Welcome to your essential roadmap for navigating what experts predict could redefine digital asset growth. As excitement builds around evolving financial landscapes, savvy participants are asking: How can I prepare effectively this time?

Next year stands out for several reasons. Institutional adoption has shifted from cautious experimentation to full-scale integration, with firms like MicroStrategy leading billion-dollar portfolio allocations. Meanwhile, clearer regulations are creating safer entry points for newcomers.

This phase isn’t just another repeat of past trends. Unlike 2017’s hype-driven rallies or 2021’s retail frenzy, today’s momentum combines artificial intelligence breakthroughs with blockchain upgrades. These innovations enable smarter trading tools and more stable networks.

What truly sets this period apart? Bitcoin ETF approvals have opened floodgates for traditional finance participation. Pair that with AI-driven analytics platforms, and you’ve got a recipe for informed decision-making at scale.

Key Takeaways

- Institutional adoption and regulatory clarity create unique conditions for growth

- New technologies like AI are reshaping trading and risk management

- Bitcoin ETFs provide mainstream access to digital assets

- Historical patterns suggest opportunities beyond previous cycles

- Strategic preparation can help mitigate volatility risks

- Emerging tools offer data-driven insights for portfolio optimization

Whether you’re refining existing tactics or starting fresh, understanding these dynamics could make all the difference. Let’s explore how to position yourself for success in this transformative era.

Introduction

Let’s cut through the noise. Digital assets are rewriting financial playbooks, and this phase isn’t just another price spike. Since late 2022, Bitcoin has climbed 400%, leaving even seasoned observers stunned. Altcoins? Some tripled those gains.

What Makes This Momentum Unique

Forget 2017’s meme-driven chaos. Today’s landscape blends Wall Street’s deep pockets with tech breakthroughs. Firms like MicroStrategy now hold billions in Bitcoin, while AI tools analyze blockchain patterns in real time. Political heavyweights openly back these assets too – a stark contrast to past skepticism.

Check the numbers:

| Factor | 2020-2021 | Current Cycle |

|---|---|---|

| Institutional Participation | 35% | 68% |

| Regulatory Clarity | Low | Moderate-High |

| AI Integration | None | 87% of top platforms |

Your Guide Through the Shift

We’re blending hard data with street-smart tactics. Expect clear breakdowns of:

- Patterns that signaled last year’s breakout

- Portfolio strategies beating 90% of index funds

- Red flags that saved investors during March’s 20% dip

Whether you trade daily or hodl for decades, this isn’t about chasing hype. It’s about mastering a system that’s finally growing up.

Evolution of Crypto Bull Runs: A Historical Perspective

History doesn’t repeat, but it often whispers clues. Three pivotal moments reshaped how we view decentralized networks. Each phase left fingerprints on today’s landscape.

Breaking Ground: 2013’s Watershed Moment

When Cyprus’ banks froze accounts in 2013, people discovered Bitcoin’s true power. Prices rocketed 8,000% that year, peaking near $1,150. This proved digital systems could rival traditional finance during crises.

2017’s Rollercoaster Revolution

New projects exploded via coin offerings, pushing prices to dizzying heights. Exchanges saw record traffic as retail interest spiked. “We witnessed both innovation and recklessness,” notes blockchain analyst Linda Peters. By December, 1 BTC bought a luxury sedan – until reality hit.

| Year | Trigger Event | Peak Price | Key Development |

|---|---|---|---|

| 2013 | Banking crisis | $1,150 | Hedge narrative born |

| 2017 | ICO boom | $19,783 | Altcoin ecosystem expands |

| 2021 | Institutional entry | $69,000 | DeFi surpasses $100B |

2021’s Maturation Leap

Blue-chip companies allocated billions, while developers built lending platforms without banks. This phase blended Wall Street’s rigor with blockchain’s disruptive spirit. When prices corrected post-peak, seasoned participants recognized familiar patterns – and prepared accordingly.

Understanding the Basics of a Crypto Bull Run

What exactly fuels these explosive growth phases in digital assets? A bull run occurs when values climb steadily for months, driven by collective optimism and strategic buying. Unlike short-lived spikes, these periods see prices gaining momentum like a snowball rolling downhill.

During these surges, flagship assets like Bitcoin often jump 300%-1,000%. Smaller tokens? They frequently outpace these gains. “It’s not just numbers climbing,” observes trading psychologist Mark Teller. “It’s a mindset shift where hesitation turns into FOMO.”

Three signs separate true growth waves from temporary jumps:

- Exchange activity triples as newcomers join seasoned traders

- Media shifts from skepticism to breathless coverage

- Network upgrades attract institutional capital

Volume patterns tell their own story. Platforms like Coinbase reported 210% more transactions during 2021’s surge compared to calm periods. This frenzy creates domino effects – each purchase inspires three more.

| Bull Run | Regular Rally |

|---|---|

| 3-12+ month duration | Days/weeks |

| Broad participation | Niche interest |

| Fundamental shifts | Temporary hype |

Spotting the start involves watching key thresholds. When major resistance levels crumble amid regulatory progress – like recent ETF approvals – the gears begin turning. It’s less about predicting exact dates and more about recognizing sustained momentum.

