Why Digital Scarcity is the Most Important Innovation of Our Time.

Think about the internet for a second. Its entire premise, its revolutionary power, was built on one simple, beautiful idea: infinite, costless replication. You could copy a song, a picture, an article, a piece of software a million times, and the original would remain untouched. Abundance was the name of the game. It gave us the world we know, from social media to streaming services. But this superpower had a dark side—it completely shattered the concept of ownership and value online. How can something be valuable if you can create infinite copies of it with a right-click? For decades, we just accepted this. But then, quietly at first, and now with a deafening roar, a new concept emerged, one that flips the last 30 years of the internet on its head. That concept is digital scarcity, and I believe it’s the single most important, and most misunderstood, innovation of our time.

Key Takeaways:

- Digital Scarcity is a New Paradigm: It introduces the concept of unique, provably rare, and ownable digital items into an online world previously defined by infinite copying.

- Blockchain is the Key: Technologies like blockchain create a shared, unchangeable public ledger that can verify the authenticity and ownership history of a digital asset without needing a central authority.

- It’s More Than Just NFTs: While NFTs are the most famous example, digital scarcity also underpins cryptocurrencies like Bitcoin and has massive implications for digital identity, property rights, and supply chain management.

- This Changes Everything for Creators: For the first time, artists, musicians, and other creators can sell original digital works directly to their audience, retaining ownership and earning royalties in a way that was previously impossible.

The Original Sin of the Internet: The Problem of Infinite Copies

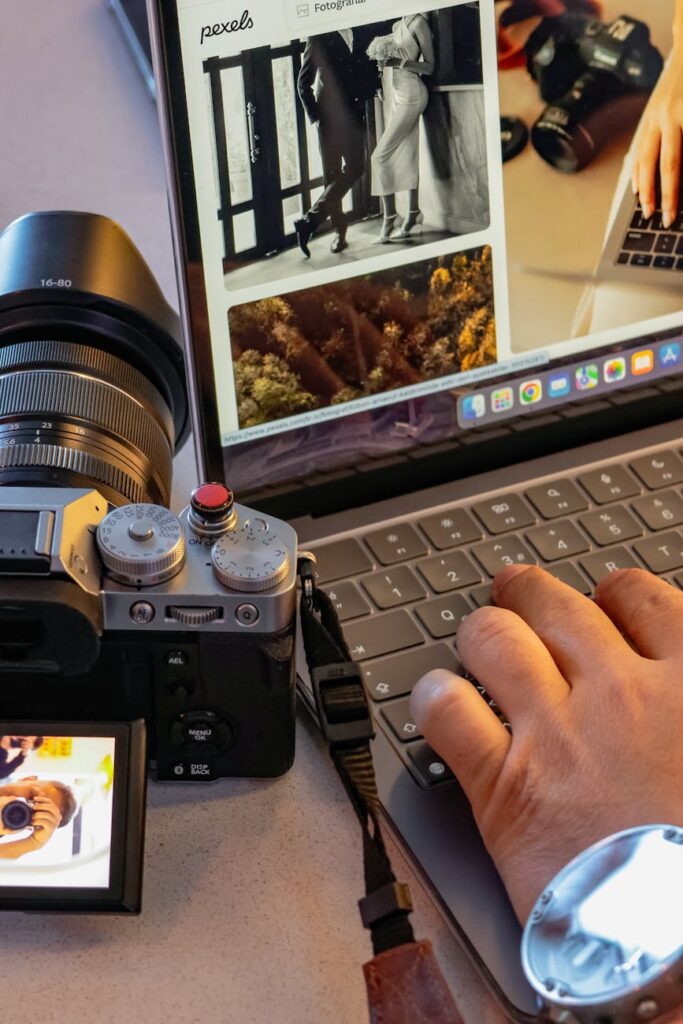

Let’s get tangible. Imagine you’re a photographer. You take a once-in-a-lifetime shot. It’s breathtaking. In the physical world, you could print a limited run of, say, 10 copies. You could number and sign each one. The scarcity of those prints, combined with your signature, gives them value. People who buy them know they own something special, one of only ten in existence. They can prove it.

Now, post that same photo online. It’s beautiful. People love it. They share it. They right-click and save it. It becomes a meme, a desktop background, an image in a thousand blog posts. It’s everywhere. You, the creator, have lost all control. You can’t prove which one is the “original.” You can’t sell the “original” because, functionally, there isn’t one. The very act of sharing it online created infinite, identical copies, reducing its monetary value to effectively zero. This has been the reality for every digital creator since the dawn of the web.

