The Dawn of a New Financial Era or Just More Hype?

For years, it was the financial world’s favorite soap opera. A constant back-and-forth, a ‘will they or won’t they?’ saga that kept investors, traders, and crypto believers glued to their screens. The topic? A spot Bitcoin ETF in the United States. Then, in early 2024, it happened. The floodgates didn’t just open; they were blown clean off their hinges. But this story is so much bigger than a single regulatory decision in the US. It’s the culmination of a global movement, a high-stakes competition between the world’s financial centers to become the dominant hub for this new asset class. The global race for Crypto ETFs is in full swing, and its implications are shaking the very foundations of traditional finance and digital asset markets alike. It’s a revolution wrapped in regulatory filings.

So, what does this all mean? Is this the moment crypto finally sheds its wild-west image and puts on a suit and tie? Or is it a dangerous melding of two worlds that were never meant to mix? We’re going to break it all down. Forget the jargon and the confusing headlines. We’ll explore what these products are, who’s leading the charge around the globe, and most importantly, what this seismic shift means for the markets and potentially for your own investment strategy.

Key Takeaways

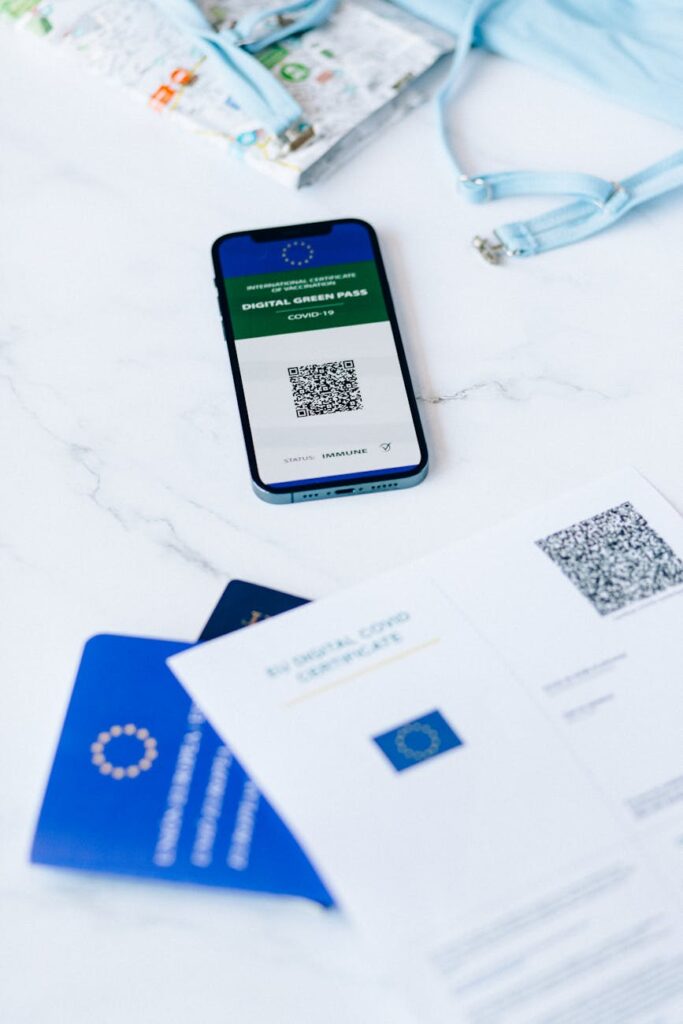

- What is a Crypto ETF? It’s a regulated investment fund traded on a stock exchange that allows investors to gain exposure to cryptocurrencies like Bitcoin without having to buy and store the digital assets themselves.

- Spot vs. Futures: Spot ETFs, the recent breakthrough in the US, hold the actual cryptocurrency. Futures ETFs, which came first, track the price of crypto futures contracts, a crucial but less direct form of exposure.

- A Global Competition: While the U.S. launch was monumental, Canada and Europe were years ahead. Now, Asian hubs like Hong Kong are aggressively entering the fray, creating a true global race.

- The Institutional On-Ramp: ETFs are a familiar, regulated structure for large institutions like pension funds and asset managers, potentially unlocking trillions of dollars in capital for the crypto market.

- Risks Remain: Despite the new layer of legitimacy, regulatory uncertainty for other cryptos, custody risks, and the inherent volatility of the underlying assets are still very real challenges.

First Things First: What Even *Is* a Crypto ETF?

Let’s strip away the complexity. An Exchange-Traded Fund, or ETF, is one of the most popular investment tools of the last few decades. Think of it like a basket. Instead of going to the store and buying apples, oranges, and bananas individually, you can buy a pre-made fruit basket. An ETF is that basket. A single share of an S&P 500 ETF, for example, gives you a tiny slice of 500 of the largest U.S. companies. You buy and sell it on a stock exchange just like you would a share of Apple or Amazon.

