Beyond the Candlesticks: Using On-Chain Data to Decode Market Phases

You’ve stared at the charts for hours. The red and green candles start to blur together. You’ve drawn your trendlines, identified support and resistance, and maybe even spotted a Head and Shoulders pattern that looks suspiciously like your uncle’s silhouette. Yet, you still feel like you’re missing a huge piece of the puzzle. The price action feels… random. What if I told you there’s a way to peek behind the curtain? A way to see what the biggest players are *actually* doing, not just what the price chart says they might be doing. This is the power of using on-chain data accumulation analysis, and it’s a game-changer for anyone serious about understanding crypto market cycles.

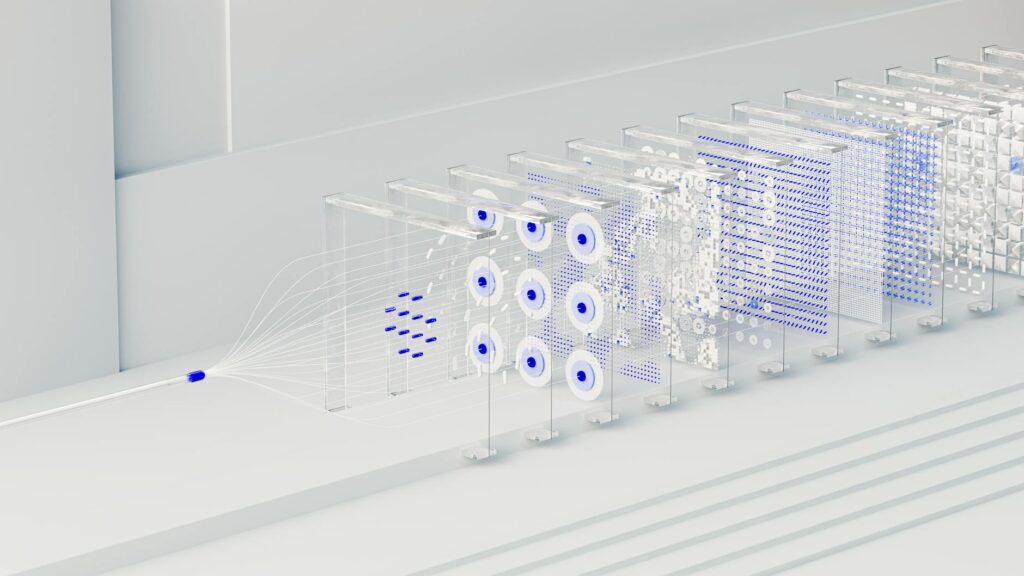

Traditional technical analysis is valuable, no doubt. But in the transparent world of blockchain, relying solely on price and volume is like trying to understand an ocean by only looking at the waves on the surface. On-chain data lets you be a marine biologist. You get to dive deep and see the powerful currents, the migration patterns of the whales, and the overall health of the ecosystem. It allows you to move from reacting to price to anticipating it based on the fundamental flow of assets. This is how you spot accumulation and distribution phases while the rest of the market is still trying to interpret the latest candlestick pattern.

First, A Quick Nod to the Classics: What Are Accumulation and Distribution?

Before we dive into the data, let’s get our terms straight. These concepts, popularized by the legendary trader Richard Wyckoff, describe the lifecycle of a market trend. They represent the actions of the “smart money”—institutional investors, whales, and other well-informed market participants.

- Accumulation: This is the quiet phase. After a major price drop, smart money begins to buy up assets, absorbing the supply from panicked sellers. They do this stealthily, without causing huge price spikes. On a chart, this often looks like a boring, sideways consolidation or a ‘ranging’ market. It’s the calm before the storm.

- Distribution: This is the opposite. After a massive price run-up (the ‘markup’ phase), smart money begins to sell their holdings to the excited, FOMO-driven retail crowd. They distribute their assets gradually to avoid crashing the price. This often appears as a volatile, choppy topping pattern on the chart, where the price struggles to make new highs.

The problem? Identifying these phases from price action alone is notoriously difficult and subjective. It often becomes clear only in hindsight. On-chain data gives us a more objective lens.

The On-Chain Advantage: Why It’s Different

Every single transaction on a public blockchain like Bitcoin or Ethereum is recorded on an immutable, public ledger. Forever. This means we can track the flow of coins between wallets, see how long coins have been held, and monitor the balance of exchange wallets with incredible accuracy. It’s a level of transparency that simply doesn’t exist in traditional finance. This isn’t about looking at order books, which can be spoofed. This is about watching the actual, settled movement of assets.

By analyzing this data, we can build a picture of market sentiment and behavior based on hard evidence. Are long-term holders selling? Are large wallets buying the dip? Is a massive amount of stablecoins flowing onto exchanges, ready to buy? These are the questions on-chain analysis can help answer.

Key Metrics for Spotting On-Chain Data Accumulation

Alright, let’s get to the good stuff. How do you actually use this data? Here are some of the most powerful and accessible metrics for identifying when the smart money is quietly buying.

1. Exchange Netflow: The Simplest, Strongest Signal

This is your bread and butter. Exchange Netflow is the total amount of a cryptocurrency (like BTC or ETH) flowing into exchanges minus the amount flowing out. The logic is beautifully simple:

- Negative Netflow (Outflows > Inflows): When more coins are leaving exchanges than arriving, it’s a strong bullish signal. Why? Because investors typically move coins *off* an exchange when they intend to hold them for the long term in a private wallet (a practice known as self-custody). They have no immediate intention to sell. Sustained, large outflows during a market downturn are a classic sign of accumulation.

