Unlocking Hidden Profits: How Jito is Democratizing MEV for Stakers

Let’s talk about the hidden economy of blockchain. It’s a wild, often invisible marketplace running underneath every transaction you make. For years, this secret layer, known as Maximal Extractable Value (MEV), was a playground for the pros—sophisticated validators and specialized searchers who could capture millions in extra profit. Everyday stakers? We were mostly left out, earning our standard APR while the big players skimmed the cream off the top. But the game is changing. Protocols like Jito on Solana are leading a revolution, creating tools for democratizing MEV and giving that value back to the people who actually secure the network: the stakers. It’s a fundamental shift, turning a once-exclusive profit center into a shared reward system.

Key Takeaways

- What is MEV? MEV is the extra profit validators can make by strategically ordering, inserting, or censoring transactions within a block they produce.

- The Old Problem: Historically, MEV profits went almost exclusively to sophisticated validators, creating an unfair advantage and centralizing pressure on the network.

- Jito’s Solution: Jito created a system on Solana that auctions off blockspace to MEV searchers. The profits from this auction are then distributed back to stakers through the JitoSOL liquid staking token.

- Why It Matters: This model democratizes access to MEV rewards, increasing the overall yield for everyday stakers and promoting a healthier, more decentralized network.

- Beyond Solana: Similar concepts, like Flashbots’ MEV-Boost on Ethereum, are tackling the same problem, signaling a major trend across the crypto ecosystem.

So, What Exactly is This MEV Thing?

Imagine you’re at a super-fast, high-stakes auction. Everyone is shouting bids at once. The auctioneer (the validator) gets to decide the order in which they hear those bids. What if they could see all the bids ahead of time? They could place their own bid right before a huge one, knowing it would drive the price up. Or they could take a fee from a bidder to make sure their bid is heard first. That’s MEV in a nutshell.

MEV, or Maximal (formerly Miner) Extractable Value, is the total value that can be extracted from block production in excess of the standard block reward and gas fees. It’s all about the power to order transactions. Because validators on networks like Solana and Ethereum get to decide the final sequence of transactions in a block, they can manipulate that order for profit.

This isn’t just theoretical. It happens constantly through strategies like:

- Arbitrage: Spotting a price difference for the same asset on two different decentralized exchanges (DEXs) and executing a buy-low, sell-high transaction within the same block.

- Front-running: Seeing a large pending trade, jumping in front of it with your own trade to profit from the price impact, and then immediately selling.

- Sandwich Attacks: A more malicious form of front-running. A searcher sees your large buy order, places a buy order right before yours to drive the price up, lets your order execute at that higher price, and then immediately places a sell order to profit from the price difference they created. You, the user, get a worse execution price. Ouch.

For a long time, this was a dark and messy part of crypto, often called the “dark forest.” It created a chaotic, adversarial environment where sophisticated bots fought for scraps of profit, often at the expense of regular users and network efficiency. The rewards were massive, but they were concentrated in the hands of a very small, technically advanced group.

The Centralization Creep: MEV’s Unintended Consequence

The problem with MEV wasn’t just that everyday users were getting a raw deal. It was actively pushing networks toward centralization. Think about it. If a few large, sophisticated validators could earn an extra 5-10% (or more) in MEV rewards on top of their normal staking yield, they could afford better hardware, attract more stake, and grow even larger. Their competitive advantage would snowball.

Smaller validators, unable to invest in the complex infrastructure needed to extract MEV, would fall behind. They’d offer lower rewards and slowly bleed stake to the giants. Over time, this could lead to a scenario where a handful of powerful entities control a significant portion of the network’s stake, which is a major security risk for any blockchain. The very principle of decentralization was at stake. Something had to be done to level the playing field.

Enter Jito: The Solana-Sized Solution

This is where Jito steps onto the scene, specifically for the high-throughput world of Solana. The Jito Labs team saw this MEV problem and decided to tackle it head-on. Instead of letting it remain a chaotic free-for-all, they built an organized, transparent marketplace for it.

