The Unsung Hero of the Multi-Chain World: Why IBC is a Foundational Standard

Let’s talk about the state of crypto. For years, we’ve lived in an archipelago of digital islands. Bitcoin was over here. Ethereum was over there. A hundred other chains popped up, each a sovereign nation with its own rules, its own language, and its own assets. They were powerful, sure, but they were isolated. Getting value from one island to another was a treacherous journey, often involving sketchy ferries and the constant risk of pirates. This isolation has been one of the biggest bottlenecks to mass adoption. But what if there was a universal language? A set of rules for how these island nations could talk to each other, trade, and collaborate without giving up their sovereignty? That’s the promise of Inter-Blockchain Communication (IBC), and it’s not just another piece of tech; it’s rapidly becoming the foundational standard for a truly interconnected web of blockchains.

Key Takeaways

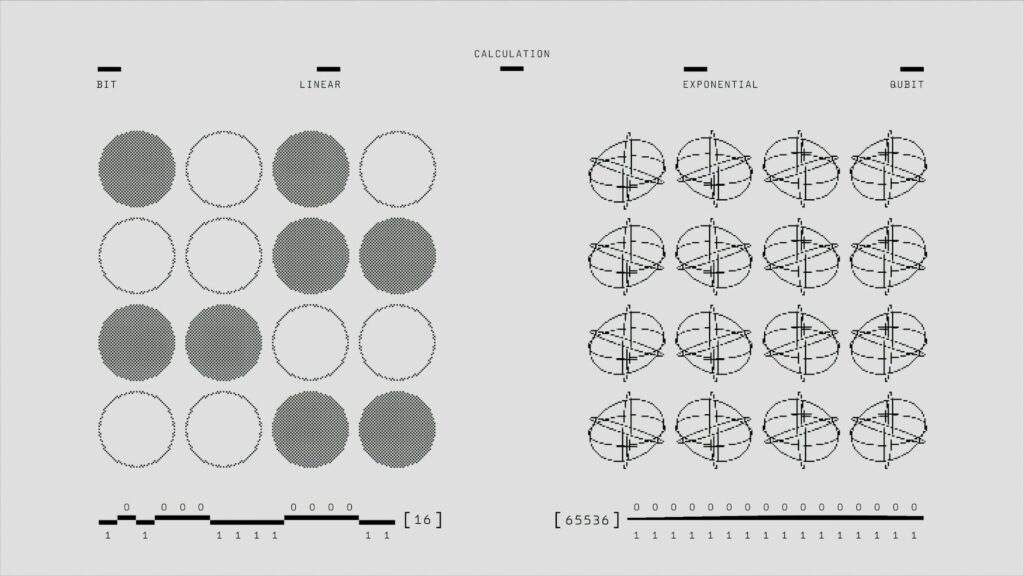

- Beyond Bridging: IBC is not just a bridge; it’s a universal protocol, like TCP/IP for the internet, that allows sovereign blockchains to communicate trustlessly.

- Security is Paramount: Unlike most bridges that rely on a small set of validators, IBC’s security is based on the security of the participating chains themselves. No extra trust assumptions are needed.

- Sovereignty and Connection: With IBC, blockchains can connect and interoperate without sacrificing their independence, governance, or security models.

- The Network Effect: As more chains adopt IBC, the value of the entire ecosystem grows exponentially, enabling complex cross-chain applications that were previously impossible.

What Exactly *Is* Inter-Blockchain Communication?

When most people hear “cross-chain,” they immediately think of a bridge. You lock assets on one chain and get a wrapped, IOU version on another. It works, kind of, but it’s often clunky and, as we’ve seen from countless nine-figure hacks, incredibly risky. IBC is fundamentally different. It’s not a thing; it’s a rulebook. Think of it less like a specific bridge and more like the international shipping and customs agreements that allow global trade to happen smoothly. It’s the TCP/IP of the blockchain world.

TCP/IP (Transmission Control Protocol/Internet Protocol) is the invisible magic that makes the internet work. It doesn’t care if you’re on a Mac or a PC, using Wi-Fi or a cable; it provides a standard way for computers to package, send, and receive data. You don’t think about it, you just open your browser and it works. IBC aims to be that for blockchains. It provides a standardized framework for blockchains to authenticate each other and securely exchange data packets. This data can be anything—a token transfer, a governance vote, a smart contract call, an NFT. It’s a general-purpose messaging protocol.

The core of IBC is built on two simple but powerful layers:

- TAO (Transport, Authentication, and Ordering): This is the base layer. It handles the low-level stuff—how to securely transport data packets between two chains, prove they came from where they say they came from, and ensure they are delivered in the right order. This is the ‘shipping container and customs’ part of our analogy.