- Positive Netflow (Inflows > Outflows): Conversely, when coins are rushing *onto* exchanges, it suggests an increased intention to sell. This is a bearish signal and a hallmark of distribution.

Think of it like this: an exchange is a marketplace. You don’t bring your goods to the market unless you’re thinking about selling them. When everyone is taking their goods home, it means they believe the value will be higher tomorrow.

2. Whale and Shark Activity: Following the Smart Money

In crypto, “whales” are addresses holding a massive amount of a specific coin (e.g., >1,000 BTC). “Sharks” might be the next tier down (e.g., 100-1,000 BTC). These large players have the capital to move markets. While we don’t know who they are, we can watch what their wallets are doing.

During accumulation phases, you’ll often see the number of addresses holding significant balances begin to creep up. This isn’t about one whale making a single giant purchase. It’s about a pattern of sustained buying from multiple large entities over weeks or months. Data providers like Glassnode or Santiment offer charts that track the supply held by different wallet cohorts. If you see the price going sideways or down, but the line representing whale holdings is steadily ticking up, pay very close attention. Someone with deep pockets is buying what others are selling in fear.

3. Holder Behavior Metrics: Gauging Conviction

This is where things get a bit more nuanced but incredibly powerful. We can analyze the age of coins being moved to understand the psychology of the market.

- HODL Waves: This metric visualizes the age distribution of coins. It shows what percentage of the supply hasn’t moved in a day, a week, a month, a year, etc. During accumulation, you’ll see the long-term holder bands (e.g., coins held for 1+ year) expand. This means old coins are staying put, and new coins are aging into these older bands. It signals a market with high conviction and a preference for holding over selling.

- Spent Output Profit Ratio (SOPR): SOPR tells us whether coins being sold on any given day are, on average, being sold at a profit or a loss. A SOPR value greater than 1 means profit-taking; less than 1 means loss-taking. During bear markets, the SOPR will often dip below 1 repeatedly. This signifies capitulation—investors are selling at a loss just to get out. When the market refuses to let SOPR stay below 1, it’s a powerful sign that a floor is in. Buyers are absorbing every dip, and the weak hands have been flushed out. This is a prime environment for accumulation.

The most potent accumulation signals appear when macro price fear is at its peak, but on-chain data shows large, long-term investors are calmly and consistently buying the panic.

The Other Side of the Coin: Spotting Distribution

Just as on-chain data can signal the bottom, it can also warn you of the top. Distribution phases have their own distinct on-chain signatures that often appear while the price is still climbing and retail sentiment is euphoric.

1. Massive Exchange Inflows

This is the clear opposite of accumulation. When you see a huge, sustained spike in coins moving *to* exchanges, it’s a major red flag. This is the smart money getting their assets in position to sell to the incoming wave of retail FOMO. Often, these inflows will precede a major market top by a few days or weeks.

2. Decreasing Long-Term Holder Supply

Remember those HODL Waves? During distribution, you see the opposite effect. The bands representing long-term holders (1+ year) start to shrink. This means old, smart-money coins are finally on the move, being sold to new, inexperienced buyers at a massive profit. The ‘diamond hands’ are starting to cash out.

3. Spikes in Dormancy and Coin Days Destroyed

Dormancy is a metric that tracks the average age of coins transacted on a given day. When very old coins, which have been sitting dormant in a wallet for years, suddenly start moving, it’s a significant event. This is often a sign that the earliest investors and whales believe the market is overheated and are taking profits. ‘Coin Days Destroyed’ is a related metric that gives more weight to coins that have been dormant for longer. A massive spike in this metric during a bull run is a five-alarm fire drill. It’s the ultimate signal that the oldest and wisest money is heading for the exits.

Putting It All Together: A Practical Example

Let’s imagine the market has just crashed 50% from its all-time high. The news is terrible. Everyone is calling for the end of crypto. What do you look for?

First, you check the Exchange Netflow. You notice that despite the scary price action, there are consistent, large green bars indicating net outflows. Coins are leaving exchanges in droves.

Next, you look at Whale Wallets. The number of addresses holding over 1,000 BTC, which had been declining during the crash, has stabilized and is now slowly starting to tick upwards. They are buying the fear.

Then, you check SOPR. It dipped below 1 (panic selling) but is now struggling to stay below that line. Every dip below 1 is getting bought up aggressively, showing a shift in control from panicked sellers to determined buyers.

Finally, you glance at the HODL Waves. The 1-2 year holder band is getting wider, showing that the buyers from the last cycle are not selling, and their conviction remains strong.

Not one of these metrics alone is a perfect buy signal. But together? They paint a very clear picture. While the chart looks like a wasteland, the on-chain data is screaming that a major on-chain data accumulation phase is underway. This is the information edge that helps you act with conviction when others are paralyzed by fear.

Conclusion

Learning to read on-chain data is like developing a superpower. It allows you to filter out the market noise and focus on the signal: the actual behavior of market participants. It’s not a crystal ball—no single tool is. But it provides invaluable context that price charts alone can never offer. By combining the classic wisdom of Wyckoff’s market cycles with the modern transparency of blockchain data, you can build a more robust, evidence-based framework for navigating the wild world of crypto.

Stop just watching the waves. It’s time to learn what’s happening in the deep. Start with Exchange Netflow, keep an eye on the whales, and soon you’ll be spotting these crucial phases with a clarity you never thought possible.