Remember when ‘investing’ in crypto just meant buying a coin and hoping for the best? Those days feel almost quaint now. The crypto landscape has morphed into a bustling, interactive ecosystem where your assets can do more than just sit in a wallet. They can work for you, securing networks and generating yield. This evolution began with staking, a fundamental concept in Proof-of-Stake blockchains. But innovation never sleeps. We quickly moved to liquid staking to solve a key problem, and now, the conversation is dominated by a powerful, albeit much more complex, new layer: restaking. The complex interplay between staking and restaking, with liquid staking as the crucial bridge, is reshaping how we think about crypto-economic security and capital efficiency. It’s not just a trend; it’s a paradigm shift.

But let’s be real. These terms get thrown around a lot, often without clear explanations. What’s the actual difference? Where does the risk lie? And is the potential reward worth it? We’re going to break it all down, piece by piece, so you can understand this critical evolution in the decentralized world.

Key Takeaways

- Staking: The foundational act of locking up crypto to help secure a Proof-of-Stake network in exchange for rewards. Your capital is illiquid.

- Liquid Staking: A solution to staking’s illiquidity. You stake your assets through a protocol and receive a liquid staking token (LST) in return, which represents your staked position and can be used elsewhere in DeFi.

- Restaking: The next layer. It allows you to use your staked assets (either directly or via an LST) to provide security for multiple protocols simultaneously, earning additional rewards but also compounding your risk.

- Risk vs. Reward: Each step up—from staking to liquid staking to restaking—introduces greater complexity, higher potential yield, and significantly increased risk, particularly ‘slashing’ risk.

What is Staking? The Bedrock of Proof-of-Stake (PoS)

Before we can run, we have to walk. And in the world of crypto yield, staking is walking. It’s the foundational concept that powers blockchains like Ethereum, Solana, and Cardano. Think of it as the decentralized version of earning interest in a savings account. But instead of just parking your money, you’re playing an active role in the bank’s security.

How Staking Actually Works

In a Proof-of-Stake (PoS) system, there are no miners solving complex puzzles like in Bitcoin’s Proof-of-Work. Instead, network security is maintained by validators. These validators are responsible for processing transactions and creating new blocks. To become a validator, you must ‘stake’—that is, lock up—a specific amount of the network’s native cryptocurrency. For Ethereum, this is a hefty 32 ETH.

This stake acts as a security deposit, or collateral. If you, as a validator, act honestly and do your job correctly, you’re rewarded with more of the cryptocurrency (the staking rewards). But if you act maliciously or are simply negligent (e.g., your validator node goes offline), the network can penalize you through a process called slashing. Slashing means a portion of your staked crypto is forfeit and destroyed. It’s a powerful economic incentive to play by the rules.

Of course, not everyone has 32 ETH or the technical know-how to run a validator node 24/7. That’s why staking pools and centralized exchange staking services became popular. They allow you to pool your smaller amount of crypto with others, and they handle the technical side for a fee.

The Pros and Cons of Traditional Staking

The beauty of staking is its relative simplicity and its direct contribution to network health.

- Pros: Earn a relatively predictable yield, directly support the decentralization and security of a network you believe in.

- Cons: The biggest drawback is illiquidity. Your funds are locked up. You can’t sell them, you can’t trade them, and you can’t use them as collateral in DeFi protocols. In some cases, there are long ‘unbonding’ periods before you can get your funds back, during which you’re exposed to market volatility without being able to react.

This illiquidity problem was a major hurdle for many investors and a huge drag on capital efficiency. And it’s precisely this problem that led to the next major innovation.

Enter Liquid Staking: Unlocking Capital Liquidity

What if you could have your cake and eat it too? What if you could stake your ETH, earn rewards, secure the network, and still have a liquid asset you could use across the DeFi ecosystem? That’s the revolutionary promise of liquid staking.

Protocols like Lido, Rocket Pool, and Frax Ether emerged as game-changers. The process is brilliantly simple for the user:

- You deposit your ETH (or other PoS asset) into a liquid staking protocol.

- The protocol stakes it for you, pooling it with other users’ funds.

- In return, you immediately receive a receipt token, known as a Liquid Staking Token (LST). For example, if you stake ETH with Lido, you get stETH. With Rocket Pool, you get rETH.