We tried to fight this. We built walls. DRM (Digital Rights Management), copyright watermarks, paywalls—all of these are attempts to artificially impose scarcity on a system that is inherently abundant. They are bandages on a wound, often creating frustrating user experiences while being easily circumvented by determined individuals. They treat the user as a potential thief rather than a customer. It was a losing battle because it fought against the very nature of the digital medium. It was trying to put a physical-world lock on a digital ghost.

The Engine Room: How Blockchain Forges Scarcity from Code

So, how do you solve the unsolvable? You don’t build a better wall. You change the foundation entirely. That’s what blockchain technology did. I know, I know—the word ‘blockchain’ can make people’s eyes glaze over. So let’s forget the jargon for a minute.

Imagine a global, public notebook that anyone can see but no one can erase. Every time someone makes a transaction—say, “Alice gives Bob the original copy of her digital photo”—a new line is written in this notebook. This entry is cryptographically linked to the one before it, creating a chain of entries. To change a past entry, you’d have to rewrite every single entry that came after it, and you’d have to do it on thousands of computers around the world all at the same time. It’s practically impossible.

This public, unchangeable notebook is a decentralized ledger. It’s the source of truth. It doesn’t need a bank, a government, or a company to vouch for it. The network itself is the notary. This is the mechanism that allows us to create true, verifiable digital scarcity. For the first time, you can point to a specific digital file and say, “The global notebook confirms that *this* is the original, and I am the owner.”

Non-Fungible Tokens (NFTs): The Poster Child of Scarcity

This brings us to NFTs, or Non-Fungible Tokens. It’s the application of this tech that most people have heard of, often accompanied by stories of pixelated apes selling for millions. But the hype obscures the simple, powerful idea underneath.

“Fungible” just means interchangeable. A dollar is fungible; you don’t care which specific dollar bill you have, they are all worth the same. “Non-fungible” means unique and irreplaceable. Your house is non-fungible. The Mona Lisa is non-fungible. Your concert ticket for seat 14A is non-fungible.

An NFT is simply a line in that global notebook (a token on the blockchain) that points to a specific digital asset and says, “This is the one.” It’s a certificate of authenticity and ownership for a digital thing. Suddenly, our photographer from before can “mint” her photo as an NFT. She can create just one, or a limited edition of 10. Each one is a unique token on the blockchain. Now, even if people right-click and save the image a million times, only one person (or ten people) can prove they own the *original* piece. They have the receipt in the global, public notebook. This simple change restores the very concept of provenance and value to the digital world.

Cryptocurrencies: Money With Built-in Rules

Before NFTs, the original proof-of-concept for digital scarcity was Bitcoin. Its anonymous creator, Satoshi Nakamoto, hard-coded a rule into the system: there will only ever be 21 million Bitcoin. Ever. No central bank can print more. No government can inflate the supply. It’s a monetary system governed by math, not by committee.

Whether you believe Bitcoin is the future of money or a speculative asset is beside the point. The crucial innovation was proving that you could create a digital asset that is inherently, verifiably finite. Its scarcity is what gives it the potential to be a store of value, just like gold. Gold is valuable not just because it’s shiny, but because you can’t just print more of it. It’s physically scarce. Bitcoin proved you could achieve the same effect with pure code.

Beyond Collectibles: The Real-World Impact of Verifiable Digital Scarcity

Okay, so we can make unique JPEGs and digital money. Cool. But is that really the “most important innovation of our time”? The answer is a resounding yes, because the underlying principle of verifiable ownership extends far, far beyond art and currency.

Redefining Ownership in a Digital World

Think about what you “own” online right now. Your social media profile? It belongs to the platform. Your character and all the items you earned in an online game? They belong to the game company. Your domain name? You’re just leasing it from a registrar. If any of these companies go out of business or decide to change their terms of service, your “assets” can vanish in an instant. You have custody, but not true ownership.

Digital scarcity changes this. Imagine your in-game sword wasn’t just a line of code on a company’s private server, but an NFT that you truly owned in your digital wallet. You could sell it, trade it, or even use it in a different game that supports the same standard. Imagine your unique social media handle or your personal data being an asset you control, not one that is rented to you in exchange for being sold to advertisers. This is the promise of Web3, an internet built on a foundation of user ownership, powered by digital scarcity.

Revolutionizing Industries

The implications are staggering when you start applying this to physical systems. The ability to create a unique, tamper-proof digital twin for a real-world asset is a game-changer.

- Real Estate: Instead of months of paperwork and title searches, a property’s deed could be an NFT. Transferring ownership could become as simple, secure, and transparent as a blockchain transaction. You could even sell fractional ownership of a building.

