The Unseen Architecture: Building the Bridge to Institutional-Grade DeFi

For years, Decentralized Finance (DeFi) has been the financial equivalent of a vibrant, chaotic, and slightly dangerous frontier town. It’s where fortunes are made overnight and lost in an instant. The innovation is breathtaking, the returns can be astronomical, and the risks? Well, they’re just as massive. This high-risk, high-reward environment has been a playground for degens and early adopters, but a no-go zone for the big money: the institutions. Pension funds, asset managers, and corporate treasuries have been watching from the sidelines, intrigued by the promise but terrified of the peril. That’s all changing. Right now, a sophisticated technology stack is being meticulously assembled to create a safe, compliant, and robust pathway for Institutional-Grade DeFi access. This isn’t about making DeFi less decentralized; it’s about building the professional-grade tools needed to navigate it.

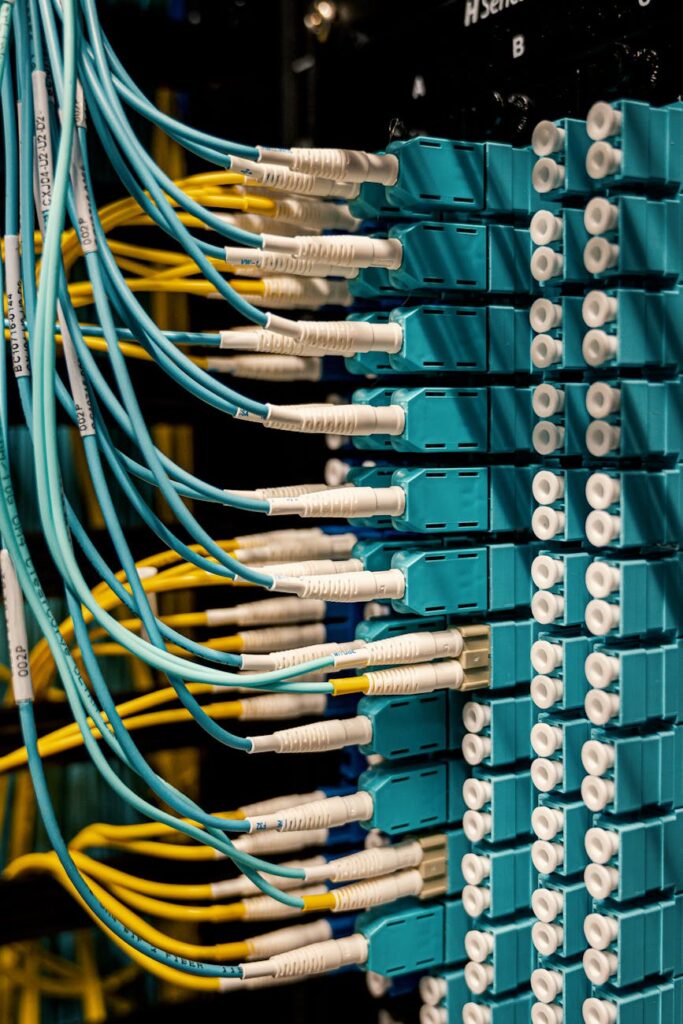

This isn’t just a single piece of software or a new platform. It’s a multi-layered ecosystem of technologies designed to solve the very specific, very demanding problems that institutions face. Think of it as building the highways, the security systems, the legal frameworks, and the banking infrastructure for this new digital economy. Without this foundational work, institutional capital will remain on the sidelines, and DeFi will never reach its full potential. So, what does this stack actually look like? Let’s break it down, layer by layer.

Key Takeaways

- Compliance is Non-Negotiable: The stack’s foundation is built on KYC/AML solutions that allow institutions to interact with DeFi while meeting strict regulatory requirements.

- Custody is King: Advanced wallet infrastructure, including Multi-Party Computation (MPC), is replacing the traditional self-custody model to secure billions in assets.

- Execution Matters: Institutions require sophisticated tools like smart order routers and RFQ systems to access deep liquidity without causing massive price slippage.

- Risk Management and Reporting are Essential: The new stack provides real-time risk analytics and generates audit-ready reports, translating complex on-chain data into familiar financial formats.

Deconstructing the Institutional DeFi Stack: A Modular Approach

The first thing to understand is that there’s no single, monolithic “institutional DeFi platform.” Instead, what’s emerging is a modular stack where different providers specialize in different layers. This allows an asset manager to pick and choose the best-in-class solutions for their specific needs, from custody to compliance to execution. It’s a powerful, flexible approach that mirrors the way traditional finance (TradFi) is built. The goal isn’t to force a square peg into a round hole; it’s to build a whole new set of professional-grade, interoperable tools.

