The Cross-Chain Nightmare: Why Your Crypto Is Stuck

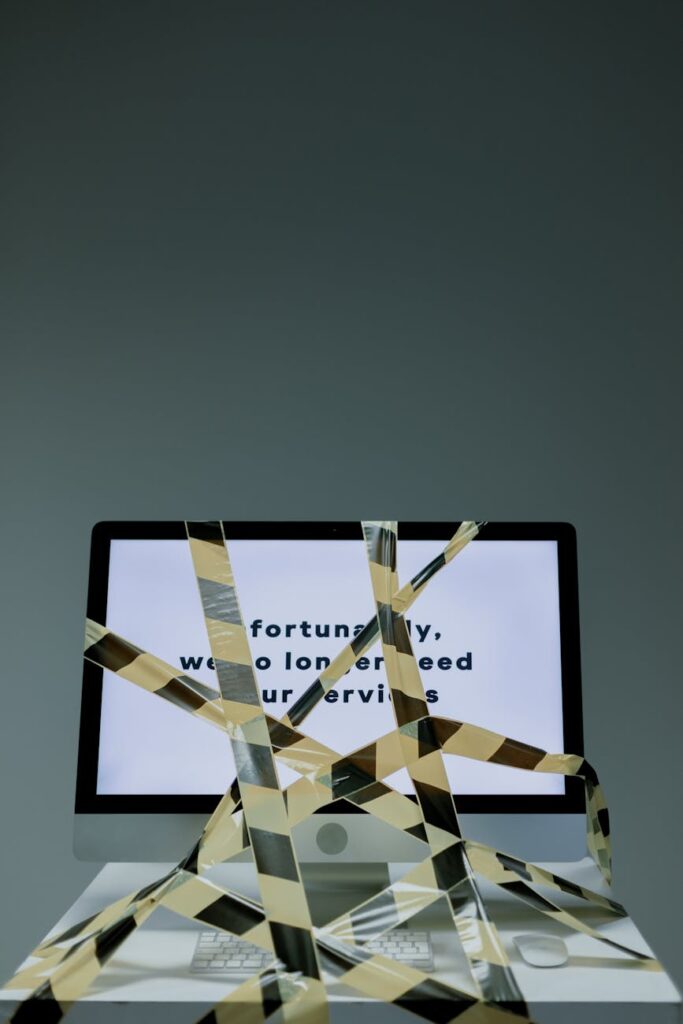

Let’s be honest. Using a crypto bridge today feels like navigating a minefield in the dark. You’ve found a great DeFi opportunity on a new chain, but your assets are on Ethereum. Now what? You find a bridge, connect your wallet, sign a flurry of transactions you barely understand, and then… you wait. And you pray. You pray the transaction doesn’t fail, you pray you don’t get hit with insane fees, and you pray the bridge itself doesn’t get hacked while your funds are in limbo. This clunky, high-stress process is the reality for most cross-chain interactions, and it’s a massive barrier to a truly interconnected web3. We’re asking users to act like expert blockchain mechanics just to move a token from A to B. It’s unsustainable. But what if you could just state your goal—your intent—and let someone else figure out the complicated steps? That’s the revolutionary promise of intents.

Key Takeaways:

- Current Bridging is Broken: Today’s cross-chain experience is complex, risky, and user-hostile, requiring users to manage multiple steps and transactions.

- Intents are the Solution: An intent is a user-signed message that declares a desired outcome (e.g., “I want 100 USDC on Arbitrum in exchange for my 0.05 ETH on mainnet”) without specifying the exact steps to achieve it.

- Shift from ‘How’ to ‘What’: Intents shift the burden of execution from the user to a competitive network of specialized actors called “solvers.”

- Major Benefits: This new paradigm promises vastly improved user experience (UX), enhanced security by minimizing malicious contract interactions, and greater capital efficiency.

- The Future is Chain-Abstracted: Ultimately, intents pave the way for a future where users don’t even need to know what chain they’re on. They just interact with dApps seamlessly.

