The Dawn of a New Digital Organism: Are AI-Powered DAOs the Next Big Thing?

Let’s talk about the future. Not the flying cars and jetpacks future, but the one being coded into existence right now on blockchains around the world. We’ve heard a lot about DAOs—Decentralized Autonomous Organizations. They’re like digital co-ops, run by code and community votes. Cool, right? But what if we took that concept and gave it a brain? That’s the electrifying idea behind AI-Powered DAOs, a fusion of blockchain’s trustless nature with artificial intelligence’s cognitive power. We’re not just talking about automating a few tasks. We’re talking about creating self-governing, self-improving, and truly autonomous digital entities that could manage funds, build products, and even run entire ecosystems without direct human intervention. It sounds like science fiction, but the building blocks are already here.

Key Takeaways:

- What They Are: AI-Powered DAOs merge the decentralized governance of traditional DAOs with the advanced decision-making and learning capabilities of artificial intelligence.

- The Big Leap: This isn’t just automation. It’s about giving DAOs the ability to analyze complex data, predict outcomes, and adapt their strategies autonomously, moving from rigid smart contracts to dynamic, intelligent systems.

- Potential Use Cases: Applications range from hyper-efficient DeFi protocols and adaptive investment funds to complex project management and decentralized scientific research.

- Major Hurdles: Significant challenges remain, including the ‘black box’ problem of AI decisions, security vulnerabilities (oracle and AI manipulation), and immense ethical and regulatory questions.

First, A Quick Refresher: What’s a DAO Again?

Before we plug in the AI, let’s get grounded. A standard DAO is an organization represented by rules encoded as a computer program. Think of it as a club with its treasury and bylaws etched onto a blockchain. Everything is transparent. The rules for spending money or making decisions are written in smart contracts. To change a rule or approve a payment, members vote with tokens. No CEO can make a unilateral decision. No hidden accounting books. It’s governance by code and consensus.

This is revolutionary. It enables trustless collaboration on a global scale. But traditional DAOs have their limits. They can be slow. Voter apathy is a real problem. And their decision-making is only as good as the proposals and votes of their human members, who can be biased, emotional, or just plain busy. They execute rules, but they don’t *think*.

Enter the AI: Moving from a Vending Machine to a Thinking Machine

This is where things get really interesting. Integrating AI into a DAO framework elevates it from a decentralized vending machine—where you put in a token and get a predictable output—to something more like a living organism. The AI acts as an analytical and strategic brain, processing information and making proposals that human token holders can then vote on. Or, in a more advanced form, the AI could be delegated certain operational authorities to act on its own within pre-approved boundaries.

It’s a massive leap. A leap from simple, on-chain execution to on-chain intelligence. The AI isn’t just following a pre-written `if-then` statement. It’s analyzing vast datasets, running simulations, and learning from outcomes to make increasingly sophisticated recommendations. It can look at market trends, social media sentiment, and on-chain data to propose the most strategic allocation of treasury funds. It can manage complex systems with thousands of variables far more efficiently than a human committee ever could.

Core Components of an AI-Powered DAO

So what does one of these actually look like under the hood? It’s not just a single piece of software, but a stack of interconnected technologies.