The Magic of Liquid Staking Tokens (LSTs)

This LST is where the magic happens. It’s a derivative token that represents your claim on the underlying staked ETH plus any rewards it accrues. The value of stETH, for instance, should track the value of ETH. But unlike your original staked ETH, stETH is a fully liquid, standard ERC-20 token.

You can do anything with it:

- Trade it: Sell your stETH on a decentralized exchange like Uniswap if you need liquidity, effectively ‘unstaking’ instantly without waiting for an unbonding period.

- Lend it: Deposit your stETH on a lending platform like Aave to earn additional yield.

- Use it as collateral: Borrow other assets against your stETH to leverage your position.

Suddenly, the opportunity cost of staking vanished. You were no longer choosing between securing the network and participating in DeFi. You could do both. This dramatically improved capital efficiency across the entire ecosystem and led to an explosion in the popularity of LSTs, which are now some of the largest assets in DeFi.

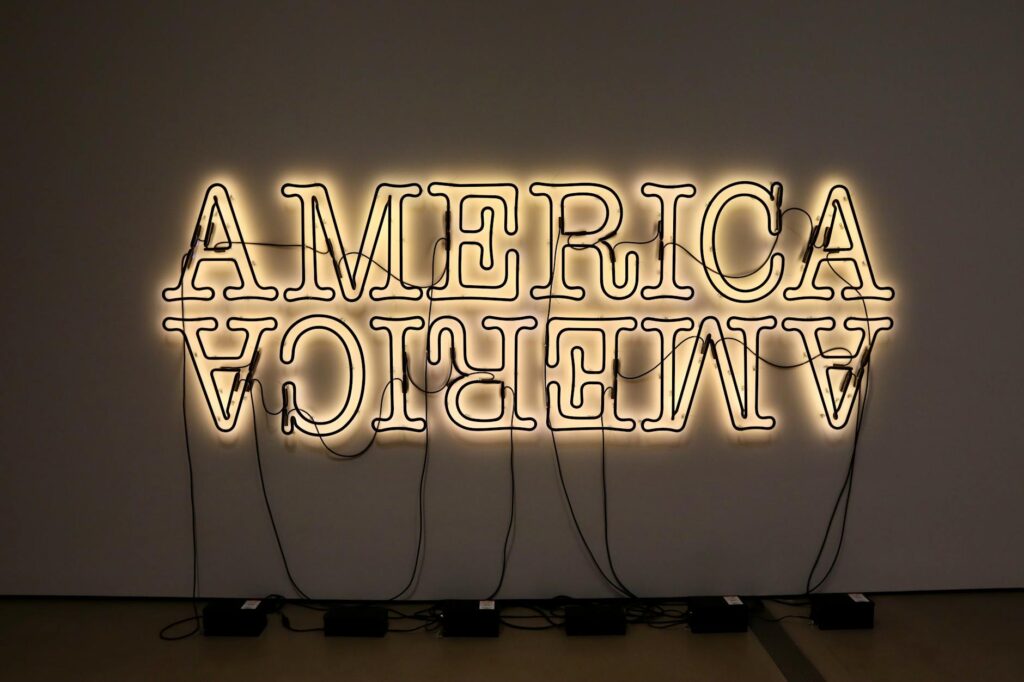

The New Frontier: A Deeper Look at Staking and Restaking

Just when we thought we had reached peak capital efficiency, a new, mind-bending concept arrived: restaking. Pioneered almost single-handedly by a protocol called EigenLayer, restaking takes the security deposit you’ve made for one network (like Ethereum) and lets you reuse it to secure other things.

Think about it. Ethereum has a massive amount of staked ETH, creating an enormous pool of crypto-economic security. It’s incredibly expensive to attack. But new protocols, sidechains, or services (called Actively Validated Services or AVSs in the EigenLayer world) don’t have that luxury. Bootstrapping their own set of validators and their own security budget is a monumental task.

Restaking offers a shortcut. It creates a marketplace where these new projects can essentially ‘rent’ security from the existing pool of Ethereum stakers.

How Restaking Works with EigenLayer

You, as a staker, can ‘opt-in’ to provide security for these additional AVSs. You can do this in two ways:

- Native Restaking: If you’re a solo validator running your own node, you can point your withdrawal credentials to EigenLayer’s smart contracts.

- Liquid Restaking: This is the more common method. You take the LST you got from liquid staking (like stETH) and deposit that into EigenLayer.