So, What Exactly Is an ‘Intent’?

Think about how you use a food delivery app. You don’t tell the app, “Find a driver, give them this specific route, have them wait at this specific light, pick up my order, then take this other exact route to my house.” That would be absurd. Instead, you declare your intent: “I want a burrito from Chipotle delivered to my address.” The app then broadcasts this request, and a network of drivers (solvers) competes to fulfill it in the most efficient way possible. You just care about the end result—the burrito arriving at your door.

That’s precisely what intents bring to crypto. Instead of crafting a complex series of transactions (approve token, swap token, bridge asset, receive wrapped asset, swap again), you simply state your desired end state. It’s a signed, off-chain message that says, “This is what I have, and this is what I want to end up with.”

The Old Way vs. The Intent Way

Let’s make this concrete.

The Old Way (Imperative Transactions):

- Go to Uniswap on Ethereum. Swap 0.05 ETH for USDC. Pay gas.

- Go to a bridge’s website. Connect wallet.

- Approve the bridge contract to spend your USDC. Pay gas.

- Execute the bridge transaction to send USDC to Arbitrum. Pay gas.

- Wait anxiously for 10-20 minutes (or more).

- Receive bridged USDC (sometimes called USDC.e) on Arbitrum.

- If you need native USDC, find another DEX on Arbitrum to swap USDC.e for native USDC. Pay more gas.

The New Way (Declarative Intents):

- Go to an intent-based aggregator or dApp.

- You state: “I want to turn 0.05 ETH on Ethereum into at least 99.5 native USDC on Arbitrum.”

- You sign a single message. That’s it.

Behind the scenes, a whole new world springs into action.

The Magic Behind the Curtain: Solvers and Order Flow Auctions

So if you’re not doing the work, who is? This is where the concept of solvers (sometimes called fillers or executors) comes in. Solvers are sophisticated, independent agents—they can be market makers, searchers, or specialized protocols—that constantly monitor for user intents.

When you sign your intent, it’s broadcast to a network. Solvers then compete in a real-time auction to find the best possible way to fulfill your request. They might have private inventory on the destination chain, access to exclusive liquidity pools, or the ability to batch multiple transactions together to save on fees. They are financially incentivized to give you the best execution price because that’s how they win the auction and capture the (often tiny) spread.

Why This Is a Game-Changer for Security and MEV

One of the scariest parts of DeFi is signing transactions. You’re granting a smart contract permission to do things with your funds, and one wrong signature on a malicious site can drain your wallet. Intents flip this on its head.

With an intent-based system, you’re not interacting directly with a dozen complex, potentially vulnerable external protocols. You’re simply signing a statement of your desired outcome. The risk of execution is transferred to the professional solver.

This also has massive implications for Miner Extractable Value (MEV). MEV often harms users through things like sandwich attacks, where a bot sees your large trade, front-runs you, and then back-runs you, profiting from the price slippage you created. With intents, your transaction isn’t sitting naked in the public mempool for predators to attack. It’s part of a private or semi-private order flow that solvers bid on. The competitive nature of the solver network forces them to return most of this value back to you, the user, in the form of better prices. It turns an adversarial relationship into a service-based one.

The Real-World Impact on **Cross-Chain Interactions**

This isn’t just a theoretical improvement; it’s a complete paradigm shift that will redefine what’s possible in a multi-chain world. The goal is to make the underlying blockchains invisible—a concept often called chain abstraction.

Example 1: Cross-Chain Yield Farming

Imagine you want to deposit into a high-yield liquidity pool on Solana, but your funds are in an LP token on Polygon. Today, this is a multi-hour, high-fee nightmare. With intents, you could simply state: “Unstake my MATIC-USDC LP token on Polygon, convert the underlying assets to SOL and USDC, and deposit them into this Orca liquidity pool on Solana.” A solver would calculate the entire path, execute it, and you’d just see the final result in your wallet. Days of work become a single click.

