Why Digital Assets Need Special Inheritance Planning

Unlike physical possessions that can be easily transferred through traditional wills, digital assets present unique challenges. Passwords, encryption, and terms of service agreements often create barriers that prevent even legally appointed executors from accessing accounts.

According to recent surveys, nearly 70% of Americans have no provisions for their digital assets in their estate plans, despite owning an average of 25 online accounts. For cryptocurrency holders, the stakes are even higher—an estimated $140 billion in Bitcoin alone is currently inaccessible due to lost keys or deceased owners who didn’t leave proper instructions.

“Many people don’t fully appreciate that digital assets are different animals from traditional assets such as bank accounts. They’re often subject to terms of service agreements as well as state and federal laws.”

The consequences of failing to plan can be devastating. From permanently lost family photos to inaccessible cryptocurrency worth thousands or millions of dollars, proper inheritance planning for digital assets is no longer optional—it’s essential.

Don’t Leave Your Digital Legacy to Chance

Get our comprehensive Digital Asset Inheritance Guide and ensure your loved ones can access what matters most.

Understanding Your Digital Asset Portfolio

Before creating an inheritance plan, you need to identify all your digital assets. These typically fall into four main categories:

Financial Assets

- Cryptocurrency wallets

- Online banking accounts

- Investment platforms

- Digital payment services

- NFTs (Non-fungible tokens)

Personal Assets

- Email accounts

- Cloud storage (photos, documents)

- Digital media libraries

- Subscription services

- Smartphone data

Social Assets

- Social media accounts

- Blog/website content

- Online gaming accounts

- Forum memberships

- Dating profiles

Business Assets

- Domain names

- Online business accounts

- Digital intellectual property

- Client databases

- Digital storefronts

Each category requires different inheritance planning approaches. For example, cryptocurrency requires secure transfer of seed phrases and private keys, while social media accounts may need legacy contact designation through platform-specific tools.

The Legal Landscape of Digital Inheritance

The laws governing digital asset inheritance are still evolving. Currently, the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) provides the legal framework in most U.S. states, establishing a three-tier approach to digital asset access:

- Online Tools: Platform-specific legacy tools (like Facebook’s Legacy Contact or Google’s Inactive Account Manager) take first priority

- Legal Documents: Instructions in wills, trusts, or powers of attorney take second priority

- Terms of Service: Platform terms of service apply if no other instructions exist

Important: Simply sharing passwords with family members may violate terms of service agreements and even computer fraud laws. Proper legal documentation is essential for authorized access.

Working with an attorney who specializes in digital estate planning ensures your inheritance instructions will be legally valid and enforceable. This is particularly important for cryptocurrency holders, as these assets require specialized knowledge to properly include in estate documents.

Crypto Inheritance: Protecting Your Digital Currency

Cryptocurrency presents unique inheritance challenges. Unlike traditional bank accounts, there’s no central authority to help heirs recover lost access. If your seed phrases or private keys are lost, your crypto assets could be permanently inaccessible.

Documenting Crypto Wallets and Seed Phrases

Creating a secure inventory of your cryptocurrency holdings is essential. This should include:

- Types of cryptocurrency owned

- Approximate value (updated periodically)

- Wallet types and locations (hardware, software, exchange)

- Access methods for each wallet

- Seed phrases and recovery information

Seed Phrase Security: Never store seed phrases digitally where they could be hacked. Consider using metal backups that are fireproof and waterproof, stored in secure locations known to trusted individuals.

Some crypto holders use the “3-2-1 approach” for seed phrase inheritance: 3 copies, stored in 2 different formats, with at least 1 copy in a separate physical location. This might include a safe deposit box, home safe, and with a trusted attorney.

Protect Your Crypto Legacy

Our Crypto Inheritance Template helps you document your holdings securely and create foolproof instructions for your heirs.

