Navigating the Crypto Maze: Avoiding the Top 5 New Investor Traps

You’ve heard the stories. The overnight millionaires, the tech visionaries, the people who bought some obscure digital coin for pennies and now drive Lamborghinis. The allure of cryptocurrency is powerful, promising a decentralized future and life-changing returns. But for every success story, there are countless untold tales of painful losses, avoidable mistakes, and shattered dreams. The digital frontier is exciting, but it’s also riddled with traps for the uninitiated. Understanding the most common cryptocurrency investors pitfalls isn’t just helpful; it’s essential for survival. It’s the difference between building wealth and becoming another cautionary tale.

The truth is, most new investors make the same handful of mistakes. They’re driven by emotion, a lack of fundamental knowledge, and the intoxicating hype that permeates the space. This isn’t about being the smartest person in the room. It’s about being the most disciplined. It’s about learning from the mistakes of others so you don’t have to make them yourself. So, before you transfer another dollar to an exchange, let’s walk through the five chasms that new investors tumble into, and more importantly, how you can build a bridge right over them.

Key Takeaways:

- Control Your Emotions: Fear of Missing Out (FOMO) and panic selling are the primary drivers of poor investment decisions. A clear strategy is your best defense.

- Security is Non-Negotiable: The phrase “Not your keys, not your coins” is paramount. Learn to self-custody your assets to protect them from exchange hacks and failures.

- Don’t Bet the Farm: Diversification is a time-tested principle that applies just as much to crypto. Going all-in on one coin is a high-risk gamble, not an investment strategy.

- Embrace Volatility: Crypto markets are notoriously volatile. Understanding this and using strategies like Dollar-Cost Averaging (DCA) can turn this volatility to your advantage.

- If It Sounds Too Good to Be True, It Is: The crypto space is rife with scams. Developing a healthy sense of skepticism will protect your capital from bad actors promising guaranteed, astronomical returns.

Pitfall #1: Succumbing to FOMO and Hype

It’s a classic story. A friend mentions a new coin that’s about to ‘moon.’ You see it all over social media, with rocket emojis and talk of 100x gains. You check the price, and it’s already up 50% in the last 24 hours. You feel that pull, that urgent, gut-wrenching need to buy in right now before you miss the rocket ship. That, my friend, is FOMO. And it’s probably the single most destructive force for a new investor’s portfolio.

What FOMO Looks Like in Crypto

FOMO makes you abandon all logic. You buy at the peak of a parabolic run-up, just as early investors are starting to take profits. You invest in a project you know absolutely nothing about, simply because its name is trending. You’re not investing; you’re gambling on pure momentum. This is how people end up buying a memecoin at its all-time high, only to watch it crash 90% in the following week. Hype is the fuel, and FOMO is the engine that drives you off a financial cliff.

The Antidote: DYOR (Do Your Own Research)

The only cure for FOMO is knowledge and a solid plan. Before you invest a single cent, you need to engage in what the crypto world calls DYOR – Do Your Own Research. This isn’t just a catchy acronym; it’s a foundational discipline. It means you stop listening to the noise and start looking at the fundamentals.

- Read the Whitepaper: What problem does this project solve? Is it a genuine innovation or just a copy of something else with better marketing? The whitepaper is the project’s business plan. If you can’t understand it, or if it’s full of buzzwords with no substance, that’s a huge red flag.

- Investigate the Team: Are the founders and developers public? Do they have a track record of success in technology or business? Anonymous teams are a significant risk. You want to know who is behind the project you’re entrusting with your capital.

- Understand the Tokenomics: How many coins are there? How are they distributed? Is there a high inflation rate that will dilute your investment? Is a large percentage of the supply held by the founders and early VCs who might dump on the market? These token economics are critically important to a project’s long-term value.

- Check Community and Development Activity: Is the community engaged and genuinely discussing the technology, or is it just focused on price? Check the project’s GitHub to see if developers are actively working and improving the code. A ghost town is a bad sign.