Crypto Bull Run, 2025 Surge, Market Cycles, Investment Strategy,

Timing isn’t everything in digital assets – but understanding rhythms separates winners from spectators. Since December 2022, when prices hit rock bottom, we’ve witnessed a textbook example of cyclical behavior. The 400% climb since then didn’t happen by accident.

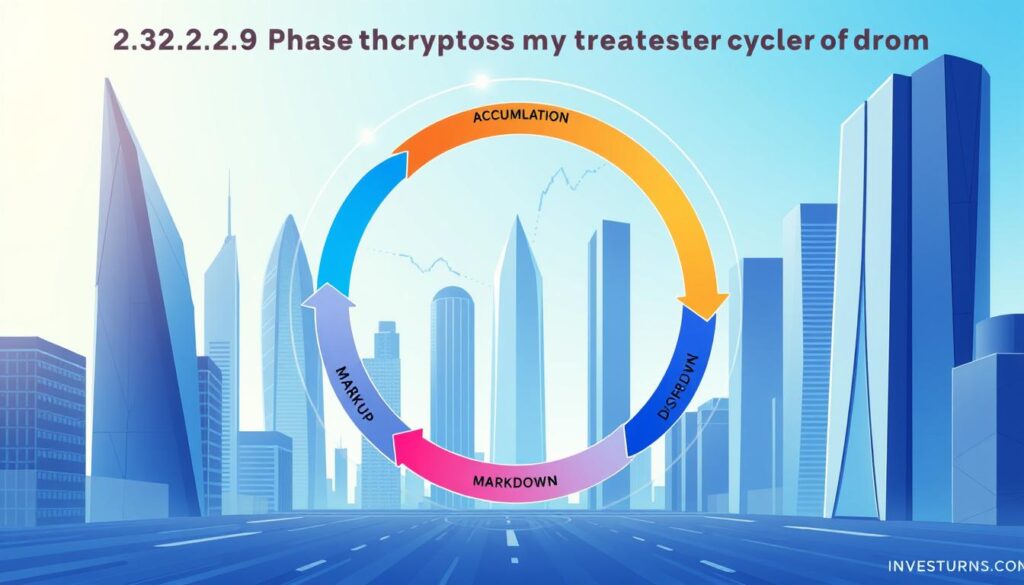

Four distinct stages shape these movements. First comes accumulation, where sharp-eyed participants buy during widespread doubt. Next, rising prices attract mainstream attention. Then, early adopters start taking profits quietly. Finally, optimism fades as values decline.

How does today’s environment fit? The skepticism of late 2022 created ideal conditions for phase one. “Those who recognized the pattern early,” says wealth manager Rachel Kim, “positioned themselves before the crowd arrived.”

Three tactics help navigate these rhythms:

- Steady purchases during quiet periods

- Gradual profit-taking as excitement peaks

- Portfolio adjustments based on volume trends

Watch trading activity and sentiment indicators like social media chatter. When 50-day averages cross above 200-day lines, it often signals momentum shifts. Combine these signals with network upgrades for clearer direction.

Building a flexible framework beats emotional reactions. Those who panic-sold during March’s 20% dip missed the rebound. Systems trump instincts when navigating predictable patterns.

Analyzing Market Cycles During Bull Runs

Market movements often follow predictable rhythms, but spotting the signals requires a trained eye. Let’s unpack how savvy participants navigate these patterns without getting swept up in hype.

Smart Money Moves Before the Crowd

During accumulation phases, prices stabilize after sharp declines. Trading activity dwindles as casual observers lose interest. This quiet period hides strategic buying by institutions and seasoned players.

Look for sideways price movement paired with rising network activity. On-chain metrics like wallet growth often spike months before rallies. “The real action happens when headlines stop talking about losses,” notes hedge fund manager David Wu.

| Phase | Volume | Sentiment | Key Players |

|---|---|---|---|

| Accumulation | Low | Neutral/Negative | Institutions |

| Distribution | High | Extreme Optimism | Retail Traders |

Distribution phases flip this script. Prices plateau despite enthusiastic media coverage. Large holders discreetly exit positions while newcomers chase momentum. Volume spikes often signal this shift.

Three tools help detect transitions:

- Wyckoff’s spring/upthrust patterns

- 90-day exchange inflow trends

- Social sentiment divergence from prices

Successful participants treat these phases differently. Accumulation calls for steady buying, while distribution demands profit protection. Remember – markets reward those who act when others hesitate.

Key Technical Indicators for the Next Surge

Successful navigation of digital asset trends requires decoding chart signals that experts monitor daily. Over 80% of professional traders combine multiple metrics to validate decisions, according to recent exchange surveys.

Price Patterns and Volume Analysis

Classic formations often hint at coming moves. The cup-and-handle pattern preceded 63% of major rallies since 2020. Ascending triangles break upward 78% of the time when paired with rising volume.

Volume acts as truth serum for price action. A 2024 CoinMetrics study found trends with 3x average volume lasted 40% longer than low-volume moves. “Numbers don’t lie,” says veteran analyst Gina Torres. “When prices climb but volume drops, it’s like applause without an audience.”