- Application Layer: This sits on top of TAO. This is where developers define *what* the data packets mean. Is this a token transfer? A request to stake on another chain? The possibilities are endless. This is the ‘what’s inside the shipping container’ part.

This layered approach is what makes IBC so powerful. It separates the ‘how’ from the ‘what,’ creating a flexible and future-proof foundation for all kinds of cross-chain interactions.

The Pre-IBC World: A Landscape of Silos and Risky Bridges

To really appreciate why IBC is a game-changer, you have to understand the world without it. It was a mess. A very expensive, very risky mess. The primary method for moving assets was, and in many ecosystems still is, the trusted bridge.

Most bridges work on a lock-and-mint mechanism managed by a set of trusted parties, often a multisig wallet or a separate set of validators. You send your USDC to an address on Ethereum, they lock it, and a federated group of signers gives the green light to mint a wrapped version of USDC on another chain. The problem? That central group of signers is a massive honeypot and a single point of failure. It introduces a new trust assumption. You’re no longer just trusting the security of Ethereum and the destination chain; you’re also trusting this small, intermediary group not to get hacked, collude, or lose their keys.

The history of crypto is littered with the corpses of hacked bridges. Wormhole, Ronin, Poly Network—we’re talking about billions of dollars in user funds evaporated because of this flawed model. It’s like putting all your gold in a single vault guarded by just a handful of people and then broadcasting the vault’s location to the entire world. It’s not a question of *if* it will be attacked, but *when*.

Beyond the security nightmare, this model also creates a terrible user experience and liquidity fragmentation. Every bridge creates its *own* version of a wrapped asset. So you might have bridgeA-USDC, bridgeB-USDC, and bridgeC-USDC all on the same chain. They aren’t fungible, meaning they can’t be used interchangeably in DeFi protocols, which shatters liquidity and creates a confusing mess for users. It’s a band-aid solution to a fundamental architectural problem.

How IBC Works Under the Hood (Without Making Your Head Spin)

So, if IBC isn’t a bridge, how does it work its magic? The secret sauce is a combination of on-chain light clients and off-chain relayers. It sounds complicated, but the concept is surprisingly elegant.

Imagine Chain A wants to send a packet to Chain B.

- Light Clients: Chain B runs a ‘light client’ of Chain A on its own chain. A light client is exactly what it sounds like: a lightweight piece of software that tracks the block headers of another chain. It doesn’t store all the transaction data, just the cryptographic proof of the chain’s state. Think of it as Chain B having a direct, verifiable news feed of what’s happening on Chain A, without having to read every single newspaper article. It can independently and trustlessly verify that a specific event happened on Chain A.

- Connections & Channels: Once two chains have light clients for each other, they establish a connection. On top of that connection, they open specific channels for different types of applications. For example, one channel for token transfers, another for interchain accounts. This keeps things organized and secure.

- Relayers: This is the missing piece. Relayers are off-chain processes—anyone can run one—that simply watch for packets being sent on one chain, grab the proof, and deliver it to the other chain. They are just messengers. They can’t fake or alter the message because the light client on the receiving chain would immediately reject it. Relayers are permissionless and are incentivized by fees, ensuring the messages get delivered.

So, when you send 10 ATOM from the Cosmos Hub to Osmosis, you’re essentially posting a letter on the Cosmos Hub. A relayer sees it, picks it up along with the cryptographic proof that it was officially sent, and delivers it to Osmosis. The Osmosis chain looks at the proof, verifies it using its light client of the Cosmos Hub, and says, “Yep, this is legit. I’ll credit this user with 10 ATOM.” It’s secure, trust-minimized, and beautifully simple in its design.

Why Inter-Blockchain Communication as a *Standard* is a Game-Changer

The technology is brilliant, but the most important part of IBC is its adoption as a standard. Standards are what allow complex systems to flourish. The USB standard means you can plug any device into any computer. The HTTP standard means you can use any browser to visit any website. IBC is that for blockchains.

True Sovereignty Meets Cooperation

This is perhaps the most profound aspect. Before IBC, to connect with the liquidity and users of a larger ecosystem, a new chain often had to become a Layer 2 or a parachain, sacrificing some of its autonomy. IBC allows for a different model: the ‘Internet of Blockchains.’ Each chain remains fully sovereign, with its own validator set, its own governance, and its own tokenomics. They connect on their own terms, forming alliances and economic zones. It’s a shift from a monolithic or hierarchical model to a peer-to-peer network of equals.

Unparalleled Security

We touched on this, but it’s worth hammering home. IBC’s security model is trust-minimized. The only trust assumption is that both participating chains are secure. You are trusting the validator sets of Chain A and Chain B, which you were already doing by using them in the first place. There is no third-party group of bridge operators that can be compromised. The security of an IBC connection is literally as strong as the two chains involved. This is a monumental leap forward from the honeypot model of traditional bridges.