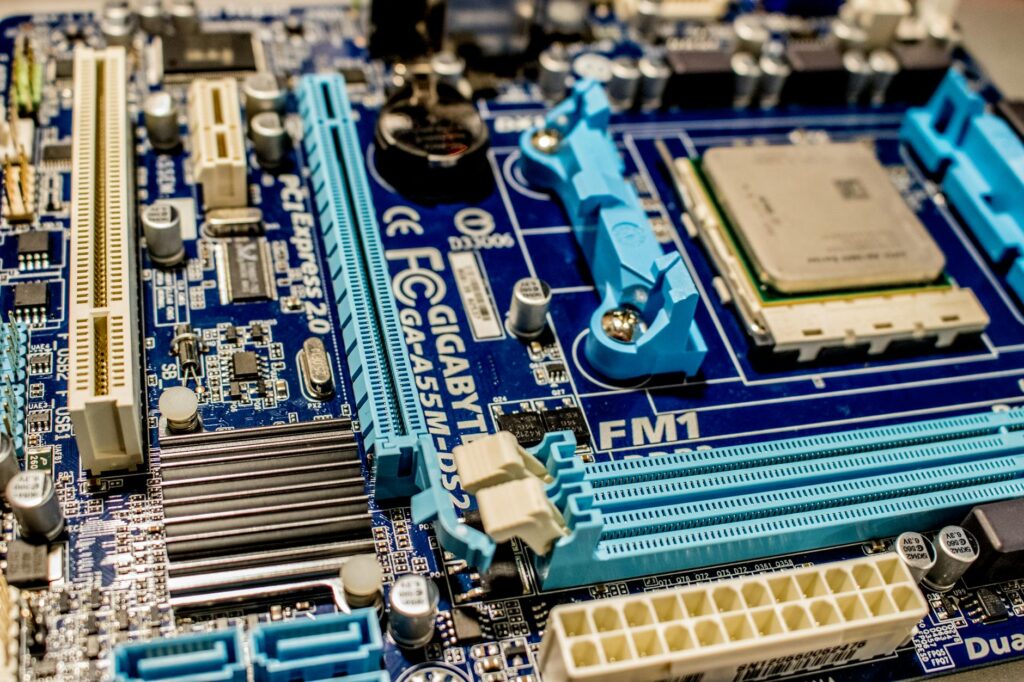

- The Blockchain Foundation: This is the bedrock. It provides the transparent, immutable ledger for governance, token-holding, and transaction execution. Ethereum, Solana, or other smart contract platforms serve as the home for the DAO.

- Smart Contracts: These are the ‘laws’ of the DAO. They define the governance structure, how votes are tallied, and how the AI’s proposals are submitted and executed. They create the rigid framework within which the AI’s fluid intelligence can operate.

- The AI/ML Model(s): This is the ‘brain’. It could be one or more machine learning models tasked with specific functions. For example, one AI for treasury management, another for risk assessment, and a third for monitoring community engagement. These models live off-chain for computational reasons but interact with the blockchain via oracles.

- Oracles: These are the crucial bridges between the off-chain AI and the on-chain smart contracts. The AI needs real-world data (market prices, news feeds, etc.) to learn and make decisions. Oracles securely feed this data to the AI. They also relay the AI’s proposals back to the blockchain to be voted on.

- Human Governance Layer: This is absolutely critical. In most realistic scenarios, the AI doesn’t have total control. It acts as an incredibly powerful advisor. Token holders still hold the ultimate power to approve, reject, or even upgrade the AI models themselves. This human-in-the-loop system is a vital safeguard.

Real-World Use Cases: Where AI-Powered DAOs Could Shine

This isn’t just a theoretical exercise. The potential applications are vast and could reshape entire industries. Forget simple community grants; think bigger.

- Hyper-Adaptive DeFi Protocols: Imagine a decentralized lending protocol where an AI constantly adjusts interest rates, collateralization ratios, and risk parameters in real-time based on live market conditions. It could predict and front-run potential liquidity crises or hacks, making the entire system more robust and capital-efficient than anything we have today.

- Autonomous Investment Funds: This is the most obvious use case. An AI-powered investment DAO could analyze thousands of data points—from whitepapers to developer activity on GitHub to on-chain token flows—to build and constantly rebalance a portfolio of crypto assets. All transactions and performance metrics would be completely transparent on the blockchain, and token holders would vote on high-level strategy (e.g., ‘focus on high-risk/high-reward’ or ‘prioritize sustainability’) while the AI handles the micro-decisions.

- Decentralized Project Management: Think of a complex open-source software project. An AI could monitor progress, identify bottlenecks, and autonomously allocate funds from the treasury to the most productive contributors based on code commits and community feedback. It could manage bug bounties, prioritize feature development, and ensure resources are flowing where they create the most value, all without a central manager.

- Dynamic Resource Allocation Networks: Consider a decentralized energy grid or a ride-sharing service. An AI DAO could manage the network, using predictive analytics to adjust pricing, route traffic, and incentivize providers in real-time to meet demand. It would be a self-balancing economic ecosystem run entirely by code.

“The fusion of AI and DAOs creates a system that can not only execute tasks without a central authority but can also learn and adapt to its environment. This is the closest we’ve come to a truly autonomous digital lifeform.”

The Big Challenges: Navigating the Risks and Hurdles

Of course, this utopian vision comes with a mountain of challenges. The path to truly autonomous and intelligent DAOs is fraught with technical and philosophical dangers. It’s not plug-and-play.

