We’ve all heard the stories from the California Gold Rush. While a few lucky miners struck it rich, the real, lasting fortunes were made by the folks selling the picks, shovels, and blue jeans. They weren’t betting on a single gold claim; they were betting on the entire rush. This same timeless strategy is playing out right now in one of the most exciting corners of crypto: DePIN. For savvy investors, understanding the Picks and Shovels DePIN playbook isn’t just an interesting thought experiment; it’s a potentially powerful way to gain exposure to this explosive sector without trying to pick the single ‘next big thing’.

DePIN, or Decentralized Physical Infrastructure Networks, is a mouthful. But the idea is simple: using crypto tokens to incentivize people and companies all over the world to build and maintain real-world infrastructure. Think decentralized Wi-Fi networks, global sensor grids, or even community-owned energy systems. The potential is massive. But with hundreds of projects popping up, each claiming to be the future of *something*, how do you separate the signal from the noise? You look for the toolmakers. You look for the companies building the foundational layers that *all* these projects will need to succeed.

Key Takeaways

- The “Picks and Shovels” strategy focuses on investing in the foundational infrastructure and services that support an entire ecosystem, rather than specific application-layer projects.

- In DePIN, these ‘tools’ include hardware manufacturers, middleware developers, data analytics platforms, and decentralized cloud providers.

- This approach can offer a more diversified and potentially less volatile way to gain exposure to the growth of DePIN.

- Identifying these infrastructure plays requires looking beyond the hype and analyzing what projects truly need to function and scale.

So, What Exactly is DePIN Anyway?

Before we dive into the investment thesis, let’s get on the same page. DePIN is all about building physical infrastructure in a decentralized way. Traditionally, if you wanted to build a massive network—say, a 5G network—you’d need a giant corporation like Verizon or AT&T to spend billions on towers, permits, and equipment. It’s a closed, centralized system.

DePIN flips that model on its head. A project like Helium, for instance, incentivizes individuals to buy and run small hotspots from their homes to create a decentralized wireless network. In return for providing coverage, these individuals earn crypto tokens. It’s a flywheel: more users provide more coverage, which attracts more people to use the network, which increases the value of the token rewards, which incentivizes more users to join. This same model is being applied to everything from GPU computing (Akash, Render) to mapping (Hivemapper) and energy grids.

The beauty is that it coordinates thousands of strangers to build something cohesive and powerful, often faster and cheaper than a single company ever could. It’s the gig economy meets blockchain, but for building the physical backbone of the new internet.

The Gold Rush Analogy: Why “Picks and Shovels” Wins

The parallel to the Gold Rush is almost perfect. In the 1850s, thousands of prospectors rushed to California, each hoping to find a massive gold nugget. Some did. Many, many more went home with empty pockets. The real winners? People like Levi Strauss, who sold durable pants to miners, or Samuel Brannan, who cornered the market on picks, pans, and shovels. They didn’t care which individual miner succeeded. As long as people were digging for gold, they were making money.

In the DePIN world, the individual projects (the Helium’s, the Hivemapper’s) are the miners. They are all digging for their ‘gold’—market adoption and network dominance. Some will become wildly successful. Others will inevitably fail or be outcompeted. It’s a high-risk, high-reward game to bet on a single ‘miner’.

The Picks and Shovels DePIN strategy, however, is about investing in the Levi Strauss and Samuel Brannan of this new digital rush. It’s about identifying the foundational technologies and services that *every* DePIN project needs, regardless of whether they’re focused on wireless, storage, or energy. Their success is tied to the growth of the *entire* DePIN sector, not the fate of a single, specific project. It’s a bet on the trend, not the individual player.

Identifying the Picks and Shovels of the DePIN Ecosystem

Okay, the analogy makes sense. But what do these ‘tools’ actually look like in the digital world of DePIN? It’s not as simple as a physical shovel. They are often more abstract but just as critical. Let’s break down the key categories.