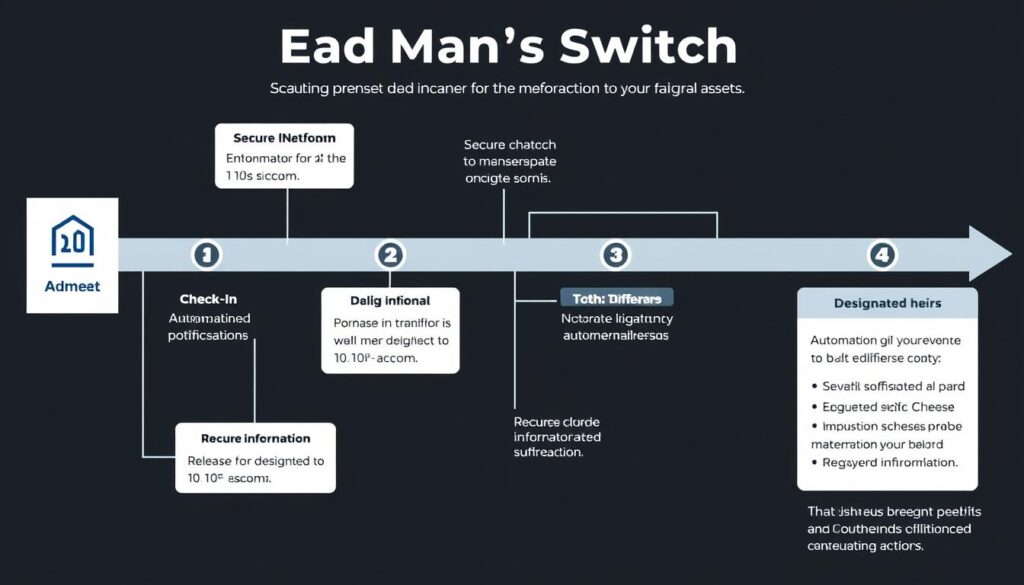

Setting Up a Dead Man’s Switch for Emergency Access

A “dead man’s switch” is an automated system that triggers if you don’t respond to regular check-ins, providing a way for your heirs to access critical information after your death or incapacitation.

For digital assets, especially cryptocurrency, a dead man’s switch might:

Benefits

- Provide automatic access without probate delays

- Keep sensitive information secure until needed

- Work even if heirs don’t know about all assets

- Function across international boundaries

- Reduce risk of contested inheritance

Implementation Options

- Specialized services like Safe Haven or TrustVerse

- Smart contracts on blockchain platforms

- Digital vault services with timed access

- Email systems with delayed messages

- Multi-signature wallet arrangements

Important: Test your dead man’s switch regularly to ensure it functions as expected. False triggers can expose sensitive information prematurely, while system failures could prevent access entirely.

Legal Tools for Digital Estate Planning

Proper inheritance planning for digital assets requires specific legal documentation. Standard wills and trusts may not adequately address the unique challenges of digital property.

Essential legal tools for digital asset inheritance include:

| Legal Document | Purpose for Digital Assets | Key Provisions to Include |

| Digital Asset Will Addendum | Specifically addresses digital property inheritance | Authorization for executor access, specific instructions for each asset category |

| Digital Asset Power of Attorney | Grants access during incapacity | Explicit digital access rights, limitations on authority |

| Digital Asset Trust | Holds and manages digital assets | Transfer mechanisms for crypto, access protocols |

| Digital Executor Designation | Names person specifically for digital assets | Technical qualifications, specific responsibilities |

Work with an attorney who understands both estate law and digital assets to ensure your documents provide proper authorization under RUFADAA and other applicable laws.

Get Expert Legal Guidance

Our network of digital estate planning attorneys can help create legally sound documents for your digital assets.

Creating Your Digital Vault

A digital vault serves as a secure repository for your digital asset information, providing authorized access to your heirs when needed while maintaining security during your lifetime.

Effective digital vaults typically include:

- Asset Inventory: Comprehensive listing of all digital assets

- Access Instructions: Detailed steps for accessing each asset

- Security Credentials: Passwords, PINs, and authentication methods

- Legacy Instructions: Specific wishes for each digital account

- Contact Information: Technical advisors who can assist heirs

Digital Vault Benefits

- Centralized information storage

- Military-grade encryption

- Controlled access permissions

- Regular update reminders

- Integration with legal documents

Digital Vault Considerations

- Requires regular updates

- May have subscription costs

- Needs secure master password

- Requires technical setup

- Must be legally authorized

When selecting a digital vault service, look for options that offer inheritance features specifically designed for estate planning, not just general password managers.