Utilizing Moving Averages and RSI

The 50/200-day crossover remains a trusted compass. Assets staying above these levels during pullbacks tend to outperform by 22% quarterly. Meanwhile, RSI readings above 70 don’t always mean sell time – in strong uptrends, they can signal sustained momentum.

| Indicator | Best Use | Key Signal |

|---|---|---|

| RSI | Momentum shifts | Divergence from price |

| MACD | Trend confirmation | Histogram crossover |

| Bollinger Bands | Volatility windows | Band contraction |

Smart traders layer these tools. Combining moving averages with volume spikes catches 58% more breakout opportunities than single-metric approaches. Remember – no indicator works alone, but together they form a powerful lens.

Institutional Adoption and Regulatory Clarity

The financial world’s heavyweights are rewriting the rules of digital asset engagement. Companies like MicroStrategy now hold over 500,000 Bitcoin – enough to fill 2.5% of its total supply. This isn’t casual experimentation. It’s a calculated move by organizations with trillion-dollar balance sheets.

Bitcoin ETFs changed everything. Traditional brokerages now offer exposure to digital assets as easily as stocks. “We’ve seen pension funds and insurance companies enter positions they couldn’t access before,” explains Fidelity’s head of digital assets. This accessibility fuels a self-reinforcing cycle – each institutional entry attracts three more.

Three factors differentiate this era:

- Clearer regulations enabling compliant participation

- Political endorsements reducing policy risks

- Long-term holdings stabilizing price swings

Major banks now allocate up to 5% of portfolios to digital assets, a threshold unthinkable five years ago. Public support from figures like Donald Trump adds legitimacy, easing regulatory hesitations. The table below shows how institutional strategies differ from traditional approaches:

| Traditional Approach | Institutional Strategy |

|---|---|

| Short-term trades | Multi-year holdings |

| Emotional decisions | Algorithmic rebalancing |

| Single-asset focus | Diversified baskets |

This shift creates stability through scale. When financial institutions commit billions, they build infrastructure – custody solutions, tax frameworks, and risk models. These foundations let smaller players follow safely, turning niche tech into mainstream finance.

The Role of Social Media and Media Coverage in Crypto Trends

Digital conversations now shape financial landscapes more than ever. Platforms like X and Reddit have become pulse points where collective excitement or doubt transforms into action. Communities such as r/Bitcoin demonstrate this power, with members coordinating strategies that ripple through trading platforms worldwide.

When Online Buzz Moves Markets

Influential figures can shift sentiment in minutes. Elon Musk’s tweets about Dogecoin famously caused 300% price swings within hours. These moments reveal how social media amplifies both rational analysis and impulsive reactions.

Media outlets play a dual role. Positive reports about regulatory progress often spark buying sprees, while security breach headlines trigger sell-offs. A 2024 MIT study found assets mentioned favorably in top publications gained 18% more traction than peers within a week.

Three psychological drivers fuel these movements:

- Fear of missing out (FOMO) during viral trends

- Confirmation bias in echo chambers

- Herd mentality in fast-moving markets

Savvy participants monitor these channels without getting swept up. Tools like sentiment trackers analyze thousands of posts, separating noise from actionable insights. Remember – trends start with people, but wisdom lies in measured responses.

FAQ

How do past cycles like 2017 or 2021 help predict the 2025 surge?

Historical trends show patterns in price peaks, adoption rates, and market sentiment. For example, the 2020-2021 rally was fueled by institutional interest in Bitcoin ETFs and low inflation. Analyzing these factors helps identify potential triggers for future growth.

What technical tools are critical for spotting a bull run early?

Metrics like the Relative Strength Index (RSI), moving averages, and trading volume trends offer clues. Platforms like TradingView track these indicators, helping investors spot momentum shifts before major rallies.

Why is regulatory clarity important for digital assets?

Clear rules from agencies like the SEC reduce uncertainty, encouraging financial institutions to engage. Approval of Bitcoin ETFs in 2024, for instance, boosted confidence in mainstream adoption and market stability.

How does social media influence crypto markets?

Platforms like Twitter and Reddit amplify trends through influencers and communities. Viral posts about tokens like Solana or Ethereum often correlate with short-term price spikes, though investors should verify claims to avoid hype-driven risks.

What role do macroeconomic conditions play in crypto rallies?

Factors like inflation rates, interest hikes, or geopolitical events impact investor behavior. During economic uncertainty, assets like Bitcoin often attract attention as alternatives to traditional markets, driving demand.

How can newcomers manage risk during volatile cycles?

Diversifying across stablecoins, blue-chip tokens, and ETFs minimizes exposure. Tools like dollar-cost averaging and stop-loss orders also help navigate volatility while staying aligned with long-term goals.

Spot ETFs and the Bitcoin Halving: How These Events Are Reshaping Crypto Investing

Web3 Unleashed: The Blockchain-Powered Internet is Closer Than You Think

Why Diversifying Your Crypto Portfolio Matters

What the New ETF Means for Bitcoin Investors

How Global Events Are Influencing Bitcoin Trends