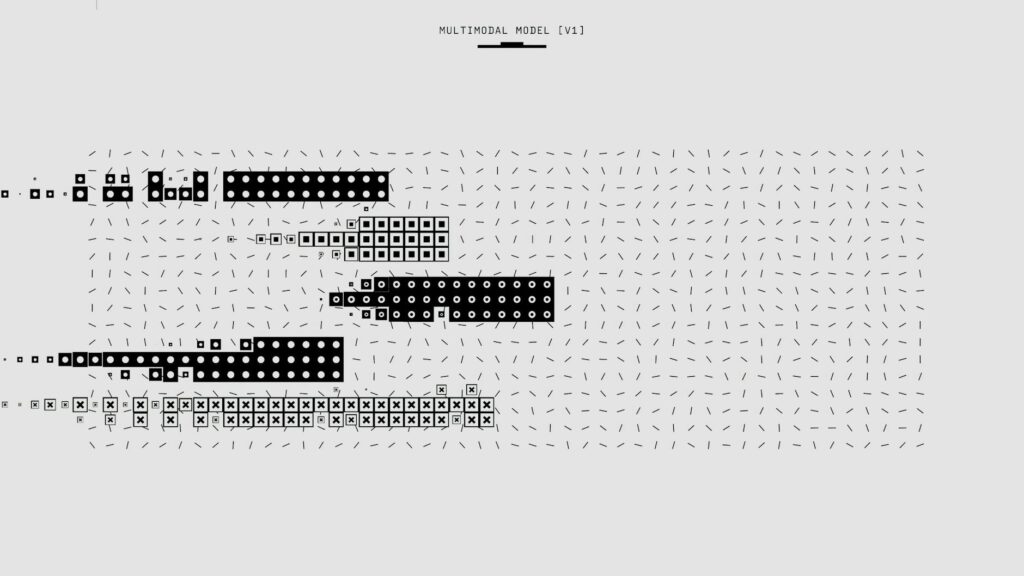

The Jito system has three main parts:

- Jito-Solana Client: This is a modified, open-source validator client. Validators can choose to run this version instead of the standard Solana client. It’s built to be more efficient and, crucially, to communicate with Jito’s other components.

- The Jito Block Engine: Think of this as the brain. It connects to validators running the Jito client and simulates every possible combination of transactions to find the most profitable ordering. It runs a continuous auction for this valuable blockspace.

- The Jito Relayer: This is the communication hub. It filters and verifies transactions from MEV searchers (the people trying to execute arbitrage, etc.) and passes them along to the Block Engine to be included in the auctions.

So, how does this all come together? MEV searchers submit “bundles” of transactions to the Relayer, along with a “tip” they’re willing to pay to have their bundle included. The Block Engine runs a real-time auction, finds the most profitable bundles, and builds an optimal block. This block is then passed to a validator to propose to the network. The validator gets the block, the searcher gets their profitable transaction included, and the tip they paid? That’s where the magic happens for stakers.

How Jito is Actually Democratizing MEV

Here’s the brilliant part. The revenue generated from these MEV auctions—all those tips paid by searchers—doesn’t just go to the single validator who proposed the block. That would just perpetuate the old problem. Instead, Jito pools this revenue and distributes it across its entire liquid staking pool.

The Power of JitoSOL

When you stake your SOL with Jito, you receive a liquid staking token (LST) called JitoSOL. This token represents your staked SOL plus any accrued staking rewards. But with Jito, it also includes a share of the MEV rewards generated by the entire network of Jito validators. The value of JitoSOL grows not just from standard inflation rewards, but also from the MEV tips captured by the system. Suddenly, you, as a simple staker, are earning a slice of the MEV pie without needing to run a complex validator or MEV-searching bot.

This is a complete paradigm shift. It transforms MEV from an exclusive, extractive practice into a collective, additive reward. It’s no longer about a few validators winning big; it’s about the entire pool of stakers winning together.

By staking with Jito, you’re essentially delegating the complex task of MEV extraction to a specialized system, and in return, you get a share of the profits. This directly boosts your APY beyond what you could get from a standard validator. Your staking rewards are now a combination of:

- Staking Inflation: The standard rewards for securing the network.

- Transaction Fees: A portion of the fees from transactions in the blocks.

- MEV Rewards: Your share of the tips from the Jito Block Engine’s auctions.

This is what true democratization looks like. It takes a complex, inaccessible source of value and makes it accessible to anyone, regardless of their technical skill or size of their stake.

Beyond Jito: A Look at the Broader MEV Landscape

Jito’s model is groundbreaking for Solana, but it’s part of a larger movement across the entire crypto space to tame and redistribute MEV. The most prominent example on Ethereum is Flashbots.

Flashbots and MEV-Boost: The Ethereum Approach

Flashbots pioneered many of the concepts that Jito later adapted for Solana. They recognized that MEV was causing massive network congestion and high gas fees on Ethereum as bots engaged in “priority gas auctions” (PGAs), essentially spamming the network and outbidding each other to get their transactions included first.

