The Psychology of Surviving and Thriving in Extended Bear Markets

Let’s be honest, nobody *likes* an extended bear market. It’s like that unwelcome houseguest who overstays their welcome, eating all your snacks and leaving dirty socks everywhere. Except instead of snacks, they’re munching on your portfolio returns, and the dirty socks? Well, let’s just say they represent the lingering feeling of anxiety. Surviving an extended bear market isn’t just about financial strategy; it’s a psychological battle. It tests your patience, resilience, and your belief in the very foundations of your investment philosophy. But here’s the silver lining: within these challenging times lies an incredible opportunity not just to survive, but to thrive.

Understanding the Emotional Rollercoaster

First, recognize that you’re not alone. The market’s downturn triggers a cascade of emotions. Fear, doubt, panic—these are all normal reactions. I remember the 2008 crash vividly. I was a relatively new investor, and watching my hard-earned savings seemingly evaporate overnight was terrifying. I considered pulling out entirely. I’m glad I didn’t. This experience, however painful at the time, taught me a valuable lesson: understanding and managing your emotions is just as critical as understanding financial statements.

Taming the Fear and Greed Cycle

The market is driven by two powerful forces: fear and greed. In bull markets, greed reigns supreme, pushing prices to unsustainable heights. Then, inevitably, fear takes over, driving prices down in a painful correction. During an extended bear market, fear becomes the dominant force. This can lead to impulsive decisions, like panic selling at the bottom. This is precisely when you need to be the most rational. Easier said than done, right? Absolutely. That’s why developing a disciplined approach, rooted in sound investment principles, is crucial. It acts as an anchor in stormy seas.

The Power of Perspective

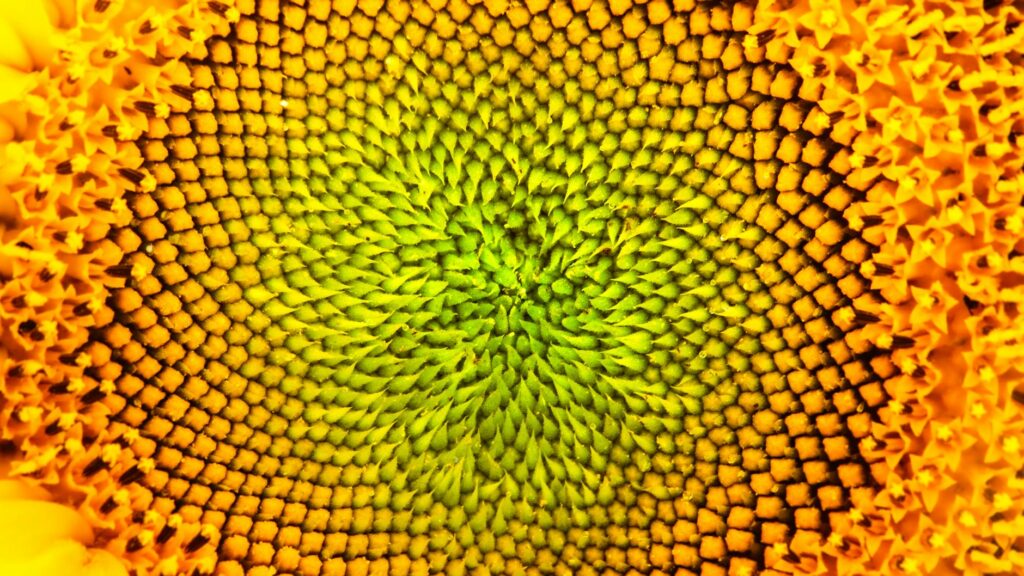

Think of market downturns like winter. They’re a natural part of the cycle. Winter, while harsh, prepares the ground for spring’s renewal. Similarly, bear markets clear out excesses and create opportunities for future growth. They allow you to buy assets at discounted prices, essentially planting the seeds for future gains.

Developing a Survival Mindset

Surviving an extended bear market demands a shift in mindset. It’s less about chasing quick returns and more about preserving capital and positioning yourself for the eventual recovery.

Focus on Long-Term Goals

Remind yourself of your long-term investment goals. Are you saving for retirement? A down payment on a house? These goals remain constant, regardless of short-term market fluctuations. Keeping your eye on the prize helps you stay focused and avoid impulsive decisions driven by short-term market noise.

Diversify Your Portfolio

Don’t put all your eggs in one basket. Diversification across different asset classes – stocks, bonds, real estate, precious metals – can help mitigate risk. During an extended bear market, some asset classes may hold up better than others. Diversification helps buffer your portfolio against severe losses in any single sector.

Rebalance Regularly

Rebalancing your portfolio involves periodically adjusting your asset allocation to maintain your desired risk profile. During a bear market, some assets may decline more than others, throwing your portfolio out of balance. Rebalancing forces you to sell assets that have performed relatively well and buy assets that have declined, essentially buying low and selling high. This disciplined approach can enhance returns over the long term.

Thriving in the Downturn: Strategies for Success

Surviving is good, but thriving is even better. Here’s how to turn a challenging market into an opportunity for growth:

Value Investing: Finding Diamonds in the Rough

Extended bear markets often present opportunities to buy high-quality assets at discounted prices. This is where value investing comes into play. Look for fundamentally strong companies with solid financials that have been unfairly punished by the market downturn.

“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett

Dollar-Cost Averaging: Smoothing Out the Ride

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy helps you buy more shares when prices are low and fewer shares when prices are high, effectively smoothing out the average cost per share over time. It’s a powerful tool for mitigating risk and taking advantage of market volatility.

Learn and Grow: Investing in Yourself

Use the downtime during a bear market to enhance your investment knowledge. Read books, attend webinars, and study market history. The more you learn, the better equipped you’ll be to make informed investment decisions, both during and after the downturn.

Seek Professional Advice

Don’t hesitate to consult with a qualified financial advisor. They can provide personalized guidance based on your individual circumstances and help you navigate the complexities of the market.

Beyond the Numbers: Cultivating Resilience

Finally, remember that investing is as much about psychology as it is about numbers. Cultivating resilience is crucial for long-term success. This means staying disciplined, focusing on your long-term goals, and learning from your mistakes. Remember, even the most experienced investors face setbacks. The key is to learn from those experiences, adapt, and keep moving forward. Extended bear markets are undeniably challenging. But they also offer unique opportunities for growth, both financially and personally. By understanding the psychology of market downturns and developing a resilient mindset, you can not only survive but thrive, emerging stronger and more prepared for future market cycles. So, buckle up, stay focused, and remember, spring always follows winter.