Example 2: Cross-Chain NFT Purchases

You see a must-have NFT minting on Base, but all your liquid ETH is on Ethereum mainnet. Instead of a frantic scramble to bridge funds and risk missing the mint, you could create an intent: “Use my ETH on mainnet to mint this NFT on Base and send it to my wallet.” A solver who already has liquidity on Base could mint it for you instantly and settle with you later via a slower, cheaper bridge or through netting against other transactions. You get your NFT without the headache.

Example 3: Gasless and Fee-Abstracted Transactions

What if you didn’t need to hold the native token of every chain you use? Intents make this possible. You could create an intent like, “Swap my USDC on Arbitrum for WETH on Optimism, and pay the gas fees for all steps using my USDC.” The solver would handle all the gas payments on both chains, simply deducting the equivalent cost from the final amount you receive. This removes a huge point of friction for new users who are constantly confused about which token they need for gas.

The Unavoidable Hurdles on the Path to an Intent-Centric World

While the vision is powerful, we’re not there yet. Several challenges need to be addressed for intent-based systems to become the standard.

- Solver Centralization: There’s a real risk that only a few highly sophisticated, well-capitalized players will be able to act as solvers. This could lead to censorship or monopolistic pricing if not designed carefully with decentralization in mind.

- Expressivity vs. Complexity: How do you create a system that allows for very complex, specific intents without making the intent-creation process itself too complicated for the average user? Finding this balance is key.

- Cross-Domain Composability: Fulfilling an intent might require pulling liquidity from a bridge, a CEX, a private market maker, and an AMM all at once. Building the infrastructure to connect these disparate liquidity sources is a massive engineering challenge.

- Security of the Intent System: While intents can protect users from faulty dApps, the intent matching and settlement system itself becomes a new potential point of failure that needs to be incredibly robust and secure.

Projects like SUAVE (Single Unifying Auction for Value Expression) from Flashbots, and protocols like CowSwap, 1inch Fusion, and Across are pioneering these concepts, each tackling a different piece of the puzzle. The infrastructure is being built, brick by brick.

Conclusion: Stop Building Bridges, Start Defining Destinations

For years, the crypto space has been obsessed with building better, faster, and more secure bridges. We’ve been focused on the *how*. Intents force us to reconsider the entire problem. The user doesn’t care about the bridge; they care about the destination. They don’t want to be a cross-chain logistics manager; they just want their assets to be where they need them to be.

Intent-based architecture is the most promising path toward delivering this user-centric vision. It abstracts away the maddening complexity of a multi-chain world, enhances security, and creates a more efficient market for transaction execution. It transforms the user’s role from a stressed-out pilot navigating a storm to a passenger who simply states their destination and enjoys the ride. The revolution in cross-chain interactions won’t be a new bridge; it will be the moment we stop thinking about bridges altogether.

FAQ

Are intents the same as limit orders?

They are related but not the same. A limit order is a simple form of an intent (“I want to sell X for Y at this price or better”). However, intents can be far more expressive and complex. An intent can span multiple chains, involve several actions (e.g., stake, swap, bridge), and have dynamic conditions that a simple limit order cannot accommodate. Think of limit orders as a subset of what’s possible with a full intent-based system.

Is this just for DeFi experts and ‘whales’?

Absolutely not! While sophisticated traders will certainly leverage intents for complex strategies, the biggest beneficiaries will be everyday users. The entire point is to hide the complexity that currently makes crypto intimidating. By simplifying actions down to a single, signed outcome, intents will make web3 dramatically more accessible and safer for beginners who don’t know the difference between a bridge and a DEX.

If I don’t set the transaction path, can’t a solver just give me a bad deal?

This is where the competitive auction mechanism is critical. When you submit an intent, you also specify your minimum acceptable outcome (e.g., “I want at least 99.5 USDC”). Multiple solvers then compete to give you the best outcome above that minimum. The solver who can find the most efficient path and is willing to take the smallest profit margin will win the right to execute your intent. This competition ensures you get a fair, if not the best possible, price.