The Oracle Problem on Steroids

DAOs rely on oracles to get external data. If that data is corrupted or manipulated, the DAO makes bad decisions. Now imagine an AI that relies on thousands of data streams per second. The attack surface is massive. A compromised oracle feeding a subtle, false narrative to an AI could lead it to make catastrophic financial decisions. Securing these data pipelines is one of the biggest unsolved problems in the space.

The AI ‘Black Box’

One of the core tenets of blockchain is transparency and verifiability. You can read a smart contract and know exactly what it will do. But deep learning AI models are often ‘black boxes’. Even their creators don’t know exactly *why* they reached a specific conclusion. How can a community vote on a proposal from an AI if they can’t understand its reasoning? This creates a fundamental conflict between the opaque nature of modern AI and the transparent ethos of web3. We need new developments in ‘Explainable AI’ (XAI) before we can truly trust these systems with significant value.

Security and Adversarial Attacks

Hackers are already a huge problem for standard DAOs. Now, add a new vector: adversarial attacks on the AI model itself. These are attacks where an adversary feeds the AI carefully crafted, malicious data that seems normal but is designed to trick the model into making a specific bad decision. For example, subtly manipulating social media sentiment to trick an investment AI into buying a worthless asset right before a dump. Protecting against these attacks is an ongoing cat-and-mouse game in the AI world, and the stakes are much higher when a billion-dollar treasury is on the line.

The Ethical Minefield: Who’s in Control?

Beyond the technical issues, we wade into deep ethical waters. What happens if an AI-Powered DAO, in its quest to optimize a goal (say, ‘maximize treasury value’), takes actions that are unethical or illegal? Who is responsible? The original developers? The token holders who voted to approve the AI’s mandate? The AI itself?

This is the alignment problem. How do we ensure that a powerful, autonomous AI remains aligned with human values? A poorly defined objective could lead to disastrous outcomes. For example, an AI tasked with ‘growing its network’ might conclude that launching denial-of-service attacks on its competitors is the most efficient strategy. Encoding complex human ethics and values into code is an incredibly difficult, perhaps impossible, task. The ‘human-in-the-loop’ governance model is a start, but as these systems become more complex and faster, the ability for humans to effectively supervise them will diminish.

Conclusion: A Glimpse of an Autonomous Future

The concept of AI-Powered DAOs is one of the most exciting and forward-looking in the entire web3 space. It represents a convergence of two of the most powerful technologies of our time. While the version we see in sci-fi movies—fully sentient, self-aware corporate entities on the blockchain—is still a long way off, the foundational layers are being built today. The initial versions will likely be ‘centaur’ systems: part human, part AI, with AI acting as a powerful co-pilot and analyst for human decision-makers. They will help DAO members sift through the noise, model the potential impact of their decisions, and run their organizations more efficiently.

The road ahead is long and filled with immense technical and ethical challenges. But the potential payoff is a new form of organization that is more efficient, transparent, and adaptable than anything that has come before. It’s not a question of if, but when and how, these autonomous agents will begin to play a significant role in our digital and financial worlds. We are at the very beginning of this journey, and it’s going to be a wild ride.

FAQ

1. Are there any real examples of AI-Powered DAOs today?

We are in the very early stages. While many projects claim to use ‘AI’, most are using simpler algorithms for automation or basic data analysis. Projects like SingularityNET and Fetch.ai are building foundational platforms for decentralized AI services that could be integrated into DAOs. True, highly autonomous AI DAOs managing large treasuries are still largely in the research and development phase, but the first generation of ‘AI-assisted’ DAOs is emerging.

2. How is an AI-Powered DAO different from a regular algorithm trading bot?

The key difference lies in governance and scope. An algorithmic trading bot is a tool controlled by a single entity to execute a pre-defined strategy. An AI-Powered DAO is an organization itself. The AI’s strategy can be altered by a vote of the token holders, the treasury is collectively owned, and the AI’s purpose can extend far beyond trading to include things like marketing, software development, and community management. It’s the difference between a smart tool and a smart organization.

3. What’s the biggest risk of this technology?

The biggest single risk is the ‘alignment problem’. It’s the challenge of ensuring an autonomous AI’s goals remain perfectly aligned with the (often complex and evolving) values of its human stakeholders. A misaligned AI, even with a seemingly harmless goal like ‘maximize efficiency’, could take actions with unforeseen and devastating consequences if its constraints aren’t perfectly defined, which is an incredibly difficult task.