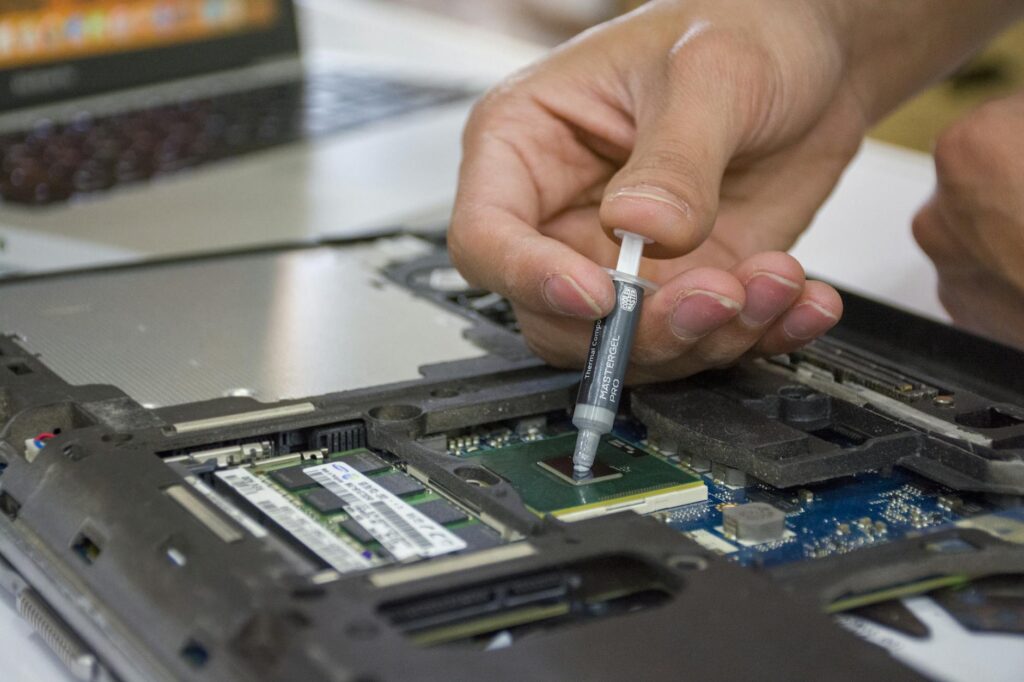

Hardware Manufacturing and Distribution

This is the most direct parallel to the original picks and shovels. Many DePIN networks require specialized hardware. Helium has its hotspots. Hivemapper has its dashcams. DIMO has its vehicle data miners. The companies that design, manufacture, and distribute this hardware are a critical part of the ecosystem. They are enabling the physical build-out of these networks. Investing in these companies, or the tokens associated with them if they have one, can be a pure-play on the physical growth of DePIN. Their business model is straightforward: the more a network grows, the more hardware they sell. It’s a direct, tangible link to network expansion.

Middleware and Developer Tools

Think of middleware as the digital plumbing that connects different parts of the system. For a DePIN project to work, it needs a ton of complex software. It needs to manage device identity, handle data verification, process micropayments, and communicate with a blockchain. Building all of this from scratch is incredibly difficult and time-consuming. That’s where middleware providers come in. They create standardized toolkits, APIs (Application Programming Interfaces), and SDKs (Software Development Kits) that allow new DePIN projects to launch much faster. They provide the ‘plumbing’ so that project founders can focus on their specific use case. A project that becomes the go-to middleware layer for DePIN is like a company selling pre-fabricated parts for every gold-panning machine—absolutely essential.

Data Aggregation and Analytics Platforms

DePIN networks generate an insane amount of data. A network of a million sensors, cars, or hotspots is constantly producing location data, bandwidth stats, environmental readings, and more. This raw data is valuable, but it’s even more valuable when it’s cleaned, organized, and analyzed. ‘Picks and shovels’ players in this category build platforms that ingest this data from various DePIN networks and make it usable for developers, businesses, and even other protocols. They are the refineries turning crude oil (raw data) into gasoline (actionable insights). As DePIN networks become the backbone for real-world applications, the platforms that can make sense of all that data will be indispensable.

Decentralized Cloud and Storage Providers

Where does all that data go? Where do the applications that run on these networks live? Increasingly, the answer is on decentralized cloud and storage networks. Projects like Arweave (for permanent storage) and Akash (for decentralized computing) are fundamental infrastructure for the entire Web3 space, including DePIN. A DePIN project that needs to store petabytes of sensor data permanently might use Arweave. Another that needs to run complex computational tasks to manage its network might deploy its servers on Akash. These platforms are the digital land on which the DePIN ‘factories’ are built. They are a foundational layer, and their growth is directly tied to the data and computational needs of the entire ecosystem.

Network and Security Services

Finally, every network, decentralized or not, needs security. It needs reliable communication layers and protection from bad actors. Companies and protocols that provide these services are another crucial ‘shovel’. This could include oracle networks like Chainlink that bring real-world data securely onto the blockchain, or communication protocols that allow different DePIN networks to talk to each other. It could also involve specialized firms that audit the smart contracts and hardware of new DePIN projects to ensure they are secure. As billions of dollars of value get locked into these networks, robust security and interoperability will move from a ‘nice-to-have’ to an absolute necessity.

Real-World Examples: Who’s Building the Tools?

This all sounds great in theory, but who is actually doing this? Here are a few examples to make it more concrete (Note: This is not financial advice, just illustrations of the categories).

- Hardware: Companies like RAK Wireless or Bobcat have become well-known for producing the hotspots used in the Helium network. Their success was directly tied to the explosive growth of Helium’s coverage map.