“Interoperability that relies on a trusted third party is a bug, not a feature. True interoperability is trustless, and that’s the principle IBC is built on. It’s about creating a whole that is greater, and more secure, than the sum of its parts.”

Composability and Network Effects

When you have a standard, you get composability. Developers can build applications that seamlessly leverage features from multiple chains. Imagine a lending protocol on Chain A using a price feed from an oracle on Chain B to allow a user to borrow an asset native to Chain C. This is interchain composability, and it unlocks a design space for dApps that is orders of magnitude larger than what’s possible on a single chain.

This creates a powerful network effect. Every new chain that adopts the IBC standard doesn’t just connect to one other chain; it instantly gains the ability to connect to every *other* IBC-enabled chain. The value of joining the network grows exponentially with each new participant, creating a gravitational pull that encourages further adoption. It’s the same reason the internet became so dominant.

IBC in Action: It’s Already Here

This isn’t just theory. The IBC ecosystem, centered around the Cosmos Hub, is thriving and showcases what’s possible. The ‘Interchain’ is a living, breathing economy.

- Cross-Chain DEXs: Osmosis is a decentralized exchange that acts as a liquidity hub for the entire IBC ecosystem. You can seamlessly swap assets from dozens of different sovereign chains in a single transaction. It feels like magic.

- Liquid Staking: Protocols like Stride allow you to stake your assets on one chain (e.g., ATOM on the Cosmos Hub) and receive a liquid, yield-bearing token on another chain that you can then use in DeFi.

- Interchain Accounts: This is a mind-bendingly powerful upgrade. It allows you to control an account on Chain B directly from your account on Chain A. Imagine using your Cosmos Hub wallet to vote on a governance proposal on the Stargaze NFT chain, without ever leaving your home interface.

- NFTs on the Move: NFTs are no longer trapped on their minting chain. With IBC, you can send an NFT from a marketplace on one chain to a game on a completely different chain.

Challenges and the Road Ahead

Of course, the journey isn’t over. IBC faces its own set of challenges. Relayer incentivization is still being perfected to ensure the network remains robust and decentralized. The user experience, while vastly improved, can still be complex for newcomers trying to navigate dozens of chains. The biggest hurdle, however, is expanding beyond the Cosmos ecosystem. While projects are actively working to connect IBC to chains like Ethereum, Avalanche, and Polkadot, these connections are complex and will take time to mature and prove their security.

But these are engineering and UX challenges, not fundamental design flaws. The core protocol is sound, secure, and battle-tested with billions of dollars transferred without a single protocol-level exploit. The foundation is rock solid.

Conclusion

In a world hurtling towards a multi-chain future, the need for a secure, decentralized, and open standard for communication is not just a ‘nice to have’—it’s an absolute necessity. Isolated chains are a dead end. Centralized, trusted bridges are a disaster waiting to happen. The only viable path forward is a protocol that allows sovereign chains to connect on their own terms, without introducing new points of failure.

That protocol is Inter-Blockchain Communication. It’s the quiet, robust, and elegant solution that has been working in the background, securing billions in assets and enabling a vibrant interchain economy. As more developers and ecosystems recognize the profound security and sovereignty guarantees it provides, IBC is poised to move from being the standard of the Cosmos to being the standard for the entire internet of blockchains. It’s not just a feature; it’s the future.

FAQ

Is IBC only for Cosmos chains?

While IBC was born in the Cosmos ecosystem and is most widely used there (as most Cosmos chains are built with the Cosmos SDK which has IBC built-in), it is not exclusive to it. IBC is a general-purpose specification that any blockchain can implement. There are active projects and research dedicated to connecting IBC to other major ecosystems like Ethereum (via ZK proofs or light clients), Polkadot, and others. The goal is for IBC to be truly universal.

How is IBC different from a bridge like Wormhole or a protocol like LayerZero?

The key difference is the trust model. Most bridges like Wormhole rely on a dedicated, trusted set of validators to verify transactions between chains. If that small set of validators is compromised, the entire bridge’s funds are at risk. LayerZero uses a model with Oracles and Relayers, which is more decentralized but still introduces external trust assumptions. IBC is trust-minimized. It relies only on the security of the two chains communicating. It uses on-chain light clients to allow Chain A to independently verify the state of Chain B, and vice-versa, without any trusted intermediary.

Is using IBC safe?

The IBC protocol itself has been rigorously audited and battle-tested, successfully securing billions of dollars in cross-chain transfers for years without a single protocol-level exploit. Its security model is considered the gold standard for interoperability. However, safety also depends on the security of the connected chains and the applications you are using. If you connect to a small, insecure chain, or interact with a faulty smart contract on the other end, you can still lose funds. The communication layer (IBC) is incredibly secure, but you still need to be mindful of what you’re connecting to.