By doing this, you’re agreeing to a new set of slashing conditions. You’re telling the system, “In addition to my duties as an Ethereum validator, I also agree to validate for this oracle, this data availability layer, and this bridge. If I misbehave on any of these services, you have my permission to slash my original staked ETH.”

The Double-Edged Sword: Amplified Rewards vs. Compounded Risk

Why would anyone take on this extra risk? For extra rewards, of course.

The AVSs you help secure will pay you for your services, often in their own native tokens. So, you’re earning your base Ethereum staking yield, and then you’re stacking additional yields from every AVS you support on top of that. This is often called ‘yield stacking’, and the potential returns can be significantly higher than simple staking or liquid staking.

But this is absolutely not a free lunch. The risk is very, very real. The core concept of restaking is the compounding of slashing risk.

If a bug in one of the AVS’s software causes your validator to act improperly, or if the AVS has poorly designed slashing rules, your foundational 32 ETH could be slashed. The risk is no longer confined to the well-tested, battle-hardened rules of the Ethereum protocol. It’s now spread across multiple, often newer and less-audited protocols. A failure in the weakest link can jeopardize your entire principal.

A Head-to-Head Comparison: Staking vs. Liquid Staking vs. Restaking

Let’s break it down into a simple comparison to see how they stack up against each other.

1. Traditional Staking

- Liquidity: Very Low. Your assets are locked and often subject to unbonding periods.

- Reward Potential: Base. You earn the network’s standard staking APR.

- Risk Profile: Low to Moderate. Primarily consists of protocol-level slashing risk (e.g., for Ethereum validator downtime) and market price risk.

- Complexity: Low to Moderate. Can be as simple as clicking a button on an exchange or as complex as running a solo validator node.

2. Liquid Staking

- Liquidity: High. You receive a liquid LST that can be traded or used in DeFi immediately.

- Reward Potential: Base + DeFi Yield. You earn the staking APR, plus any additional yield you generate by using your LST in other protocols.

- Risk Profile: Moderate. You have the risks of traditional staking, PLUS smart contract risk from the liquid staking protocol itself, and potential de-pegging risk of the LST from its underlying asset.

- Complexity: Low. The user experience is typically very straightforward.

3. Restaking

- Liquidity: Varies. Your deposited LSTs are locked in the restaking protocol. However, a new category of ‘Liquid Restaking Tokens’ (LRTs) is emerging to solve this, adding yet another layer of complexity and risk.

- Reward Potential: High (Stacked Yield). You earn the base staking APR + yield from multiple AVSs + potential airdrops from new protocols.

- Risk Profile: High to Very High. This is the crucial part. You take on all the risks of liquid staking, and then you compound slashing risk from multiple, potentially less secure protocols. A single point of failure in one AVS could wipe out your principal stake.

- Complexity: High. Understanding which AVSs to validate, the operator you’re delegating to, and the specific slashing conditions requires significant due diligence.

Conclusion

The journey from staking to liquid staking to restaking is a perfect microcosm of DeFi’s relentless innovation. We started with a simple, powerful idea: use your assets to secure a network and earn a reward. We identified its biggest flaw—illiquidity—and solved it with the elegant abstraction of liquid staking tokens. And now, with restaking, we are pushing the boundaries of capital efficiency by creating a marketplace for shared security.

But this progression isn’t just about chasing higher yields. It’s about a fundamental trade-off. With each layer of complexity and abstraction we add, we introduce new vectors of risk. Smart contract bugs, economic exploits, and compounded slashing conditions are all part of the equation. Restaking holds immense promise to bootstrap a new generation of decentralized services, but it also carries the potential for cascading failures if not managed with extreme caution. As an investor, understanding the intricate dance between these three concepts is no longer optional—it’s essential for navigating the future of decentralized finance.

FAQ

What is the single biggest risk of restaking?

The single biggest risk is compounded slashing risk. Unlike traditional staking where your risk is confined to the rules of one blockchain (like Ethereum), restaking exposes your original stake to the slashing conditions of multiple, often newer and less-audited, protocols (AVSs). A bug or malicious rule in any one of these AVSs could lead to your base collateral being slashed.

Is restaking suitable for beginners in crypto?

Generally, no. Restaking is a highly complex and high-risk strategy. It requires a deep understanding of the underlying technologies, the specific AVSs you are securing, and the various risk factors involved, including smart contract risk and compounded slashing conditions. Beginners should focus on understanding traditional staking and liquid staking before even considering restaking.