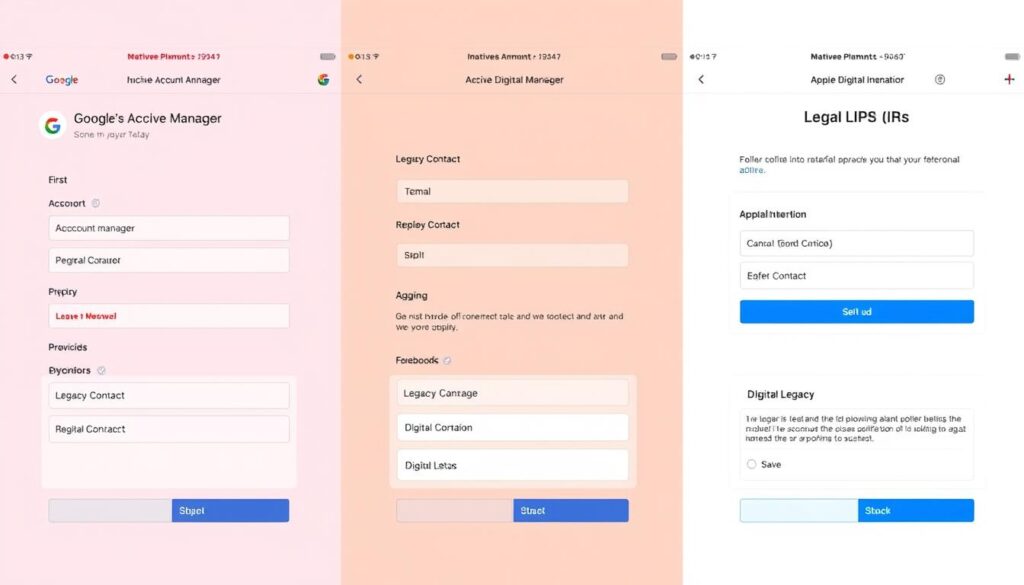

Platform-Specific Legacy Planning

Many major online platforms offer built-in legacy planning tools that take precedence over other instructions under RUFADAA. Taking advantage of these tools is an essential part of inheritance planning for digital assets.

Tool: Inactive Account Manager

Features:

- Triggers after inactivity period

- Can notify contacts

- Allows data sharing with trusted contacts

- Option to delete account

Setup: Google Account → Data & Privacy → More Options → Make a plan for your account

Tool: Legacy Contact

Features:

- Memorializes account after death

- Legacy contact can manage memorial page

- Download data option

- Option to delete account

Setup: Settings → Security → Legacy Contact

Apple

Tool: Digital Legacy

Features:

- Designate legacy contacts

- Generates access keys

- Provides access to photos, notes, files

- Requires death certificate

Setup: Settings → [Your Name] → Password & Security → Legacy Contact

Other platforms with legacy planning options include Microsoft, Twitter, LinkedIn, and PayPal. Check each service you use regularly for available legacy tools.

Remember: Platform-specific tools only work for that specific service. You still need a comprehensive digital estate plan that covers all your digital assets.

Common Mistakes in Digital Asset Inheritance Planning

Even well-intentioned inheritance planning can fall short when it comes to digital assets. Avoid these common pitfalls:

What Not To Do

- Sharing passwords through unsecured channels

- Storing seed phrases digitally without encryption

- Failing to update your inventory regularly

- Ignoring platform-specific legacy tools

- Using a single point of failure for critical information

- Assuming family members understand technical terms

- Neglecting to include digital assets in legal documents

Best Practices

- Using secure, encrypted channels for sensitive information

- Storing seed phrases on metal backups in secure locations

- Setting calendar reminders for quarterly updates

- Configuring all available platform legacy settings

- Implementing redundant storage with multiple access methods

- Creating clear, non-technical instructions for each asset

- Working with an attorney to include digital provisions

“Creating a road map of the assets you own and the debts you may have could be the most important thing you can do right now. Taking stock and keeping track of the items on your list will help ensure that your heirs or fiduciaries won’t miss anything.”