Layer 1: The Gatekeepers – Identity and Compliance (KYC/AML)

This is, without a doubt, the most critical and contentious layer. The core ethos of DeFi is permissionless access, while the core of institutional finance is… well, permissions. You can’t just airdrop a billion dollars from a corporate treasury into a liquidity pool without knowing who is on the other side of that trade. It’s a regulatory nightmare.

The solution? A new breed of on-chain identity and compliance tools. Here’s what’s inside:

- Permissioned Pools: These are essentially firewalled versions of popular DeFi protocols like Aave or Compound. Only users who have been vetted and whitelisted through a rigorous KYC (Know Your Customer) and AML (Anti-Money Laundering) process can access them. It’s DeFi with a bouncer at the door.

- Verifiable Credentials & Soulbound Tokens (SBTs): Think of these as a digital passport on the blockchain. A trusted third party can verify a user’s identity and issue a non-transferable token (an SBT) to their wallet. This token doesn’t reveal the user’s personal information, but it acts as a cryptographic proof that they’ve passed a compliance check. Protocols can then grant access based on the presence of this credential. It’s a privacy-preserving way to enforce rules.

- On-Chain Surveillance: Companies like Chainalysis and TRM Labs provide tools that continuously monitor transactions, flagging any wallets or activities associated with illicit finance. This is a crucial backstop for compliance officers who need to prove they are actively preventing money laundering.

This layer is the bedrock. Without a robust solution for identity and compliance, none of the other layers matter for institutional players.

Layer 2: The Vault – Secure Custody and Wallet Infrastructure

“Not your keys, not your crypto” is great advice for an individual. It’s a fireable offense for a portfolio manager responsible for a client’s retirement fund. Institutions cannot simply write down a 24-word seed phrase on a piece of paper and stick it in a safe. The custody layer for Institutional-Grade DeFi needs to be bulletproof, insured, and auditable.

The technology solving this is a world away from a simple hardware wallet:

- Multi-Party Computation (MPC): This is the magic. MPC wallets split a single private key into multiple shards, which are then stored by different parties in different locations. To sign a transaction, a specific threshold of those parties (e.g., 3 out of 5) must use their key shard to collaboratively generate a signature. No single party ever holds the full key. This eliminates the single point of failure that makes traditional key storage so risky. If one party is compromised, the funds remain safe.

- Hardware Security Modules (HSMs): These are specialized, tamper-resistant hardware devices designed to safeguard cryptographic keys. Institutional custody solutions often store their MPC key shards within certified HSMs, providing a physical layer of security on top of the cryptographic one.

- Qualified Custodians: These are regulated financial institutions (often trust companies) that specialize in safeguarding digital assets. They provide the legal and insurance wrappers that institutions require, offering protection against theft and operational failures. This is a critical piece for meeting fiduciary responsibilities.

This combination of MPC, HSMs, and qualified custodians provides a multi-layered defense system that gives institutions the confidence to deploy significant capital into the DeFi ecosystem.

Bridging the Gap: Execution and On-Ramps

Okay, so an institution is compliant and their assets are secure. How do they actually trade? They can’t just go to Uniswap and try to swap $100 million worth of ETH for USDC. The slippage would be catastrophic, and the front-running bots would have a field day. The execution layer is about accessing liquidity efficiently and discreetly.

Aggregating Deep Liquidity

The institutional stack provides specialized tools for this. Instead of interacting with a single decentralized exchange (DEX), they use aggregators and smart order routers. These platforms connect to dozens of liquidity sources—both on-chain DEXs and off-chain market makers—to find the best possible price for a large trade. They break the large order into smaller pieces and route them across multiple venues to minimize market impact. Some platforms are even adopting a Request-for-Quote (RFQ) system, a familiar model from TradFi. An institution can privately request a quote for a large block trade from a network of professional market makers, who then compete to offer the best price. The trade is then settled on-chain. It’s a way of bringing professional-grade execution to a decentralized world.

The Fiat-to-Crypto Connection

You can’t have institutional DeFi without a rock-solid bridge to the traditional banking system. This means more than just a simple retail on-ramp. Institutions need reliable, high-volume, and fully regulated pathways to move fiat into and out of the crypto ecosystem. This is being solved by partnerships with crypto-friendly banks and the proliferation of fully-reserved, audited stablecoins like USDC and EURC. These assets act as the primary settlement layer, the stable bedrock upon which more volatile DeFi activities can be built.

The Brains of the Operation: Risk Management and Reporting

An institution’s lifeblood is data. They need to understand their exposure, model potential risks, and generate reports for stakeholders, auditors, and regulators. DeFi’s transparent-but-chaotic nature makes this incredibly difficult. A single DeFi transaction can involve multiple smart contracts, temporary assets (like LP tokens), and complex fee structures. It’s a reporting nightmare.