Doing your own research transforms you from a gambler into an investor. It gives you the conviction to buy when others are fearful and to avoid the hype trains destined to derail.

Pitfall #2: Ignoring the Cardinal Rule of Security

You’ve bought your first Bitcoin or Ethereum on a major exchange. Congratulations! It feels great to see it sitting there in your account. But here’s a cold, hard truth that has cost investors billions: if your crypto is on an exchange, it’s not truly yours. You are trusting a third party to hold it for you, and that trust can be, and often is, broken.

“Not Your Keys, Not Your Coins” Explained

This is the most important mantra in all of cryptocurrency. When you hold crypto in your own wallet—a software wallet on your phone or computer, or a hardware wallet—you are in control of the ‘private keys.’ These keys are like the password to your personal vault on the blockchain. Only you can access it. When you leave your assets on an exchange, the exchange controls the private keys. You just have an IOU. If that exchange gets hacked, goes bankrupt (as we’ve seen with giants like FTX and Celsius), or freezes withdrawals, your funds can be lost forever. It’s a painful lesson that too many have had to learn the hard way.

Practical Security Steps You Can Take Today

Taking control of your own assets might sound intimidating, but it’s a process every serious investor must learn. It’s the equivalent of taking your cash out of a stranger’s hand and putting it in your own safe.

- Get a Reputable Wallet: Start with a well-regarded software wallet (a ‘hot wallet’) like MetaMask, Trust Wallet, or Exodus. These are great for holding smaller amounts that you might want to use or trade.

- Write Down Your Seed Phrase: When you create a new wallet, you will be given a 12 or 24-word seed phrase. This is the master key to your entire crypto life. Write it down on paper (or stamp it into metal) and store it in multiple secure, offline locations. Never, ever store it digitally—not in a text file, not in your email drafts, not in a photo. If someone gets this phrase, they get all your crypto.

- Invest in a Hardware Wallet: For any significant amount of crypto, a hardware wallet (a ‘cold wallet’) like a Ledger or Trezor is the gold standard. This small physical device keeps your private keys completely offline, immune to online hacks and malware. You use it to sign and approve transactions, making it virtually impossible for a remote hacker to steal your funds.

- Use Strong, Unique Passwords and 2FA: For any exchange accounts you still use, enable two-factor authentication (2FA) using an app like Google Authenticator, not SMS. A simple password is an open invitation for trouble.

Pitfall #3: Putting All Your Eggs in One Crypto Basket

You’ve done your research on a project. You love the tech, the team is stellar, and the community is buzzing. You’re so convinced it’s the ‘next Bitcoin’ that you decide to go all-in, converting your entire investment capital into this one single altcoin. This is an incredibly common and dangerous mistake. Even the most promising projects can fail. Technology can be out-innovated, key developers can leave, or a fatal bug can be discovered. In the traditional stock market, we call this concentration risk, and in the hyper-volatile world of crypto, that risk is amplified a thousand times over.

Why Diversification Still Matters

Diversification is the simple idea of not putting all your eggs in one basket. By spreading your investment across different assets, you reduce the risk that the failure of a single one will wipe out your entire portfolio. A well-diversified crypto portfolio can help smooth out the insane volatility and improve your risk-adjusted returns over the long term. If one of your holdings goes to zero (which can and does happen), the success of your other holdings can cushion the blow and keep your overall portfolio healthy.

“Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.” – Warren Buffett. While true for experts, new investors are, by definition, operating with a degree of ignorance. For us, diversification is not just a strategy; it’s a shield.

A Smarter Approach to Portfolio Building

So what does a sensible, diversified crypto portfolio look like for a beginner? There’s no single right answer, but a common-sense approach often starts with a solid foundation and branches out from there.

- Start with the Blue Chips: A significant portion of your portfolio (many suggest 50% or more) should be in the most established and decentralized cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH). They have the longest track records, the most security, and the widest adoption. Think of them as the large-cap stocks of the crypto world.