Flashbots introduced a system called MEV-Boost. It works on a principle of Proposer-Builder Separation (PBS). Here’s the simplified version:

- Block Builders: Specialized, sophisticated entities compete to build the most profitable block possible, filled with juicy MEV bundles.

- Relays: Trusted entities that receive these blocks from builders and pass them to validators without revealing the full contents (to prevent the validator from stealing the MEV).

- Proposers (Validators): The validator simply chooses the block header that offers the highest fee from the relay, signs it, and proposes it to the network. They don’t need to do the complex work of ordering transactions themselves.

While MEV-Boost doesn’t have a native liquid staking token to distribute rewards in the same way Jito does, it laid the philosophical and architectural groundwork. Liquid staking protocols on Ethereum, like Lido and Rocket Pool, can direct their validators to use MEV-Boost, and the extra profits earned are then passed back to their stakers (stETH and rETH holders). The goal is the same: separate the roles, create an efficient market, and spread the rewards more broadly.

The Real-World Impact: Why Should You Care?

This might all sound very technical, but the implications are huge for the average crypto user and staker. Democratizing MEV isn’t just about a few extra percentage points on your staking yield. It’s about building a more sustainable and equitable foundation for decentralized networks.

- Higher, Fairer Staking Yields: The most obvious benefit. By getting a cut of MEV, your overall staking rewards increase. This makes staking more attractive and rewarding for everyone, not just the whales.

- Reduced Network Congestion: By creating an orderly, off-chain auction for blockspace, systems like Jito and Flashbots prevent the chaotic on-chain bidding wars that clog the network and drive up gas fees for everyone.

- Improved Network Health: By distributing MEV rewards widely, these protocols reduce the incentive for validator centralization. Smaller validators can remain competitive, leading to a more diverse and resilient set of network operators. This is critical for the long-term security and censorship resistance of the blockchain.

- A More Transparent System: MEV is being brought out of the “dark forest” and into the light. These open systems provide data and transparency into what was once an opaque and often predatory market.

Are There Any Downsides or Risks?

Of course, no solution is perfect. The move towards MEV democratization brings its own set of challenges. One of the primary concerns is the potential for centralization at different points in the supply chain. For example, if only a few block builders or relays become dominant, they could wield significant power over transaction inclusion and become points of failure or censorship. This is an active area of research and development, with teams working on decentralized builder and relay solutions to mitigate these risks.

There’s also a continuing philosophical debate about the nature of MEV itself. Some argue that any form of MEV is inherently extractive and that protocols should be designed to minimize it entirely, a concept known as “MEV minimization.” Others believe it’s an unavoidable reality of blockchain economies and that the focus should be on harnessing it for the collective good, which is the path Jito and Flashbots have taken.

Conclusion: A Fairer Future for Stakers

The rise of protocols like Jito represents a crucial maturation of the blockchain space. We’re moving from a ‘wild west’ environment, where only the fastest gunslingers profited, to a more structured and civilized system where the rewards are shared more equitably. By transforming MEV from a hidden tax on users into a shared dividend for stakers, these platforms are not just boosting yields; they are strengthening the very security and decentralization that makes blockchain technology so revolutionary.

For the everyday staker, this is fantastic news. You no longer have to be a technical genius to benefit from the full economic potential of the network you help secure. The game has changed. Thanks to the hard work of teams like Jito, the value flowing through the hidden layers of the blockchain is finally making its way back to you.

FAQ

What is JitoSOL?

JitoSOL is a liquid staking token (LST) on the Solana blockchain. When you stake your SOL tokens with the Jito protocol, you receive JitoSOL in return. This token represents your staked SOL and accrues value from both standard staking rewards and a share of the MEV rewards captured by the Jito network. You can hold it, trade it, or use it in DeFi applications, all while earning rewards.

Is MEV always bad for users?

Not necessarily. While some forms of MEV, like sandwich attacks, are directly harmful to users by giving them worse trade execution, other forms, like arbitrage, are actually beneficial. Arbitrage helps keep prices consistent across different decentralized exchanges. The goal of protocols like Jito isn’t to eliminate all MEV, but to mitigate the harmful types and fairly distribute the revenue from the beneficial types.

Can I earn MEV rewards on Ethereum?

Yes. While there isn’t a single protocol exactly like Jito, you can earn MEV rewards by staking through liquid staking providers like Lido, Rocket Pool, or Stakewise. These providers run validators that use MEV-Boost to capture extra value, which is then passed on to their LST holders (e.g., stETH, rETH). The mechanism is different, but the end result of enhanced staking yield is similar.