Real-World Consequences: A Cautionary Tale

The importance of proper inheritance planning for digital assets is illustrated by numerous real-world cases where families lost access to valuable digital property.

The Case of Matthew Mellon

Banking heir Matthew Mellon had invested heavily in cryptocurrency, amassing a fortune worth approximately $1 billion in XRP. However, when he died unexpectedly in 2018, he had stored his private keys using a complex system only he understood.

Despite his wealth and connections, his family was unable to access his cryptocurrency holdings. The funds remain inaccessible to this day, effectively removed from circulation.

Key Lessons:

- Even substantial wealth doesn’t protect against poor digital planning

- Overly complex security without clear documentation can backfire

- Cryptocurrency requires specialized inheritance planning

- No central authority can help recover lost crypto access

Your Digital Inheritance Planning Checklist

Creating a comprehensive inheritance plan for your digital assets doesn’t have to be overwhelming. Follow this step-by-step approach:

- Create a comprehensive inventory of all digital assets across categories

- Determine the value (financial and sentimental) of each digital asset

- Document access methods for each asset, including accounts, passwords, and security questions

- Establish a secure storage system for sensitive information like seed phrases

- Configure platform-specific legacy tools for major services you use

- Create clear instructions for how each asset should be handled

- Update legal documents to include digital asset provisions

- Select a digital executor with appropriate technical knowledge

- Implement a digital vault or dead man’s switch if appropriate

- Review and update regularly, especially after acquiring new digital assets

Start Your Digital Inheritance Plan Today

Our comprehensive Digital Inheritance Planning Kit includes templates, checklists, and step-by-step guides to secure your digital legacy.

Frequently Asked Questions About Digital Asset Inheritance

How do I securely share my seed phrase with heirs?

The safest approach is to use physical, durable storage like steel plates or titanium cards stored in secure locations (e.g., safe deposit boxes). Split your seed phrase into multiple parts stored in different locations for additional security. Provide clear instructions on how to reconstruct the complete phrase, but never store the full seed phrase in a single location or digitally where it could be compromised.

Is a dead man’s switch legally binding?

A dead man’s switch itself is not a legal document, but rather a technical mechanism. To make it legally effective, it should be referenced in your legally binding estate documents (will, trust, etc.) with explicit authorization for the information it releases. Without this legal foundation, information released by a dead man’s switch might not give your heirs legal authority to access accounts, even if they have the technical ability to do so.

Can my digital assets be taxed like physical property?

Yes, digital assets with financial value are generally subject to the same estate and inheritance tax rules as physical assets. Cryptocurrency, valuable domain names, and monetized digital content may all be included in your taxable estate. The IRS specifically requires cryptocurrency to be reported for tax purposes. Work with a tax professional familiar with digital assets to ensure proper valuation and tax planning.

What happens to social media accounts in a digital estate plan?

The fate of social media accounts depends on both your wishes and the platform’s policies. Most major platforms offer specific legacy options: Facebook allows account memorialization or deletion, Twitter permits account removal, and Instagram offers memorialization. Your digital estate plan should specify your preferences for each account and authorize your digital executor to carry out these wishes. Using platform-specific tools like Facebook’s Legacy Contact ensures your wishes take legal precedence.

How often should I update my digital asset inventory?

Review your digital asset inventory at least quarterly, and immediately after acquiring significant new digital assets (especially cryptocurrency), opening new accounts, or changing important passwords. Set calendar reminders to ensure regular updates. Many digital vault services offer automatic reminders to help maintain an accurate inventory.

Securing Your Digital Legacy Starts Today

Inheritance planning for digital assets is no longer optional in our increasingly digital world. From irreplaceable family photos to valuable cryptocurrency holdings, your digital legacy deserves the same careful planning as your physical possessions.

By creating a comprehensive inventory, implementing secure storage solutions, configuring platform-specific tools, and updating your legal documents, you can ensure your digital assets are protected and accessible to those you trust. Don’t wait until it’s too late—start your digital inheritance planning today.

Complete Digital Inheritance Planning Kit

Get our comprehensive guide, templates, and checklists to secure your entire digital legacy—from cryptocurrency to family photos.