theoretically)

So you want to try your hand at it. Great. But you need a plan. Rushing in is the fastest way to lose money. Here’s a simplified, step-by-step process of a typical cross-exchange arbitrage trade.

- Spot the Opportunity: First, you need to find a price difference. You can’t just stare at two browser tabs and hope to catch one. You’ll need a tool—a crypto arbitrage scanner or a screen that aggregates prices from multiple exchanges in real-time. Look for a spread that’s wide enough to be profitable after all fees are considered (we’ll get to that). A 0.5% difference is nothing; you’re often looking for spreads of 2% or more to be safe.

- Check the Math (Fees Are Everything): This is the most critical step. You have to account for every single fee. This includes the trading fee on Exchange A (where you buy), the withdrawal fee from Exchange A, the blockchain network fee for the transfer, and the trading fee on Exchange B (where you sell). If your potential profit is $50 but the combined fees are $55, you just paid $5 for the privilege of losing money.

- Execute the Trades: Speed is life. If the math works, you have to act instantly. The easiest way to do this is to already have capital on both exchanges. Hold USDT or another stablecoin on Exchange A to buy the asset, and hold the asset itself (e.g., BTC) on Exchange B, ready to sell. When you spot the gap, you execute the buy order on A and the sell order on B simultaneously. This eliminates the risk of price changes during transfer.

- Rebalance and Repeat: After the trade, you’ll have more of the asset on Exchange A and more stablecoin on Exchange B. You’ll eventually need to rebalance your funds by transferring them back, ready for the next opportunity.

The Elephant in the Room: The Risks of Cryptocurrency Arbitrage

If it were as easy as following those four steps, everyone would be a millionaire. The reality is that cryptocurrency arbitrage is fraught with risk. It’s a game of inches, and one mistake can wipe out your gains.

The Killer Fees

We touched on this, but it deserves its own section. Fees are the silent assassins of arbitrage. You have maker/taker fees on exchanges, which can be up to 0.2% per trade. Then you have withdrawal fees, which can be a flat rate. Trying to arbitrage with a small amount of Bitcoin can be impossible, as the flat withdrawal fee could be larger than your entire potential profit. You must know the fee schedule of every exchange you use inside and out.

Slippage: When the Price Moves Against You

Slippage happens when you place a market order, but the price you get is different from the price you saw. On low-liquidity exchanges, a decently sized arbitrage trade can be enough to move the price against you, reducing or even eliminating your profit margin. You expected to sell at $100, but by the time your order filled, the best available price was $99.50. Ouch.

The Agony of Slow Transfer Times

If you’re using the simple arbitrage method that requires transferring assets between exchanges, you are at the mercy of the blockchain. A Bitcoin transfer can take 10 minutes or over an hour if the network is congested. An Ethereum transfer can be faster but can also get bogged down. In that time, the price gap you identified has almost certainly vanished.

“The market can stay irrational longer than you can stay solvent. But more importantly for arbitrage, the market can correct itself faster than your transaction can confirm.”

Exchange Security and KYC Hurdles

To perform arbitrage, you need accounts on multiple exchanges, fully verified and funded. This means going through Know Your Customer (KYC) processes for each one. Furthermore, some smaller exchanges where the best opportunities lie might have questionable security. Having your funds locked or stolen from an obscure exchange is a very real risk.

Gearing Up: Tools That Can Give You an Edge

Trying to do this manually is like trying to win a Formula 1 race on a bicycle. You need technology on your side.

Arbitrage Scanners and Bots

These are the essential tools of the trade. Scanners are platforms that monitor prices across dozens or hundreds of exchanges in real-time, flagging potential arbitrage opportunities for you. Bots take it a step further. You can program them with your strategy, connect them to your exchange accounts via API, and they will automatically execute the trades for you the instant an opportunity arises. This is how the pros do it.

Portfolio Trackers

With funds spread across multiple exchanges, it’s easy to lose track of your overall position. A good portfolio tracker can sync with your exchange accounts and give you a bird’s-eye view of all your holdings in one place. This is crucial for managing your capital effectively.

A Word of Caution on Bots

Be extremely careful when choosing an arbitrage bot. The space is filled with scams promising impossible returns. Never give a bot withdrawal permissions from your exchange account API. Only use reputable, well-reviewed software, and understand that even the best bot is only as good as the strategy you program into it.

Conclusion

Cryptocurrency arbitrage isn’t a myth, and it’s not exactly “free money” either. It’s a serious trading discipline that requires research, preparation, speed, and a healthy understanding of the risks involved. The opportunities are real, born from the natural inefficiencies of a young and fragmented market. But those opportunities are fleeting, often lasting for just seconds.

For the dedicated trader with the right tools and a solid strategy, it can be a viable way to generate profit with lower directional risk than traditional trading. For the casual newcomer, it can be a brutal lesson in how fees and friction can turn a sure thing into a sudden loss. If you’re going to dive in, start small. Do your homework. And never, ever risk more than you can afford to lose. The hunt can be thrilling, but make sure you’re the hunter, not the prey.

FAQ

Is crypto arbitrage still profitable today?

Yes, but it’s much harder than it used to be. The market has become more efficient, and thousands of sophisticated bots are constantly scanning for opportunities. The easy, large spreads are rare. Profitability today depends on finding smaller margins, acting with incredible speed (using bots), and operating with very low fees, which often requires high trading volumes to achieve VIP fee tiers on exchanges.

Do I need a bot to do crypto arbitrage?

For any serious and consistent attempt at crypto arbitrage, yes, a bot is practically essential. The speed required to both identify and execute a trade before the price gap closes is beyond human capability. Manual arbitrage is possible in theory, but the risk of the market moving against you during your clicks is extremely high.

What’s the minimum capital needed for crypto arbitrage?

There’s no hard minimum, but it’s difficult to be profitable with a small amount of capital. This is because fees (especially withdrawal and network fees) are often fixed. A $15 withdrawal fee is a huge percentage of a $100 profit, but a small fraction of a $5,000 profit. To overcome the friction of fees and make the effort worthwhile, most serious arbitrage traders work with several thousand dollars at a minimum.