- Supply Chain: Imagine a luxury handbag or a life-saving medication. Each item could be assigned a unique token at its creation. At every step of its journey—from factory to warehouse to store—its token is scanned and its location is updated on the blockchain. Consumers could instantly verify the authenticity of a product, obliterating the market for counterfeits.

- Voting: While complex, a system where each eligible citizen is issued a single, unique, non-transferable voting token could eliminate fraud and provide a perfectly transparent, auditable election record.

- Intellectual Property: Patents, trademarks, and music rights could be represented as NFTs, making licensing and royalty payments automatic and transparent through smart contracts.

The Creator Economy on Steroids

This brings us back to the creators. The current model is broken. Musicians get fractions of a penny per stream. Writers are at the mercy of platform algorithms. Artists see their work endlessly reposted without credit or compensation. Digital scarcity fixes this by removing the middlemen.

A musician can sell an album directly to their fans as a limited edition NFT. Not only do they get 100% of the initial sale, but they can also program a royalty into the NFT’s smart contract. This means every time that NFT is re-sold on a secondary market, the musician automatically gets a cut—forever. This is a perpetual revenue stream that has never existed before. It aligns the incentives of the artist and the collector. The collector hopes the artist becomes more successful, making their asset more valuable, and the artist is rewarded directly for that success. It’s a paradigm shift.

The Pushback and The Problems (It’s Not All Perfect)

Of course, it would be naive to ignore the significant hurdles and valid criticisms. This technology is in its infancy, and it’s messy.

The Environmental Question

The early blockchains, like Bitcoin and Ethereum, used a consensus mechanism called “Proof-of-Work” which requires immense computational power and, therefore, a lot of energy. This is a serious concern. However, the industry is acutely aware of this. Most new blockchains and even Ethereum itself (via “The Merge”) have transitioned to a system called “Proof-of-Stake,” which is vastly more energy-efficient—we’re talking a reduction of over 99%. The problem is being actively and successfully addressed.

Bubble or Revolution?

The NFT market, in particular, went through a massive hype cycle and subsequent crash. A lot of people spent a lot of money on things that are now worth very little. This is unavoidable with any transformative technology. The dot-com bubble burst in 2000, and many companies failed, but the internet didn’t go away. The core innovation—the protocol—remained. The same is happening here. The speculative froth is burning off, but the underlying technology of digital scarcity isn’t going anywhere.

“The first version of a new technology is almost always used to re-create the old world. The second version is when it finds its own native use case. We’re just now entering that second phase for digital scarcity.”

Accessibility and Usability

Let’s be honest: using this stuff is still hard. Setting up a crypto wallet, managing seed phrases, paying “gas fees”—it’s not exactly user-friendly. The user experience can be intimidating for newcomers. This is perhaps the biggest barrier to mass adoption right now. But just as we went from typing IP addresses in a command line to tapping an icon on a phone, the user interface for Web3 will improve. The complexity will be abstracted away, and it will become a seamless part of our digital lives.

Conclusion

For our entire digital lives, we have operated under a paradigm of abundance. We copied, we pasted, we shared. It gave us a connected world, but it came at the cost of value and ownership. Digital scarcity is the countervailing force. It’s not an incremental improvement; it’s a foundational shift in the very physics of the digital universe. It introduces a property that simply did not exist before.

It allows us to own things online in the same way we own things in the real world. This simple, powerful concept will unlock unimaginable new models for creativity, commerce, and community. It will power the next iteration of the internet. There will be bumps, there will be bubbles, and there will be bad actors. But the core innovation—the ability to make a digital thing unique, rare, and provably yours—is too important to ignore. It is the missing puzzle piece that will define the next century of human interaction, and that is why it is the most important innovation of our time.

FAQ

Isn’t digital scarcity just artificial? Why is it valuable?

All scarcity that gives something monetary value is, in a sense, “artificial.” A Picasso is valuable because he can’t make any more. A Supreme t-shirt is valuable because the company only releases a limited number. Bitcoin is valuable because the code dictates there will only be 21 million. In all cases, the value comes from a shared social agreement that the scarcity is real and a collective desire to own the scarce item. Blockchain provides a way to enforce the “rules” of that scarcity with mathematics, making it far more trustworthy and transparent than a company’s promise or a central bank’s policy.

Can’t I just right-click and save an NFT image? Why would I buy it?

You can, just like you can take a photo of the Mona Lisa in the Louvre. But taking a photo doesn’t mean you own the Mona Lisa. You own a copy, not the original, authenticated masterpiece. When you buy an NFT, you are not buying the JPEG itself; you are buying the provable record of ownership on the blockchain. It’s the provenance and the official “receipt” that holds the value, especially within a community that recognizes and values that ownership.