- Add Established Large-Caps: Next, you might consider allocating a smaller percentage to other well-established projects in the top 10 or 20 by market capitalization. These could be projects in different sectors like smart contract platforms, decentralized finance (DeFi), or interoperability.

- Speculate with a Small Slice: If you want to invest in smaller, riskier projects (the ‘moonshots’), allocate only a very small percentage of your total portfolio to them. This is the money you must be fully prepared to lose. This approach lets you participate in potentially high-growth opportunities without risking your entire nest egg.

Pitfall #4: Panicking During Dips and Getting Greedy at Peaks

The crypto market doesn’t move in gentle waves; it moves in tsunamis. It is not uncommon to see prices drop 20% in a single day or 80% over the course of a bear market. For new investors, this is terrifying. The natural human instinct is to sell everything to stop the bleeding. Conversely, when prices are skyrocketing and everyone is euphoric, the instinct is to pile in more money, fearing you’ll miss out on more gains. This emotional rollercoaster of panic selling at the bottom and greedily buying at the top is the fastest way to destroy your capital. You end up buying high and selling low—the exact opposite of any successful investment strategy.

Welcome to Crypto Volatility

You must accept that extreme volatility is a feature, not a bug, of this nascent asset class. If you can’t stomach the thought of your portfolio’s value being cut in half, you are either over-invested or not ready for this market. Successful investors understand this. They see massive dips not as a catastrophe, but as a potential buying opportunity. They view euphoric peaks not as a time to FOMO in, but as a potential time to take some profits off the table. This requires a mental shift from being a reactive emotional trader to a proactive, strategic investor. One of the biggest cryptocurrency investors pitfalls is letting emotions dictate your actions.

Strategies to Weather the Storm

How do you fight your own human psychology? You use systems and strategies that take the emotion out of the equation.

- Dollar-Cost Averaging (DCA): This is perhaps the most powerful tool for a new investor. Instead of trying to ‘time the market’ by investing a large lump sum, you invest a fixed amount of money at regular intervals (e.g., $100 every week), regardless of the price. When the price is high, your fixed amount buys fewer coins. When the price is low, it buys more. Over time, this averages out your purchase price and reduces the risk of buying everything at a peak. It automates your investment and removes emotion.

- Have a Plan and Stick to It: Before you invest, define your goals. What is your time horizon? Are you saving for a down payment in 5 years or for retirement in 30? What are your profit-taking targets? At what price would you consider selling a portion of your holdings? At what price drop would you consider buying more? Write this down. When the market is going crazy, refer to your plan. It is your rational self, guiding your emotional self.