Now, just replace the stocks with cryptocurrency. A spot Bitcoin ETF’s sole purpose is to hold actual, physical Bitcoin. When you buy a share of this ETF, you’re buying a claim on a small piece of the Bitcoin held in the fund’s secure storage. You get the price exposure to Bitcoin without any of the technical headaches. No need to choose a crypto exchange, set up a digital wallet, or sweat over protecting your private keys from hackers. It all happens within the familiar, regulated confines of your traditional brokerage account. It’s crypto for the mainstream.

Spot vs. Futures: The Billion-Dollar Difference

This is a critical distinction that was at the heart of the years-long regulatory battle. For a while, the only crypto ETFs available in the U.S. were based on futures contracts. A futures contract is an agreement to buy or sell an asset at a predetermined price at a specific time in the future. So, these ETFs didn’t hold any Bitcoin. They held contracts that bet on the future price of Bitcoin. It’s a layer of abstraction away from the real thing. While useful for some traders, it wasn’t what most long-term investors or large institutions wanted. They wanted the real deal.

Enter the spot ETF. This is the holy grail. A spot ETF buys and holds the underlying asset—in this case, Bitcoin—directly. Every dollar that flows into a spot Bitcoin ETF results in a dollar’s worth of Bitcoin being purchased on the open market and locked away in a secure vault by a custodian. This direct link to the asset is what makes it so powerful. It creates real, tangible demand, and it provides investors with exposure that is as close to holding the coin as you can get without actually holding it. The approval of spot ETFs was the signal the market was waiting for.

The Global Race for Crypto ETFs: Who’s Leading the Pack?

While the U.S. may have thrown the biggest party, it was fashionably late. The race to offer crypto investment products to the public has been a global marathon, with different regions taking wildly different approaches.

The United States: A Reluctant Giant Awakens

For nearly a decade, the U.S. Securities and Exchange Commission (SEC) was the great wall of crypto. Application after application for a spot Bitcoin ETF was denied, with the agency citing concerns over market manipulation and investor protection. The tide began to turn not in a boardroom, but in a courtroom. A major legal victory by Grayscale Investments against the SEC in 2023 forced the regulator to re-evaluate its stance. This cracked the door open, and the world’s largest asset managers, including giants like BlackRock, Fidelity, and Invesco, stormed through. The launch in January 2024 was nothing short of historic, unleashing billions of dollars of inflows in a matter of weeks and fundamentally altering the market’s structure.

Canada & Europe: The Early Adopters

To our neighbors to the north and across the pond, the U.S. drama was old news. Canada greenlit its first spot Bitcoin ETF, the Purpose Bitcoin ETF, way back in February 2021. They proved the model could work, providing a real-world case study on flows, custody, and trading. Europe has also had a vibrant market for years, though they use a slightly different wrapper called Exchange-Traded Products (ETPs) or Exchange-Traded Notes (ETNs). Functionally, they are very similar, offering physically-backed exposure to a range of cryptocurrencies. These regions acted as the test labs, ironing out the kinks while the U.S. was still debating at the starting line.

Asia’s Emerging Hubs: Hong Kong and Beyond

The race is now heating up in Asia. Hong Kong, in a strategic move to cement itself as a leading digital asset hub, approved its own batch of spot Bitcoin and Ether ETFs in April 2024. What makes Hong Kong’s move particularly interesting is its allowance for an “in-kind” redemption and creation model. This means large investors can swap their actual BTC or ETH directly for shares in the ETF, and vice-versa. The U.S. models are “cash-create” only. This seemingly technical difference is a big deal, potentially offering greater efficiency and tax advantages, and it shows Hong Kong isn’t just copying the U.S. playbook—it’s trying to innovate. Other jurisdictions like Singapore, Dubai, and Australia are all making moves, ensuring this competition remains fierce.

Why All the Hype? The Real-World Impact on Markets

Okay, so different countries are launching these products. Cool. But why does it matter so much? The impact is profound, and it boils down to three key areas: money, legitimacy, and market structure.

The Floodgates of Institutional Money

This is the big one. Think about massive pools of capital: pension funds, insurance companies, endowments, and sovereign wealth funds. We’re talking trillions upon trillions of dollars. For the most part, these entities couldn’t touch crypto directly. Their mandates and regulatory requirements made it impossible. Buying from an exchange and managing private keys? Absolutely not. But buying a regulated ETF issued by BlackRock or Fidelity through their existing prime brokerage relationship? That’s a completely different conversation. The ETF is the bridge. It’s the simple, regulated on-ramp that allows professional capital allocators to add crypto exposure to their portfolios with a few clicks. Even a tiny 0.5% or 1% allocation from these players represents a tsunami of new capital for the crypto market.