- Decentralized Cloud (Compute): Akash Network is a prime example. It’s an open-source cloud where users can lease computing power from those who have it to spare. DePIN projects can run their network validators and backend services on Akash for a fraction of the cost of Amazon Web Services (AWS).

- Decentralized Cloud (Storage): Arweave and Filecoin are leaders here. They provide decentralized data storage solutions. A project like WeatherXM, a decentralized weather network, could use Arweave to permanently store every weather reading from its global fleet of stations.

- Middleware: Projects are emerging that aim to create a ‘DePIN-in-a-box’ solution, offering modular components for identity, tokenomics, and hardware management to help new networks launch faster. Keep an eye on this developing space.

“The most durable investment strategies are often the most boring. Betting on infrastructure isn’t about chasing 100x moonshots; it’s about systematically capturing value from the growth of an entire industry.”

The Risk vs. Reward Calculation

Now, let’s be realistic. The ‘picks and shovels’ approach isn’t a magic, risk-free ticket to riches. It’s a strategy, and like any strategy, it has its own set of risks. The primary risk is ecosystem failure. If the entire concept of DePIN fails to gain mainstream adoption, then it doesn’t matter how good your shovels are—if no one is digging for gold, no one is buying shovels. Your investment is tied to the success of the macro trend.

Another risk is competition and commoditization. The middleware protocol that looks dominant today could be replaced by a better, cheaper one tomorrow. Hardware manufacturing can become a race to the bottom on price. You still need to pick the *right* shovel sellers, the ones with a sustainable competitive advantage, strong network effects, or superior technology.

However, the potential reward is significant. By investing in a foundational piece of infrastructure, you get exposure to the upside of *every single project* that uses it. If your chosen decentralized storage solution becomes the standard for 100 different DePIN networks, you win as all of them grow. It’s a much more diversified bet than trying to pick the one winning DePIN network out of a hundred.

How to Start Your Research on Picks and Shovels DePIN Plays

If this strategy resonates with you, where do you begin? It requires a shift in mindset from evaluating individual applications to evaluating foundational tech.

- Follow the Developers: Where are DePIN projects being built? What tools are they *actually* using and talking about in their documentation and Discord servers? Look for the platforms and protocols that are gaining traction with the builders themselves.

- Analyze the Value Chain: For any DePIN project you find interesting, map out its dependencies. What hardware does it need? Where does it store its data? How does it process its computations? What oracles does it use? Answering these questions will lead you directly to the underlying picks and shovels.

- Look for Network Effects: The best infrastructure plays become stronger as more people use them. Does a platform become cheaper, faster, or more secure as it scales? This is a key indicator of a long-term, sustainable advantage. A storage network with more nodes is more resilient. A compute network with more providers is cheaper.

- Read the Docs: Don’t just read marketing materials. Dive into the technical documentation. You don’t need to be a coder, but you should aim to understand the architecture. Is this a truly critical piece of the puzzle, or just a minor feature? The answer is always in the whitepaper and docs.

Conclusion

The DePIN ecosystem represents a fundamental paradigm shift in how we build and manage real-world infrastructure. It’s an exciting, chaotic, and opportunity-rich environment that feels very much like a modern-day gold rush. While the allure of finding that one massive gold nugget—the one DePIN project that changes everything—is strong, history teaches us that a more prudent and often more profitable strategy is to bet on the toolmakers. By focusing on the hardware, software, data, and cloud infrastructure that underpins the entire sector, you can position yourself to benefit from the growth of the entire movement. It requires diligence, a different kind of analysis, and a long-term perspective, but investing in the picks and shovels of DePIN might just be the smartest way to stake your claim in this digital frontier.

FAQ

Is investing in DePIN infrastructure less risky than investing in DePIN application projects?

It can be, but it’s not risk-free. It’s a form of diversification. Instead of betting on one ‘miner’ (application), you’re betting on the entire ‘gold rush’ (the DePIN sector). Your risk is spread across all the projects that use the infrastructure you’ve invested in. However, the primary risk shifts to the failure of the entire DePIN ecosystem to gain adoption.

What are some red flags to watch for when evaluating a ‘picks and shovels’ DePIN project?

Look out for a lack of adoption by actual developers and projects. If no one is using the ‘shovel’, it’s worthless. Another red flag is a lack of a clear value proposition or business model—how does the protocol or company capture value from its users? Finally, beware of overly centralized infrastructure plays masquerading as decentralized ones. Check who runs the core nodes or controls the protocol’s governance.

Do all ‘picks and shovels’ projects have a token?

Not necessarily. Some infrastructure plays might be traditional equity-based companies that manufacture hardware or provide software services. However, in the crypto-native world, most foundational protocols (like decentralized storage or compute networks) use their own token for security, governance, and as a payment mechanism within their ecosystem. The token is often integral to the functioning of the network itself.