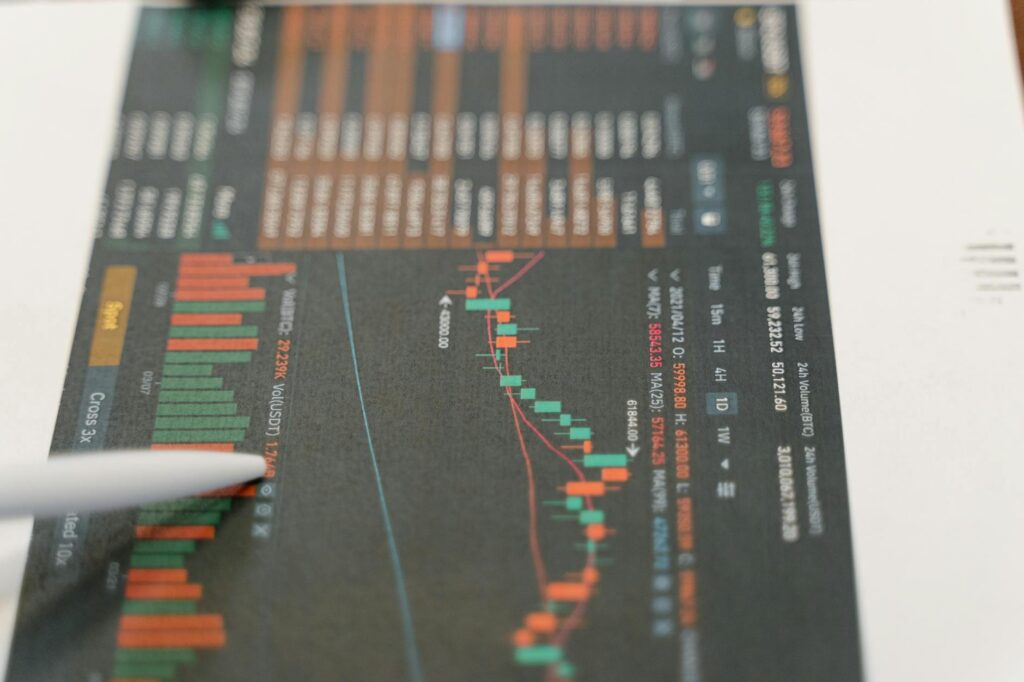

- Zoom Out: When you’re in the middle of a 30% crash, it feels like the end of the world. But if you look at a long-term price chart of Bitcoin or Ethereum, you’ll see that these kinds of corrections are normal. They are part of a larger, long-term uptrend. Keeping perspective is key to staying sane and staying the course.

Pitfall #5: Believing in Get-Rich-Quick Schemes

The semi-anonymous and largely unregulated nature of cryptocurrency makes it a playground for scammers and grifters. They prey on the two most powerful emotions of new investors: greed and the desire for an easy path to wealth. You will see advertisements, get direct messages, and see social media posts promising guaranteed returns, secret trading bots, or exclusive opportunities that are ‘too good to be true.’ And that’s because they are.

Common Crypto Scams to Watch Out For

Awareness is your first line of defense. While scammers are always inventing new methods, most fall into a few common categories.

- Phishing Scams: You receive an email or a direct message that looks like it’s from a legitimate exchange or wallet provider. It asks you to click a link to verify your account or fix a security issue. The link leads to a fake website that looks identical to the real one. When you enter your login details or seed phrase, the scammers capture it and drain your account.

- “Giveaway” or Impersonation Scams: A scammer impersonates a famous person like Elon Musk or a well-known crypto exchange on social media. They announce a giveaway: “Send 1 ETH to this address, and we’ll send you back 2 ETH!” It’s a simple but shockingly effective trick. No one is giving away free money.

- Rug Pulls: A new project appears with a lot of hype. Developers create a token, market it heavily, and get people to invest. Once the price is high enough, the anonymous developers sell all their tokens at once, crashing the price to zero, and disappear with the investors’ money.

- Fake Airdrops & NFTs: You might see a random token or NFT appear in your wallet. Your first instinct is to go to their website to see what it’s worth or to ‘claim’ it. Interacting with the scammer’s smart contract can give them permission to drain all the other assets from your wallet. If you didn’t ask for it, ignore it.

How to Protect Yourself

The mindset you need to adopt is one of extreme skepticism. Trust no one by default. Verify everything. If a stranger DMs you to offer help or an investment opportunity, it’s a scam. If an offer promises guaranteed high returns with no risk, it’s a scam. Legitimate investing is hard and involves risk. There are no shortcuts. Never, ever give your seed phrase or private keys to anyone for any reason. Period. Think of it as the password to your entire bank account, because that’s what it is.

Conclusion: Navigating Your Crypto Journey Wisely

The world of cryptocurrency is an incredibly exciting place, filled with innovation and potential. But jumping in without a map is a recipe for disaster. By understanding and actively avoiding these five common pitfalls—letting FOMO rule you, neglecting security, failing to diversify, misunderstanding volatility, and falling for scams—you dramatically shift the odds in your favor.

Your first year in crypto shouldn’t be about getting rich. It should be about learning and surviving. Focus on building good habits, deepening your knowledge, and protecting your capital. Start small, be patient, and remember that this is a marathon, not a sprint. The wealth you build won’t come from a single lucky trade; it will come from disciplined, informed decisions made over time. Welcome to the future of finance. Navigate it wisely.