Legitimacy and Mainstream Adoption

For years, crypto has fought a perception battle. To many, it was a shadowy, speculative world of anonymous developers and wild price swings. The arrival of spot ETFs, endorsed by the world’s biggest financial names and approved by stringent regulators, acts as a powerful stamp of legitimacy. It’s a signal to the mainstream that Bitcoin, at the very least, is being recognized as a viable alternative asset class. Your financial advisor, who might have scoffed at crypto a few years ago, can now offer you a regulated product. It normalizes the conversation and accelerates adoption at a pace that simply wasn’t possible before.

Volatility and Market Structure Changes

What happens when you inject Wall Street’s trading infrastructure into a market that grew up on decentralized exchanges? Things change. In the short term, the massive, concentrated buying from these ETFs can drive prices up dramatically. But over the long term, the effect on volatility is a subject of intense debate. Some argue that the steady hand of institutional investors will mature the market and dampen its infamous price swings. Others worry that because ETFs trade only during traditional market hours, they could create price gaps and that correlated flows (everyone selling at once during a market panic) could actually amplify crashes. The market’s rhythm is undeniably changing.

The Risks and Roadblocks Ahead

It’s easy to get swept up in the excitement, but it’s crucial to take a clear-eyed look at the challenges that remain. This journey is far from over.

Regulatory Hurdles Aren’t Gone

The SEC’s approval of a Bitcoin ETF was incredibly specific. The agency, particularly its chair Gary Gensler, has been clear that this endorsement does not extend to the vast majority of other crypto assets, many of which they still view as unregistered securities. The path for an ETF for XRP, Solana, or Cardano is much, much rockier. The regulatory battle has simply shifted from Bitcoin to the rest of the crypto ecosystem.

The Custody Conundrum

Who is actually holding all this Bitcoin? The ETFs don’t store it in their office safe. They rely on specialized third-party custodians, with giants like Coinbase Custody playing a pivotal role for many of the largest U.S. ETFs. This creates a concentration of risk. While these custodians are heavily regulated and have robust security, they represent massive, single points of failure. A catastrophic hack or failure at a major custodian would have devastating consequences for the entire market.

“Not Your Keys, Not Your Coins”: The Philosophical Debate

We can’t ignore the elephant in the room. The original vision of Bitcoin, born from the ashes of the 2008 financial crisis, was one of self-sovereignty and decentralization. It was about creating a financial system where you didn’t need to trust a bank or a government. You could be your own bank.

Crypto ETFs are, in many ways, the philosophical opposite of this ethos. You aren’t holding Bitcoin; you are holding a security, a promise from a financial institution. You’re trusting a custodian, an asset manager, and the entire traditional financial system to make good on that promise. For crypto purists, this is a betrayal of the core principles. For mainstream investors, it’s the only way they’d ever consider entering the space. This trade-off between convenience and control is perhaps the most important dynamic to understand.

Conclusion

The global race for crypto ETFs isn’t just a story about a new financial product. It’s a landmark event in the ongoing integration of digital assets into the global economic system. It represents a monumental transfer of an idea born on the cypherpunk fringes into the heart of Wall Street and other major financial centers. This new bridge between two worlds brings incredible opportunities—unprecedented capital inflows, mainstream legitimacy, and easier access for millions of investors. But it also brings new risks and complex questions about market structure, centralization, and the very soul of the cryptocurrency movement. One thing is certain: the market will never be the same. The race is on, and its outcome will define the next chapter in the future of finance.

FAQ

What’s the main difference between buying a crypto ETF and buying crypto directly?

The primary difference is ownership versus exposure. When you buy a crypto ETF, you own a share in a fund that holds the crypto. It’s a regulated security that sits in your brokerage account, offering convenience and simplicity. When you buy crypto directly from an exchange, you own the actual digital asset, which you can then move to a personal wallet, giving you full control and self-custody (the “your keys, your coins” principle). The ETF is easier but involves trusting third parties; direct ownership offers full control but requires more technical responsibility.

Will there be ETFs for other cryptocurrencies besides Bitcoin and Ethereum?

It’s highly likely, but the timeline is uncertain and depends heavily on regulation. In the U.S., the SEC has provided some clarity on Bitcoin and Ether not being securities, which paved the way for their respective ETFs. For most other cryptocurrencies (altcoins), their regulatory status is still a major gray area. Regulators will need to provide clear guidance on whether they consider these other tokens to be securities or commodities before asset managers will be comfortable launching new ETFs for them.

Are crypto ETFs safe?

They are safe in the sense that they are highly regulated financial products traded on major stock exchanges and managed by some of the world’s largest financial institutions. Your shares are protected in the same way your stock shares are. However, they are not safe from the extreme price volatility of the underlying asset. The price of a Bitcoin ETF will go up and down with the price of Bitcoin, which is known for its dramatic swings. So, while the product structure is secure, the investment itself remains high-risk.