Real-Time Risk Analytics

The new wave of institutional tooling is designed to tame this complexity. These platforms plug directly into the blockchain, ingesting and interpreting raw data in real-time. They can:

- Track Portfolio P&L: Accurately calculate profit and loss across multiple wallets and dozens of DeFi protocols.

- Score Smart Contract Risk: Analyze smart contract code for known vulnerabilities and provide a risk score before an institution interacts with a new protocol.

- Model Counterparty Risk: Even in DeFi, you have counterparty risk (e.g., the solvency of a stablecoin issuer or the security of a bridge). These tools help quantify and monitor that risk.

- Simulate Scenarios: Model what might happen to a portfolio under various market conditions, like a sudden de-pegging event or a spike in network gas fees.

Tax and Accounting Integration

This might be the least glamorous part of the stack, but it’s one of the most important. These tools translate indecipherable on-chain activity into standard formats that accounting software can understand. They correctly classify transactions for tax purposes (e.g., distinguishing between income, capital gains, and a non-taxable transfer), generating audit-ready reports that can be handed directly to a CFO or an auditor. Without this, operating in DeFi at scale is simply impossible.

“For institutions, compliance and risk management aren’t obstacles to be overcome; they are enablers. The technology that provides robust security, reporting, and regulatory adherence is the very thing that unlocks DeFi as a legitimate, alternative asset class.”

The Future-Proof Layer: Abstraction and Interoperability

The final layer of the stack is all about user experience and future-proofing. The crypto world is a multi-chain universe. An institution might want to lend on Ethereum, trade on Solana, and hold assets on Avalanche. Managing this complexity is a major operational headache.

The ‘Single Pane of Glass’ Approach

This is where abstraction layers and sophisticated APIs come in. Institutional platforms are building unified dashboards—a ‘single pane of glass’—that allow a portfolio manager to view and manage all their assets across multiple blockchains from one place. They don’t need to worry about switching RPC endpoints or managing different wallet types. The platform handles all the underlying technical complexity, presenting a clean, simple interface. This allows them to focus on strategy, not on wrangling infrastructure.

Cross-Chain Communication Protocols

Furthermore, the rise of secure interoperability protocols, like Chainlink’s Cross-Chain Interoperability Protocol (CCIP), is a game-changer. These protocols are creating standardized, highly secure pathways for moving both assets and data between different blockchains. For an institution, this means they can deploy capital on one chain and seamlessly utilize it in a DeFi application on another, without having to go through risky, centralized bridges. It’s the key to unlocking a truly interconnected and liquid digital asset market.

Conclusion

The journey to bring institutional capital into DeFi is a marathon, not a sprint. The technology stack being built is a testament to the maturation of the industry. It’s a deliberate and sophisticated effort to address the very real concerns of security, compliance, and operational complexity that have kept big money on the sidelines. This isn’t about taming the innovative spirit of DeFi’s “wild west.” It’s about building the professional-grade infrastructure around it, allowing institutions to participate in a way that meets their fiduciary and regulatory duties. As these layers solidify, the trickle of institutional interest we see today could very well become a flood, fundamentally reshaping both traditional finance and the future of the decentralized economy.

FAQ

What is the biggest single hurdle remaining for institutional DeFi adoption?

While technology is solving many problems, the biggest remaining hurdle is regulatory clarity. In many jurisdictions, the rules governing digital assets and DeFi are still ambiguous or non-existent. Institutions are hesitant to invest heavily until there are clear guidelines from regulators like the SEC on how these assets and activities will be treated. This legal and regulatory uncertainty is a greater barrier than any single piece of missing technology.

Is “institutional DeFi” just a sanitized version of CeFi (Centralized Finance)?

Not necessarily. While it incorporates centralized chokepoints for compliance (like KYC checks), the core activities—trading, lending, and borrowing—still happen on-chain using decentralized, non-custodial smart contracts. The key difference is the access layer. Institutional DeFi creates a permissioned on-ramp to the decentralized backend. The goal is to get the best of both worlds: the transparency and efficiency of DeFi protocols with the security and compliance of TradFi.

How can institutions ensure the smart contracts they interact with are safe?

This is a major focus of the risk management layer. Institutions rely on a multi-pronged approach. First, they almost exclusively interact with protocols that have undergone multiple, rigorous third-party audits from reputable security firms. Second, they use real-time monitoring tools that analyze smart contract code and on-chain activity for red flags. Finally, many institutional platforms maintain a ‘whitelist’ of approved protocols that have been thoroughly vetted by their internal security teams, preventing interaction with new or unproven smart contracts.